- Joined

- Feb 12, 2009

- Messages

- 7,550

- Likes

- 1,309

Deconstructing the MMRCA decision | Deccan Chronicle

(Deba Mohanty is a Senior Fellow in Security Studies at the Observer Research Foundation, New Delhi)

The multi-billion-dollar MMRCA deal has been debated for several years. The contract is now in the final stage of negotiations, and probably 6-9 months away from signing. Yet, doubts are being raised even now over the deal.

First, why buy 4+ gen. jet when 5th Gen F-35 is available: Some analysts have argued that the MMRCA deal should be scrapped at this late stage and India should opt for the American F-35 Joint Strike Fighter aircraft, which is the latest technology, and could be cheaper.

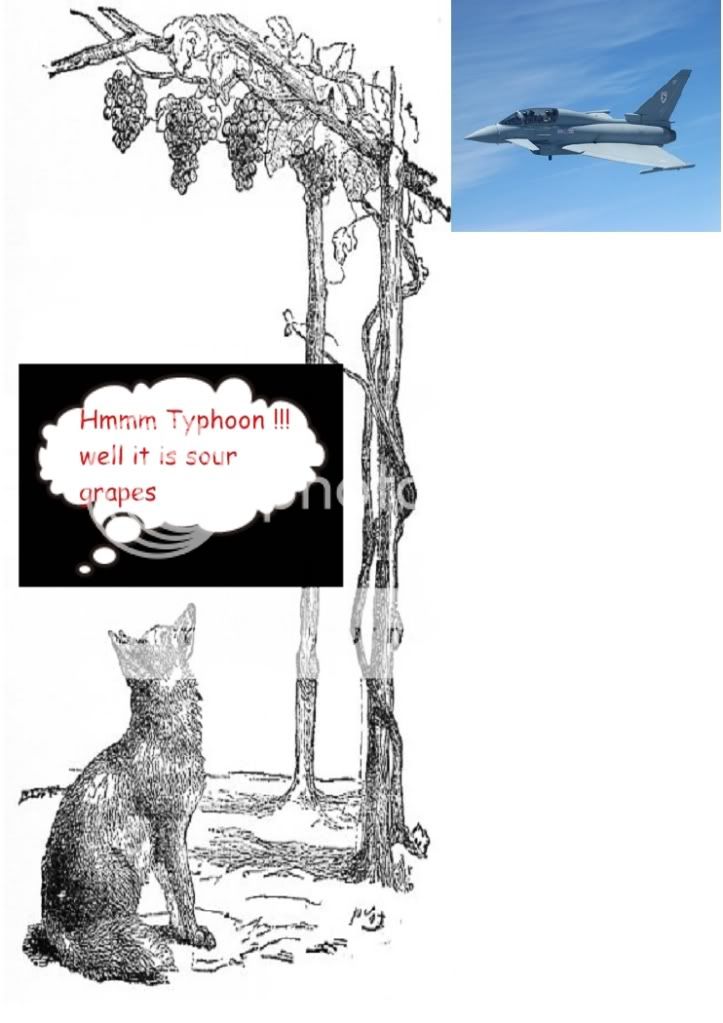

Such an argument stems from a misunderstanding of the MMRCA deal. The MMRCA is meant to achieve a balanced force structure. It will fill the gap between the indigenous Tejas LCA at the low end and the Su-30 MKI air superiority fighter at the high end, while affording new technology to Indian industry and multi-role capability and force projection to the IAF. The Air Force rejected the 1970s and 1980s vintage F-16 and F/A-18 jets, and down selected the latest operational aircraft, the Rafale and the Eurofighter Typhoon, before declaring the Rafale as the lowest cost bidder. Also, India made a conscious decision to co-develop a 5th Gen fighter with Russia.

When the MMRCA exercise began, the F-35 was neither on the table, nor anywhere near being operational. As we go to press, the USAF has announced that it is set to upgrade 350 F-16s because the F-35 continues to be delayed. Quite apart from Indian reluctance to buy American and obtain little technology transfer, the JSF is a high-technology project that is still subject to significant risks and whose proposed numbers have been dropped by the US from the original 1,800 to about a third of that number.

None of this is to suggest that India should close its options on 5th Gen fighters. In fact, the basket of options has just enlarged, and India can take advantage of that.

Second, why Rafale when cheaper options were available: Three factors determine a major acquisition decision — whether what's offered meets qualitative requirements, whether it is affordable and, now, what techno-industrial benefits it will bring. The Rafale buy may be difficult to justify purely on qualitative requirements, but factor in offsets and technology transfers, and the fact that India is still to drive a hard bargain on the final cost. By all indications, India would drop the deal if the final price escalates beyond about $18 billion. Given the past experience with Dassault, especially the recent Mirage upgrade deal, it will be interesting to see how hard India can negotiate. This is also a tricky situation for Dassault, because it knows that if it fails to meet the demands, the contract could slip out of its bag.

Third, will France transfer all the technology we want: No less than French President Nicholas Sarkozy has said that France/Dassault would transfer all the technology demanded in the contract, including source codes, a point he publicly reiterated when Dassault was announced as the lowest cost bidder. Still, it is for the Indian government to specify critical technologies that it wants, negotiate hard and ensure compliance. These are in some 10-12 areas, including composites and stealth, single-crystal blade technology, simulation, micro-radars, etc.

Fourth, life cycle costs. Introduction of life cycle costs as part of an acquisition is a new phenomenon. This is a result of India's displeasure over difficulties faced in earlier acquisitions when it faced severe constraints in supply of spares and even in maintenance of critical infrastructure. Such sourcing resulted in additional costs, new contractual conditions and delays.

Fifth, beyond commercial and technological considerations. Large arms deals invariably go beyond economic and technological considerations and the MMRCA is no exception. Although this tender has so far followed a text-book procedure, not only strategic considerations but others could come into the picture. Consider these: deals for the C-130J Hercules and the P-8I maritime reconnaissance aircraft have sustained about 35,000 jobs in the US alone; the Hawk AJTs, along with the latest follow-on orders, will sustain some 27,000 jobs in the UK; and it would not be wrong to say that over a million hearths were kept going in Russia through more than a dozen large orders from India.

Dassault, for whom the Indian Rafale order will be the first export order, is looking to come off the ventilator with an MMRCA order in 2012, and a possible follow-on some years hence. That gives India leverage to drive not only a hard bargain but also mutual strategic benefits in foreign, defence and economic relations with France.

(Deba Mohanty is a Senior Fellow in Security Studies at the Observer Research Foundation, New Delhi)

The multi-billion-dollar MMRCA deal has been debated for several years. The contract is now in the final stage of negotiations, and probably 6-9 months away from signing. Yet, doubts are being raised even now over the deal.

First, why buy 4+ gen. jet when 5th Gen F-35 is available: Some analysts have argued that the MMRCA deal should be scrapped at this late stage and India should opt for the American F-35 Joint Strike Fighter aircraft, which is the latest technology, and could be cheaper.

Such an argument stems from a misunderstanding of the MMRCA deal. The MMRCA is meant to achieve a balanced force structure. It will fill the gap between the indigenous Tejas LCA at the low end and the Su-30 MKI air superiority fighter at the high end, while affording new technology to Indian industry and multi-role capability and force projection to the IAF. The Air Force rejected the 1970s and 1980s vintage F-16 and F/A-18 jets, and down selected the latest operational aircraft, the Rafale and the Eurofighter Typhoon, before declaring the Rafale as the lowest cost bidder. Also, India made a conscious decision to co-develop a 5th Gen fighter with Russia.

When the MMRCA exercise began, the F-35 was neither on the table, nor anywhere near being operational. As we go to press, the USAF has announced that it is set to upgrade 350 F-16s because the F-35 continues to be delayed. Quite apart from Indian reluctance to buy American and obtain little technology transfer, the JSF is a high-technology project that is still subject to significant risks and whose proposed numbers have been dropped by the US from the original 1,800 to about a third of that number.

None of this is to suggest that India should close its options on 5th Gen fighters. In fact, the basket of options has just enlarged, and India can take advantage of that.

Second, why Rafale when cheaper options were available: Three factors determine a major acquisition decision — whether what's offered meets qualitative requirements, whether it is affordable and, now, what techno-industrial benefits it will bring. The Rafale buy may be difficult to justify purely on qualitative requirements, but factor in offsets and technology transfers, and the fact that India is still to drive a hard bargain on the final cost. By all indications, India would drop the deal if the final price escalates beyond about $18 billion. Given the past experience with Dassault, especially the recent Mirage upgrade deal, it will be interesting to see how hard India can negotiate. This is also a tricky situation for Dassault, because it knows that if it fails to meet the demands, the contract could slip out of its bag.

Third, will France transfer all the technology we want: No less than French President Nicholas Sarkozy has said that France/Dassault would transfer all the technology demanded in the contract, including source codes, a point he publicly reiterated when Dassault was announced as the lowest cost bidder. Still, it is for the Indian government to specify critical technologies that it wants, negotiate hard and ensure compliance. These are in some 10-12 areas, including composites and stealth, single-crystal blade technology, simulation, micro-radars, etc.

Fourth, life cycle costs. Introduction of life cycle costs as part of an acquisition is a new phenomenon. This is a result of India's displeasure over difficulties faced in earlier acquisitions when it faced severe constraints in supply of spares and even in maintenance of critical infrastructure. Such sourcing resulted in additional costs, new contractual conditions and delays.

Fifth, beyond commercial and technological considerations. Large arms deals invariably go beyond economic and technological considerations and the MMRCA is no exception. Although this tender has so far followed a text-book procedure, not only strategic considerations but others could come into the picture. Consider these: deals for the C-130J Hercules and the P-8I maritime reconnaissance aircraft have sustained about 35,000 jobs in the US alone; the Hawk AJTs, along with the latest follow-on orders, will sustain some 27,000 jobs in the UK; and it would not be wrong to say that over a million hearths were kept going in Russia through more than a dozen large orders from India.

Dassault, for whom the Indian Rafale order will be the first export order, is looking to come off the ventilator with an MMRCA order in 2012, and a possible follow-on some years hence. That gives India leverage to drive not only a hard bargain but also mutual strategic benefits in foreign, defence and economic relations with France.