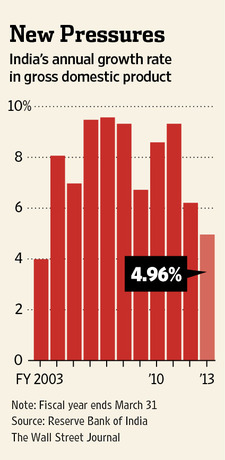

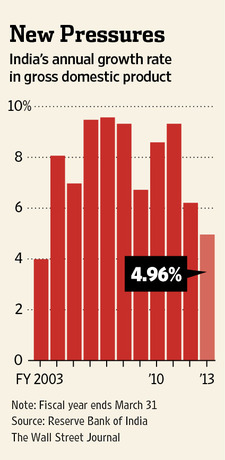

NEW DELHI—India's economy grew at its slowest annual rate in a decade, building pressure on the government to take more ambitious action to reinvigorate the ailing economy.

A laborer at an aluminum smelting factory in Mumbai in this March file photo.

Gross domestic product rose 5.0% in the fiscal year ended March 31, after a 6.2% increase in 2012 and annual rates of over 9% for a row of years before the global financial crisis of 2008.

The weak data will add pressure on the Congress party-led United Progressive Alliance national coalition government, which already is facing criticism it has inadequately sought to tackle persistent problems that have dragged on growth, including high inflation and burgeoning fiscal and current account deficits.

Boosting growth will be key for the Congress party to improve its chances of being re-elected for a third consecutive term at national polls scheduled to be held before May 2014.

While growth of 5% would be high for a developed Western economy, such a rate is insufficient in India to create enough new jobs for a young workforce.

Data also released Friday showed output grew 4.8% on year between January and March, in line with market expectations and a touch quicker than 4.7% in the preceding quarter.

Robert Prior-Wandesforde, an Asia-based economist with Credit Suisse, CSGN.VX +1.45% said there was some cause for optimism in those numbers but the data doesn't warrant the "popping of champagne corks."

India's economic growth powered ahead in the mid-2000s as investors warmed to a country which appeared to be throwing off its Socialist-inspired economic policies and opening up to greater foreign investment.

But in the past few years the narrative has changed. Foreign businesses have shunned the nation amid concerns about the slow pace of economic changes to make it easier to invest in the country. A focus instead on state-led social spending has widened the fiscal deficit, while huge oil imports have ballooned the trade gap.

That in turn, has hurt the rupee currency, which is currently trading at an 11-month low of 56.50. At the same time, inflation of near double digits has forced the central bank to keep interest rates high.

Exports, too, have fared poorly due to the slowdown in the U.S. and Europe. Even the country's IT outsourcing companies, once the symbol of shining India, have begun to face headwinds.

Also Friday, the government said it narrowed its fiscal deficit to 4.9% of GDP in the last fiscal year, below the 5.2% estimate made in the federal budget announced in February. But the level is still way above the government's 3% target and has led ratings firms to warn India's sovereign debt could soon be downgraded to non-investment-grade status.

Prime Minister Manmohan Singh last fall unveiled a series of reforms meant to kick start the economy, including allowing greater investment in sectors such as retail, broadcasting and aviation. The government also has sought to improve its finances by lowering expensive state subsidies on fuel and raising taxes to curb gold imports, the main driver of India's record-high trade deficit.

Many of these measures have been neutered by a growing protectionist sentiment in the country. Many Indian states, for instance, have opposed allowing foreign supermarkets to set up and have opted not to apply these regulations in their regions.

Businesses have for months been calling on the Reserve Bank of India—the central bank—to cut rates to jump start growth. The RBI, worried about inflation and encouraging more imports, has cut its key lending rate by 0.75 percentage point this year, much less aggressively than industry leaders wanted.

The Associated Chambers of Commerce and Industry of India, an industry lobby group, said Friday's data give out a strong indication that a turnaround in the economy is still far away and "there is a real reason for worry, requiring drastic measures from the government and the RBI."

Many observers say the government should allow greater foreign investment in other sectors, including local pension fund management companies and insurance firms.

Friday's GDP data showed growth in manufacturing output slowed to 1.0% in the last fiscal year from 2.7% the year before. Growth in services such as hotels and transport slowed to 8.6% from 11.7% while farm output growth slowed to 1.9% from 3.6%.

—Prasanta Sahu contributed to this article.

A laborer at an aluminum smelting factory in Mumbai in this March file photo.

Gross domestic product rose 5.0% in the fiscal year ended March 31, after a 6.2% increase in 2012 and annual rates of over 9% for a row of years before the global financial crisis of 2008.

The weak data will add pressure on the Congress party-led United Progressive Alliance national coalition government, which already is facing criticism it has inadequately sought to tackle persistent problems that have dragged on growth, including high inflation and burgeoning fiscal and current account deficits.

Boosting growth will be key for the Congress party to improve its chances of being re-elected for a third consecutive term at national polls scheduled to be held before May 2014.

While growth of 5% would be high for a developed Western economy, such a rate is insufficient in India to create enough new jobs for a young workforce.

Data also released Friday showed output grew 4.8% on year between January and March, in line with market expectations and a touch quicker than 4.7% in the preceding quarter.

Robert Prior-Wandesforde, an Asia-based economist with Credit Suisse, CSGN.VX +1.45% said there was some cause for optimism in those numbers but the data doesn't warrant the "popping of champagne corks."

India's economic growth powered ahead in the mid-2000s as investors warmed to a country which appeared to be throwing off its Socialist-inspired economic policies and opening up to greater foreign investment.

But in the past few years the narrative has changed. Foreign businesses have shunned the nation amid concerns about the slow pace of economic changes to make it easier to invest in the country. A focus instead on state-led social spending has widened the fiscal deficit, while huge oil imports have ballooned the trade gap.

That in turn, has hurt the rupee currency, which is currently trading at an 11-month low of 56.50. At the same time, inflation of near double digits has forced the central bank to keep interest rates high.

Exports, too, have fared poorly due to the slowdown in the U.S. and Europe. Even the country's IT outsourcing companies, once the symbol of shining India, have begun to face headwinds.

Also Friday, the government said it narrowed its fiscal deficit to 4.9% of GDP in the last fiscal year, below the 5.2% estimate made in the federal budget announced in February. But the level is still way above the government's 3% target and has led ratings firms to warn India's sovereign debt could soon be downgraded to non-investment-grade status.

Prime Minister Manmohan Singh last fall unveiled a series of reforms meant to kick start the economy, including allowing greater investment in sectors such as retail, broadcasting and aviation. The government also has sought to improve its finances by lowering expensive state subsidies on fuel and raising taxes to curb gold imports, the main driver of India's record-high trade deficit.

Many of these measures have been neutered by a growing protectionist sentiment in the country. Many Indian states, for instance, have opposed allowing foreign supermarkets to set up and have opted not to apply these regulations in their regions.

Businesses have for months been calling on the Reserve Bank of India—the central bank—to cut rates to jump start growth. The RBI, worried about inflation and encouraging more imports, has cut its key lending rate by 0.75 percentage point this year, much less aggressively than industry leaders wanted.

The Associated Chambers of Commerce and Industry of India, an industry lobby group, said Friday's data give out a strong indication that a turnaround in the economy is still far away and "there is a real reason for worry, requiring drastic measures from the government and the RBI."

Many observers say the government should allow greater foreign investment in other sectors, including local pension fund management companies and insurance firms.

Friday's GDP data showed growth in manufacturing output slowed to 1.0% in the last fiscal year from 2.7% the year before. Growth in services such as hotels and transport slowed to 8.6% from 11.7% while farm output growth slowed to 1.9% from 3.6%.

—Prasanta Sahu contributed to this article.