WolfPack86

New Member

- Joined

- Oct 20, 2015

- Messages

- 10,571

- Likes

- 16,993

India's Defence FDI Rules Should Not Treat the Sector as Homogeneous

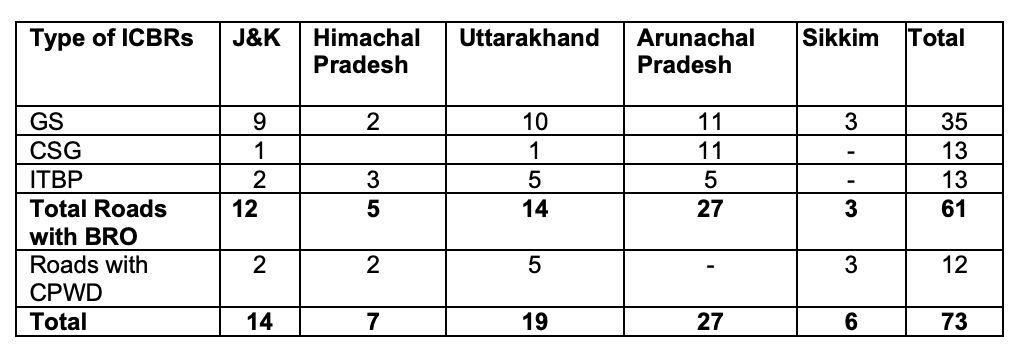

| India is the third largest defence spender in the world, only behind USA and China. Between 2015 and 2019, India was the second biggest arms importer, accounting for 9.2% of the total global arms imports. China, on the other hand, with a 249% higher defence budget than India, accounted for only 4.9% of global arms imports. But during that period, India accounted for only 0.2% of the total global arms exports, while China accounted for 5.5% of global arms exports. This absolute and relative discrepancy in the difference between India’s arms imports and exports builds a compelling case for India’s defence requirements to be manufactured in India. The government’s announcement to raise the cap in Foreign Direct Investment (FDI) in defence, through the automatic route, from 49% to 74% is therefore a welcome move. But the dynamics of defence manufacturing, unlike most other industries, is very complex and the recent announcement in hiking FDI limits across all types of defence manufacturing doesn’t adequately address this complexity. Defence manufacturing is predicated on higher order engineering capabilities and cutting-edge innovation, and an economy that excels in defence manufacturing, creates a blueprint for cascading excellence in other types of manufacturing. The correlation between GDP per-capita and a nation’s engineering advancements is also unmistakable. Central to advanced defence manufacturing capability is the development of critical technologies that form the core of cutting-edge weapons and platforms development. However, unlike in many other industries, these technologies cannot be seen as homogeneous. Different weapon platforms have different levels of technology complexity, and greater the complexity, the greater has to be incentive for global defence manufacturers to invest in India. It would, therefore, be more prudent if rules for investment in the defence aerospace sector were more relaxed from the rest. In November 2015, the Indian government announced an increase in FDI limits in defence, under the automatic route, from 24% to 49%. However, despite the government’s relentless push, the new rule yielded very little foreign investments. Between April 2000 and December 2019, India incrementally increased its FDI limits, but received only $8.82 million as FDI into its defence sector. In 2016-17, India failed to attract any FDI in defence. In 2017-18, India received $0.01 million, and in 2018-19, it received $2.18 million. These numbers don’t justify the enormous potential for foreign investments in India’s defence sector. However, the recent announcement of increasing the FDI cap in defence to 74%, under the automatic route, has the potential to attract foreign investments, but they would not be effective across the entire spectrum of defence manufacturing. In February 2017, L&T announced a joint-venture with Europe based MBDA for the development of sophisticated weapon systems. Back in 2013, Pune-based Bharat Forge, too, collaborated with Israel-based Elbit Systems to manufacture towed and mounted gun systems. There have also been many other JVs that were inked for collaboration in manufacturing of fuselage, missiles, defence software, defence components etc., even during the period when actual investments were low. The recent FDI limit hike announcement will give a significant fillip to investments through such collaborations. However, foreign collaborations in technologically sophisticated aerospace defence hasn’t taken off. Developing advanced defence aerospace technologies is a costly and a complex process, and, therefore, accessing them is understandably restricted. Given the enormous investments poured into their research and development, and the huge entry barriers into this industry, it does not make any commercial sense for global aerospace defence manufacturers to part with their proprietary technology. The 74% FDI calls for an Indian private or government partner owning 26% of the partnership, along with access to core technologies developed by the foreign partner. While this may be appropriate for manufacturing other defence platforms such as missiles or ancillary components such as fuselages, it discourages global aerospace firms with sensitive and core defence aerospace technologies from entering into such arrangement. In order to effectively and comprehensively attract FDI into the defence aerospace sector, India must make it easy for global firms to completely own their proprietary technology and their manufacturing process in India, and this calls for allowing 100% FDI in the defence aerospace sector through the automatic route. Defence aerospace manufacturing is at the higher end of the engineering and economics value chain. Nine out of the 10 largest global defence manufacturers are into defence aerospace manufacturing. When such high value and advanced weapons and platforms are manufactured in India, it would generate employment, and result in development and proliferation of higher order engineering skills. Such global manufacturers will also develop and nurture a robust eco-system of domestic suppliers to avail cost advantages, which would further encourage the growth of allied industries such as sensors, advanced communications, semiconductors and so on in India. Eventually, India could become the export hub for some of the key aerospace weapon platforms and high-end components. Allowing global aerospace manufacturers to set up fully owned subsidiaries would also proliferate the spread of technology and skill development opportunities across other sectors such as automotive, heavy engineering, industrial and product design, information technology, advanced communications etc. Given its complexity, foreign investments in defence aerospace significantly impacts other aspects of the economic machinery. The top five global defence companies are American aerospace defence majors, and they come under the 1976 United States Arms Control Export Act. This act makes it almost impossible for US arms manufacturers to sell or share their contemporary critical technologies with any foreign company or nation. Establishing a 100% subsidiary in a foreign land, with complete control over the research, design and manufacturing process doesn’t amount for sale or sharing of critical technologies. Even defence aerospace firms from nations that don’t have such laws will favourably respond to a 100% FDI limit. Boeing’s investment in a 100% subsidiary in Australia is a good example of how investments by global aerospace majors could lead to cascading gains. Set up in 2002, Boeing Australia is Boeing’s largest presence outside the US with 3,000 employees in 38 locations. It supports in excess of 9,300 jobs, works with 1,500 suppliers and contributed $1.15 billion to the Australian economy. In 2015, it exported $400 million worth of equipment. In 2016, it spent $400 million in supply chain. It’s involved in the manufacturing of five commercial aircraft programs and five aerospace defence equipment programs, such as fighter jets and helicopters. Such investments and the cascading economic benefits would not be possible without allowing for 100% FDI in aerospace defence. The notion that defence manufacturing is strategic and must be limited to Indian PSUs, Indian firms or JVs with Indian firms holding the majority stake has not yielded any economic or national security gains. Given India’s need for high end capital defence equipment, its heavy reliance on imports, and the limited contribution of the manufacturing sector to its economy, bringing advanced defence manufacturing into its shores would be a strategically sound move. This would not only reduce the cost of its defence imports expenditure, but would also result in other cascading benefits across the economic, employment, entrepreneurship, and skill development spectrums. Allowing for 74% FDI under the automatic route is therefore a good move in that directions. However, given the heterogenous nature of defence manufacturing, 100% FDI in aerospace defence sector must be allowed under the automatic route. Such differential treatment also sends out a strong message of intent to the global aerospace production majors. |

India's Defence FDI Rules Should Not Treat the Sector as Homogeneous

India is the third largest defence spender in the world, only behind USA and China. Between 2015 and 2019, India was the second biggest arms importer, accounting for 9.2% of the total global arms imports. China, on the other hand, with a 249% higher defence budget than India, accounted for only...

www.defencenews.in