AESA on drones

As medium-altitude UAVs become more widespread around the globe, the competition to sell the radars they carry is heating up. Meanwhile, demand is increasing for a fuller range of UAV radar capabilities, notably maritime surveillance.

A recent example of an air force wanting more out of its UAV radar is in Italy, where generals decided last month to dispatch their unarmed MQ-9 UAVs — which have flown in Afghanistan — to join the search for fishing boats carrying migrants in the Mediterranean after a number of vessels sank, drowning hundreds.

Working fast, General Atomics Aeronautical Systems, the US maker of the MQ-9, began testing the software addition needed to give the Italian MQ-9's Lynx Block 30 radar a maritime capability.

"It should be ready early next year," said John Fanelle, program director, Radar Systems, for General Atomics' Reconnaissance Systems Group.

The Block 30 radar, which General Atomics has sold for manned platforms to Australia and Iraq, will be sold with the Predator XP, the export version of the Predator A for non-NATO countries. The San Diego firm has sold the Predator XP to the United Arab Emirates.

"In maritime mode, the Block 30 is matched with the performance of the EO [electro-optical] sensor," Fanelle said. "When the radar detects a ship at 75 kilometers, the EO sensor operator can put eyes on the target.

"There is demand out there for low-cost, low-size, weight and power multiple-mission radars that can address 80 percent of the [intelligence, surveillance and reconnaissance] mission needs," he said.

In the US, Northrop Grumman's STARlite radar, which has been acquired by the US Army for MQ-1C Gray Eagle UAVs, is due to get a maritime mode.

The company has completed engineering flight tests for maritime capability of its extended-range version of the radar.

"Northrop Grumman Corporation will provide maritime modes as a capability in the family of STARLite radars — Extended Range, Baseline and v2 — in addition to the existing SAR, GMTI & DMTI capabilities," said a Northrop spokeswoman, referring to synthetic aperture, and ground and dismounted moving target indicator radars.

"[Northrop also] is developing a STARLite High Power variant that will provide maritime sea-search capability out to 30 nautical miles," she said.

One analyst said Northrop would do well to focus on maritime capability.

"The US Army likes the STARlite, but it could have a much bigger future if they can go maritime, which is what the US will need more of as it focuses on Asia," said David Rockwell, an analyst at the Teal Group.

US company Telephonics is already providing its AN/ZPY-4 for Northrop's MQ-8B Fire Scout unmanned helicopter, and CEO Joseph Battaglia said his company's radar is maritime through and through.

"There is a big difference between sea and ground clutter, and the RF frequency also has to be optimized for maritime applications," he said.

Battaglia said Telephonics has also signed up to supply the radar for one other UAV, a non-US, optionally piloted aircraft, about which he declined to give details.

A June report by the Teal Group stated that spending on UAV radars would total US $496 million this year, rising to $1.28 billion in 2022. Much of that spending will go toward the US multiplatform radar technology insertion program radars for the Global Hawk UAV, including $453 million to be spent on the program in 2017, about half the global figure for that year, said Rockwell, who authored the radar section of the report.

After 2017, a good deal of projected spending will be devoted to radar work for new combat UAV programs, he said.

But that leaves a niche market for medium-altitude, long-endurance UAV radars, Rockwell said.

"Outside the US, there is a good market for non-American developers, and maritime UAV radar is an area for cutting-edge technology," he said.

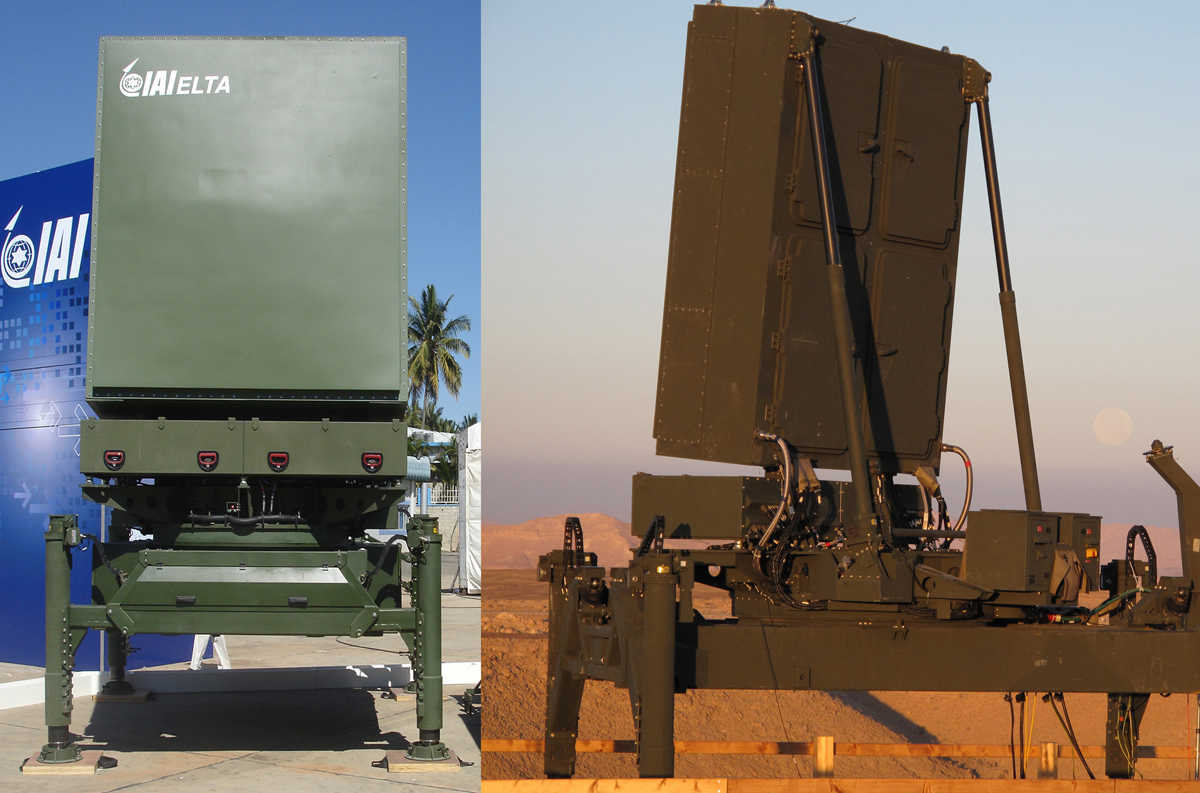

Selex ES has been carving out a slice of the market, with Israel-based Elbit Systems picking the firm's Gabbiano X-band radars for the Hermes 450 and Hermes 900 UAVs. In total, more than seven UAV types have integrated Selex surveillance radars. Selex ES is part of Italy's Finmeccanica group.

"The general trend in UAV radar is away from bespoke [or custom] solutions," said Bob Mason, vice president of sales for radar and advanced targeting for Selex ES.

"People want flexibility, meaning multimode, meaning using the radar for synthetic aperture radar missions one day and search and rescue the next," he said.

That view was shared by an EADS Cassidian official, who said, "We are working on scalable, software-defined sensors, which can be easily adapted for specific missions and roles."

Mason said he believes the Selex's active electronically scanned array (AESA) radars are essential for maritime missions. Selex's AESA range includes the Picosar UAV radar — which has been sold to Saudi Arabia — and the Seaspray.

"The Seaspray can spot small targets at sea from altitudes like 11,000 feet, with no significant constraint in terms of the size of the antenna," Mason said. "The advantage is that staying high is important for a UAV."

Besides flying on 18 manned platforms, the AESA Seaspray has been selected for Piaggio's Hammerhead UAV, and a 7500E variant flew last year in trials on a Predator B UAV.

"We see the Seaspray as one option for those customers who need a true long-range maritime product," said General Atomics' Fanelle, who added that the Italian Air Force is in talks to equip its MQ-9s with the radar to further boost its maritime surveillance potential.

But not all manufacturers see AESA technology as ripe for putting on UAVs.

Telephonics' Battaglia said he is dubious about rushing into AESA maritime radar for UAVs.

"There are numerous technical issues that have to be resolved before they become viable and cost effective, including tackling technical issues with size, weight, power and cooling," he said.

"Ideally, maritime surveillance radars should be capable of covering a 360-degree field of regard. Current AESA radars were designed for nose-mounted, forward-looking applications such as for fighter aircraft," he said.

Battaglia said Telephonics is working on a maritime AESA radar for UAVs as well as for rotary and fixed-wing aircraft that would provide a 360-degree field of regard, but would not rely on rotating the array.

"Including moving parts defeats one of the points of the benefits of AESA radar — reliability," he said.

Battaglia did not give details on the status of Telephonics' AESA development, but said, "It is in the not-too-distant future."

The firm's development effort does not, he said, immediately involve conformal arrays — the integration of arrays into the skin of airborne platforms.

"Conformal arrays are the ultimate goal, but those are still a way off," he said.