omaebakabaka

Senior Member

- Joined

- Aug 29, 2020

- Messages

- 4,945

- Likes

- 13,833

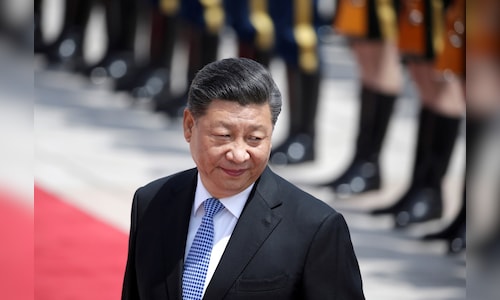

Absolute bs way to generate wealth qualitatively.....law of avgs say most middle income will lose than win over time. Story is too premature to generate the level of valuations without name brands nor strong exports to the level of top 5 market leaders. Like only show in the town in USA is market even with $ as reserve. GOI should tax the stock returns more heavily proportionately vs stable income coming from non speculated returns like income and so on. Economics of common sense is kicked into trash now everywhere....Xi is correct to kill the bubbles in some ways like Evergrande even if there is some control aspect to it.Savings have shifted from traditional instruments like Fixed Deposits to SIP, Mutual Funds, Term Insurance products etc. Market linked investments are riskier than fixed deposits but then, people believe the India growth story. About 16-17k crores are flowing into SIP every month. Markets are flush with cash and valuations are at crazy levels.

People are spending more and willing to take credit. Whether they are spending on consumer durables or on kids higher education and financing it with student loans, it will generate a cash outflow and reduced savings in the bank account.

Percapita of 3k but valuations kicking into high gear not to mention all chitfunds and bs credit markets everywhere.....

Last edited: