Advaidhya Tiwari

Senior Member

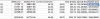

- Joined

- Aug 2, 2018

- Messages

- 1,579

- Likes

- 1,443

The problem with that is that Pakistani GDP is based on almost nil production. Also, currency depreciation has been 18%:Yes, I also realize that the rupee appreciated last year for no real reason and the correction has come this year. My point is we wouldn't have to worry about any of this if we had a trade surplus which a developing country with low wages should have. I remember making fun of the pakis this January that their GDP grew 0% in dollar terms due to their currency depreciation in 2017, and now the same thing has happened to us this year.

P.S. no I actually live in Moscow

The biggest problem of Pakistan is that it has no technology at all. Technology which India had in 1995 is not there in Pakistan.For example, India has Navy construction, radar, satellite launchers, ballistic missiles which were accurate etc which Pakistan does not have even till date. Pakistan does not even have car manufacturing.