- Joined

- Nov 17, 2012

- Messages

- 1,880

- Likes

- 680

Re: How United States' High Debt Will Weaken Economy and Hurt American

Free Speech Rally in Manchester, Tennessee draws huge Patriot crowd

JUNE 5, 2013

June 4, 2013, was an historic day in rural Tennessee. Huge crowds gathered to attend the event titled, "Public Disclosure in a Diverse Society," put on by the American Muslim Advisory Council. This event was attended by U.S. Attorney, Bill Killian and FBI agent Kenneth Moore. :ranger:

The massive crowd gathering was in large response to an Internet article written by myself and posted on the Save America Foundation website called, "Is Rural Tennessee Becoming the Next Dearborn, Michigan?" ( Save America Foundation - Patriots in Action-conservative, educational and political website.Save America Foundation ) Several different patriotic groups were in attendance. Prior to the event, a Free Speech rally took place. Pamela Geller spoke along with yours truly.

Arriving early, I was interviewed by Fox 17 news station and I had the chance to interview several people myself. People were more than enthusiastic about their First Amendment rights being under attack. They did not want to see their rights threatened by the Federal goverernment. They did not hesitate to let their voices be heard. Americans of all stripes stood boldly in defense of free speech.

People arrived hours before the event with handmade signs. They joined together in songs like "God Bless America," "The National Anthem," "The Star Spangled Banner" and "America the Beautiful" all led by yours truly! The passion of American patriots in the heartland of America was alive and well in Manchester, Tennessee.

There were public prayers to God, proclamations of faith in Jesus Christ and even a prayer for Israel led by a man speaking Hebrew who asked all of us to face toward Israel during the prayer. :ranger:

The crowd's enthusiasm spilled over into the meeting. The audience had little patience for the agenda of the Islamic group trying to make moral arguments about how Americans in the heartland are just not open minded enough as a society to understand the complexities of Islam. Killian was booed and told to resign by the audience who did not appreciate being told that it could be considered "hate speech" to speak out against Islam.

The meeting was filled to capacity and hundreds stood outside, trying to get a glimpse through the window of what has happening.

After sitting through a propaganda piece called, "Welcome to Shelbyville," the crowd was told that only two questions would be taken. One gentleman tried to speak out and asked a very important question that we all wanted answered. That question was, "What constitutes hate speech?" Of course, the question went unanswered.

I did get a chance to talk to F.B.I. agent, Kenneth Moore, who asked me to turn off my video camera. He explained to me that hate crime legislation applies to all American Citizens. I asked him why then, do we need it in the first place? He couldn't seem to answer my question. I told him that he should be aware that this is just a slice ofsmall town America and citizens everywhere are starting to wake up to what our government is doing. They know what has happened to Dearborn, MI and they see the stories of Islamic violence breaking out all over the globe. The have no issue with Muslims, per se, only the Islamic agenda that would try to change the very law of the land.

One thing is certain. No law-abiding American wants to see Sharia Law come to Tennessee or any other state. One man, who was a retired Army Veteran and winner of the Bronze Medal broke down in tears over what is happening to his country. He had fought in three wars and didn't want to see the battle lost on the homefront.

After the event people were praying and singing "Amazing Grace" and quoting from the Holy Bible. It was truly an historical day and one that won't soon be forgotten.In fact, there are some things that America will and should never forget. God bless America.

Free Speech demanded by Patriots in Tennessee.Save America Foundation

Save America Foundation (SAF) is a 501(c)(4) non-profit civic organization. SAF is nonpartisan and encourages political involvement and activism. Contributions to SAF are not tax deductible. Save America Foundation registration #:ch31949. A copy of the official registration and financial information may be obtained from the division of consumer services by calling toll-free 1-800-435-7352 within the state. Registration does not imply endorsement, approval, or recommendation by the state.

More Than 100 Million Americans Are On Welfare

There are more Americans dependent on the federal government than ever before in U.S. history. According to the Survey of Income and Program Participation conducted by the U.S. Census, well over 100 million Americans are enrolled in at least one welfare program run by the federal government. Many are enrolled in more than one. That is about a third of the entire population of the country.Sadly, that figure does not even include Social Security or Medicare. Today the federal government runs almost 80different "means-tested welfare programs", and almost all of those programs have experienced substantial growth in recent years. Yes, we will always need a "safety net" for those that cannot take care of themselves, but it is absolutely ridiculous that the federal government is financially supporting one-third of all Americans. How much farther do things really need to go before we finally admit that we have become a socialist nation? At the rate we are going, it will not be too long before half the nation is on welfare. Unfortunately, we will likely never get to that point because the gigantic debt that we are currently running up will probably destroy our financial system before that ever happens.

It is really hard to believe how rapidly some of these federal welfare programs have grown.

For example, the number of Americans on food stamps has grown from about 17 million in 2000 to 31.9 million when Barack Obama took office to 46.4 million today.

The federal government spent a staggering 71.8 billion dollars on the food stamp program in 2011.

That sure is a lot of money to spend on food.

And I thought that my grocery bills were high.

Medicaid is also growing like crazy.

The number of Americans on Medicaid grew from 34 million in 2000 to 54 million in 2011.

Once upon a time, Medicaid was supposed to help the poorest of the poor get medical care. In fact, back in 1965 only about one out of every 50 Americans was on Medicaid.

But now about one-sixth of the entire country is on Medicaid.

Will we all eventually be on Medicaid?

As I mentioned recently, It is being projected that Obamacare will add 16 million more Americans to the Medicaid rolls.

And we all know that projections like that are usually way too low.

Other federal welfare programs are exploding in size as well.

For example, federal housing assistance increased by a whopping 42 percent between 2006 and 2010.

The chart posted below was produced by Senate Budget Committee Republican staff. As you can see, the number of Americans on welfare just continues to grow and grow and grow"¦.

Keep in mind that the chart posted above does not even take into account the huge numbers of Americans that are on Social Security and Medicare.

In the United States today, more than 61 million Americans receive some form of Social Security benefits.

Just think about that.

That means that nearly one out of every five Americans is drawing on Social Security.

That is just crazy.

And in the years ahead we are going to see wave after wave of Baby Boomers retire and so the number of Americans drawing on Social Security is just going to keep going up.

The same kind of thing is happening with Medicare.

As I wrote about the other day, it is being projected that the number of Americans on Medicare will grow from 50.7 million in 2012 to 73.2 million in 2025.

Ouch.

That sure does sound expensive.

If you can believe it, Medicare is facing unfunded liabilities of more than 38 trillion dollars over the next 75 years.

That comes to approximately $328,404 for each and every household in the United States.

Will you be able to pay your share?

And that is just for Medicare.

The federal government just keeps becoming a bigger and bigger part of the health care industry.

Back in 1990, the federal government accounted for just 32 percent of all health care spending in America.

This year, it is being projected that the federal government will account for more than 50 percent of all health care spending in the United States.

Americans have become completely and totally addicted to government money, and word has gotten out to other nations that the U.S. is a place where you can live the high life at the expense of the government.

According to a report from the Center for Immigration Studies, 43 percent of all immigrants that have been in the United States for at least 20 years are still on welfare.

Keep in mind that the study only looked at immigrants that have been in the country for at least two decades.

Nearly half of them are still on welfare.

Needless to say, the system is fundamentally broken.

And there is no way in the world that we can afford all of this. We have rolled up the biggest pile of debt in the history of the world and our children and our grandchildren are facing a lifetime of endless debt slavery.

Once again this year we are facing a federal budget deficit of well over a trillion dollars, and very few of our politicians even seem to care.

We just continue to spend money as if it was going out of style.

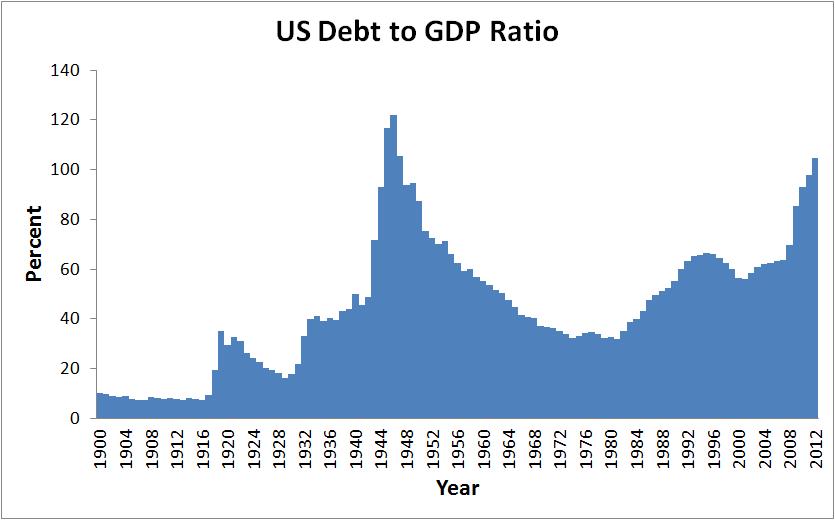

At this point, spending by the federal government accounts for more than 25 percent of U.S. GDP.

The last time that happened was during World War II when we were trying to rescue the world from the tyranny of the Germans and the Japanese.

If you divided up the U.S. national debt equally, it would come to more than $134,000 for every single household in the United States.

Ack.

Overall, the U.S. national debt has gotten more than 37 times larger than it was when Nixon took us off the gold standard.

We are a nation of debt addicts, and both political parties have been responsible for getting us into this mess.

We simply cannot afford to continue to go down this road. We need to significantly reduce all categories of government spending.

And yes, we will always need a safety net.

But we simply cannot afford to financially support more than 100 million Americans.

That is absolute madness and it must stop.

More Than 100 Million Americans Are On Welfare - Save America FoundationSave America Foundation

Free Speech Rally in Manchester, Tennessee draws huge Patriot crowd

JUNE 5, 2013

June 4, 2013, was an historic day in rural Tennessee. Huge crowds gathered to attend the event titled, "Public Disclosure in a Diverse Society," put on by the American Muslim Advisory Council. This event was attended by U.S. Attorney, Bill Killian and FBI agent Kenneth Moore. :ranger:

The massive crowd gathering was in large response to an Internet article written by myself and posted on the Save America Foundation website called, "Is Rural Tennessee Becoming the Next Dearborn, Michigan?" ( Save America Foundation - Patriots in Action-conservative, educational and political website.Save America Foundation ) Several different patriotic groups were in attendance. Prior to the event, a Free Speech rally took place. Pamela Geller spoke along with yours truly.

Arriving early, I was interviewed by Fox 17 news station and I had the chance to interview several people myself. People were more than enthusiastic about their First Amendment rights being under attack. They did not want to see their rights threatened by the Federal goverernment. They did not hesitate to let their voices be heard. Americans of all stripes stood boldly in defense of free speech.

People arrived hours before the event with handmade signs. They joined together in songs like "God Bless America," "The National Anthem," "The Star Spangled Banner" and "America the Beautiful" all led by yours truly! The passion of American patriots in the heartland of America was alive and well in Manchester, Tennessee.

There were public prayers to God, proclamations of faith in Jesus Christ and even a prayer for Israel led by a man speaking Hebrew who asked all of us to face toward Israel during the prayer. :ranger:

The crowd's enthusiasm spilled over into the meeting. The audience had little patience for the agenda of the Islamic group trying to make moral arguments about how Americans in the heartland are just not open minded enough as a society to understand the complexities of Islam. Killian was booed and told to resign by the audience who did not appreciate being told that it could be considered "hate speech" to speak out against Islam.

The meeting was filled to capacity and hundreds stood outside, trying to get a glimpse through the window of what has happening.

After sitting through a propaganda piece called, "Welcome to Shelbyville," the crowd was told that only two questions would be taken. One gentleman tried to speak out and asked a very important question that we all wanted answered. That question was, "What constitutes hate speech?" Of course, the question went unanswered.

I did get a chance to talk to F.B.I. agent, Kenneth Moore, who asked me to turn off my video camera. He explained to me that hate crime legislation applies to all American Citizens. I asked him why then, do we need it in the first place? He couldn't seem to answer my question. I told him that he should be aware that this is just a slice ofsmall town America and citizens everywhere are starting to wake up to what our government is doing. They know what has happened to Dearborn, MI and they see the stories of Islamic violence breaking out all over the globe. The have no issue with Muslims, per se, only the Islamic agenda that would try to change the very law of the land.

One thing is certain. No law-abiding American wants to see Sharia Law come to Tennessee or any other state. One man, who was a retired Army Veteran and winner of the Bronze Medal broke down in tears over what is happening to his country. He had fought in three wars and didn't want to see the battle lost on the homefront.

After the event people were praying and singing "Amazing Grace" and quoting from the Holy Bible. It was truly an historical day and one that won't soon be forgotten.In fact, there are some things that America will and should never forget. God bless America.

Free Speech demanded by Patriots in Tennessee.Save America Foundation

. but one thing is fully confirmed that they can't build their own society, they also know this fact, and hence they have to get something done in other countries now to ensure free Welfare/Free medical etc for their under high school passed people, along with bringing the most competent migrants of rest of the world to develop the best technologies for their industries this way....... I have said before too,

. but one thing is fully confirmed that they can't build their own society, they also know this fact, and hence they have to get something done in other countries now to ensure free Welfare/Free medical etc for their under high school passed people, along with bringing the most competent migrants of rest of the world to develop the best technologies for their industries this way....... I have said before too,

. for example the recent proposal to increase taxes on the riches of US, which has in fact resulted in high renouncing of US's citizenship too.....

. for example the recent proposal to increase taxes on the riches of US, which has in fact resulted in high renouncing of US's citizenship too.....