Indian Economy: News and Discussion

- Thread starter Tuco

- Start date

More options

Who Replied?- Joined

- Aug 10, 2020

- Messages

- 29,517

- Likes

- 113,415

Ya'll Nibbiars

realty.economictimes.indiatimes.com

realty.economictimes.indiatimes.com

SC refuses to entertain fresh plea of Supertech to extend time to demolish twin towers - ET RealEstate

Supertech Emerald Court: In October the top court had refused to modify its directive to demolish the twin 40-story towers in Noida for violation of norms and dismissed an application of Supertech Ltd seeking to save one tower and partially demolish 224 units in the other to conform with...

To understand what has changed from 2014 in India, below is an anecdotal evidence. The poor Indians in villages had literally nothing and within few years they have all the basic necessity of life covered via Modi schemes. Today they have hope for even more upward mobility in life. Modi sells them dreams, gets votes and delivers it without any corruption or delay or compromise in service. They vote Modi even with a bigger majority. All Mldi supporters are more focused on Hindu issues. Congress and opposition are clueless what's happening.

- Joined

- Oct 14, 2020

- Messages

- 27,498

- Likes

- 189,876

- Joined

- Aug 10, 2020

- Messages

- 29,517

- Likes

- 113,415

Ya'll Nibbiars The project is not going well like all other commercial projects in noida, it was launched at least 5 years ago and if you see recent images it seems like it will never be completed.

- Joined

- Jun 23, 2020

- Messages

- 3,564

- Likes

- 9,414

congress and other so called secular parties are still trapped in old and outdated gandhian phiolosophy which celebrates poverty and hunger thats the reason they were unable to make india a rich and prosperous country in last 70 yearsTo understand what has changed from 2014 in India, below is an anecdotal evidence. The poor Indians in villages had literally nothing and within few years they have all the basic necessity of life covered via Modi schemes. Today they have hope for even more upward mobility in life. Modi sells them dreams, gets votes and delivers it without any corruption or delay or compromise in service. They vote Modi even with a bigger majority. All Mldi supporters are more focused on Hindu issues. Congress and opposition are clueless what's happening.

What's the status of Kohinoor Tower in Dadar? Despite incomplete it still looks sexy.Ya'll Nibbiars Parniee Billions. Office Building of 57 floors 260 meters coming in Worli. Launched in July 2021. Under Construction 10 floors alreday constructed.

View attachment 116797

- Joined

- Aug 10, 2020

- Messages

- 29,517

- Likes

- 113,415

Ya'll Nibbiars interior works finished Lower floors being leashed. And the residental building almost completes.What's the status of Kohinoor Tower in Dadar? Despite incomplete it still looks sexy.

avknight1408

Senior Member

- Joined

- Apr 16, 2015

- Messages

- 1,099

- Likes

- 5,014

Govt's excise collection on petro products 79% more than pre-Covid levels

The government's collection from levy of excise duty on petroleum products has risen 33 per cent in the first six months of the current fiscal when compared with last year and is 79 per cent more than pre-Covid levels, official data showed.

Data available from the Controller General of Accounts (CGA) in the Union Ministry of Finance showed excise duty collections during April-September 2021 surging to over Rs 1.71 lakh crore, from Rs 1.28 lakh crore mop-up in the same period of the previous fiscal.

Thanks to a steep hike in excise duty rates, the collection is 79 per cent more than Rs 95,930 crore mop-up in April-September 2019.

In the full 2020-21 fiscal, excise collections were Rs 3.89 lakh crore and in 2019-20, it was Rs 2.39 lakh crore, CGA data showed.

After the introduction of the Goods and Services Tax (GST) regime, excise duty is levied only on petrol, diesel, ATF and natural gas. Barring these products, all other goods and services are under the GST regime.

Out of the Rs 2.3 lakh crore excise collection in 2018-19, Rs 35,874 crore was devolved to states, according to the CGA. In the previous 2017-18 fiscal, Rs 71,759 crore was devolution to the states out of a collection of Rs 2.58 lakh crore.

The incremental collection of Rs 42,931 crore in the first six months of the fiscal year 2021-22 (April 2021 to March 2022) is four times the Rs 10,000 crore liability that the government has in the full year towards repayment of oil bonds that were issued by the previous Congress-led UPA government to subsidise fuel.

The bulk of excise duty collection is from the levy on petrol and diesel and with sales picking up with a rebounding economy, the incremental collections in the current year may be over Rs 1 lakh crore when compared with the previous year, industry sources said.

In all, the UPA government had issued Rs 1.34 lakh crore worth of bonds (equivalent to a sovereign commitment to pay in future) to state-owned oil companies to compensate them for selling fuel such as cooking gas LPG, kerosene and diesel at rates below cost.

Of this, Rs 10,000 crore is due to be repaid in the current fiscal, according to the finance ministry.

First, Finance Minister Nirmala Sitharaman and then Oil Minister Hardeep Singh Puri had blamed the oil bonds for limiting fiscal space to give relief to people from fuel prices trading at all-time high levels. The bulk of the excise collections come from petrol and diesel on which the Modi government had levied record taxes last year.

Excise duty on petrol was hiked from Rs 19.98 per litre to Rs 32.9 last year to recoup gain arising from international oil prices plunging to multi-year low as pandemic gulped demand. On diesel, the duty is hiked to Rs 31.80.

While international prices have since recovered to USD 85 and demand returned, excise duty has remained at the same level. This has resulted in petrol price soaring above Rs 100-a-litre-mark in all major cities and diesel crossing that level in more than one-and-a-half dozen states.

The total increase in petrol price since the May 5, 2020 decision of the government to raise excise duty to record levels now totals Rs 37.38 per litre. Diesel rates have during this period gone up by Rs 27.98 per litre.

The government had raised excise duty on petrol and diesel to mop up gains that would have otherwise accrued to consumers from international oil prices crashing to as low as USD 19 per barrel.

Petrol and diesel as well as cooking gas and kerosene were sold at subsidised rates during the previous Congress-led UPA government. Instead of paying for the subsidy to bring parity between the artificially suppressed retail selling price and the cost that had soared because of international rates crossing USD 100 per barrel, the then government issued oil bonds totalling Rs 1.34 lakh crore to the state-fuel retailers.

These oil bonds and the interest thereon are being paid now.

Of the Rs 1.34 lakh crore of oil bonds, only Rs 3,500 crore of principal has been paid and the remaining Rs 1.3 lakh crore is due for repayment between this fiscal and 2025-26, according to information made available by the finance ministry.

The government has to repay Rs 10,000 crore this fiscal year (2021-22). Another Rs 31,150 crore is due to be repaid in 2023-24, Rs 52,860.17 crore in the following year and Rs 36,913 crore in 2025-26.

Minister of State for Petroleum and Natural Gas Rameswar Teli had in July told Parliament that the Union government's tax collections on petrol and diesel jumped by 88 per cent to Rs 3.35 lakh crore in the year to March 31, 2021 (2020-21 fiscal) from Rs 1.78 lakh crore a year back.

Excise collection in pre-pandemic 2018-19 was Rs 2.13 lakh crore.

The government's collection from levy of excise duty on petroleum products has risen 33 per cent in the first six months of the current fiscal when compared with last year and is 79 per cent more than pre-Covid levels, official data showed.

Data available from the Controller General of Accounts (CGA) in the Union Ministry of Finance showed excise duty collections during April-September 2021 surging to over Rs 1.71 lakh crore, from Rs 1.28 lakh crore mop-up in the same period of the previous fiscal.

Thanks to a steep hike in excise duty rates, the collection is 79 per cent more than Rs 95,930 crore mop-up in April-September 2019.

In the full 2020-21 fiscal, excise collections were Rs 3.89 lakh crore and in 2019-20, it was Rs 2.39 lakh crore, CGA data showed.

After the introduction of the Goods and Services Tax (GST) regime, excise duty is levied only on petrol, diesel, ATF and natural gas. Barring these products, all other goods and services are under the GST regime.

Out of the Rs 2.3 lakh crore excise collection in 2018-19, Rs 35,874 crore was devolved to states, according to the CGA. In the previous 2017-18 fiscal, Rs 71,759 crore was devolution to the states out of a collection of Rs 2.58 lakh crore.

The incremental collection of Rs 42,931 crore in the first six months of the fiscal year 2021-22 (April 2021 to March 2022) is four times the Rs 10,000 crore liability that the government has in the full year towards repayment of oil bonds that were issued by the previous Congress-led UPA government to subsidise fuel.

The bulk of excise duty collection is from the levy on petrol and diesel and with sales picking up with a rebounding economy, the incremental collections in the current year may be over Rs 1 lakh crore when compared with the previous year, industry sources said.

In all, the UPA government had issued Rs 1.34 lakh crore worth of bonds (equivalent to a sovereign commitment to pay in future) to state-owned oil companies to compensate them for selling fuel such as cooking gas LPG, kerosene and diesel at rates below cost.

Of this, Rs 10,000 crore is due to be repaid in the current fiscal, according to the finance ministry.

First, Finance Minister Nirmala Sitharaman and then Oil Minister Hardeep Singh Puri had blamed the oil bonds for limiting fiscal space to give relief to people from fuel prices trading at all-time high levels. The bulk of the excise collections come from petrol and diesel on which the Modi government had levied record taxes last year.

Excise duty on petrol was hiked from Rs 19.98 per litre to Rs 32.9 last year to recoup gain arising from international oil prices plunging to multi-year low as pandemic gulped demand. On diesel, the duty is hiked to Rs 31.80.

While international prices have since recovered to USD 85 and demand returned, excise duty has remained at the same level. This has resulted in petrol price soaring above Rs 100-a-litre-mark in all major cities and diesel crossing that level in more than one-and-a-half dozen states.

The total increase in petrol price since the May 5, 2020 decision of the government to raise excise duty to record levels now totals Rs 37.38 per litre. Diesel rates have during this period gone up by Rs 27.98 per litre.

The government had raised excise duty on petrol and diesel to mop up gains that would have otherwise accrued to consumers from international oil prices crashing to as low as USD 19 per barrel.

Petrol and diesel as well as cooking gas and kerosene were sold at subsidised rates during the previous Congress-led UPA government. Instead of paying for the subsidy to bring parity between the artificially suppressed retail selling price and the cost that had soared because of international rates crossing USD 100 per barrel, the then government issued oil bonds totalling Rs 1.34 lakh crore to the state-fuel retailers.

These oil bonds and the interest thereon are being paid now.

Of the Rs 1.34 lakh crore of oil bonds, only Rs 3,500 crore of principal has been paid and the remaining Rs 1.3 lakh crore is due for repayment between this fiscal and 2025-26, according to information made available by the finance ministry.

The government has to repay Rs 10,000 crore this fiscal year (2021-22). Another Rs 31,150 crore is due to be repaid in 2023-24, Rs 52,860.17 crore in the following year and Rs 36,913 crore in 2025-26.

Minister of State for Petroleum and Natural Gas Rameswar Teli had in July told Parliament that the Union government's tax collections on petrol and diesel jumped by 88 per cent to Rs 3.35 lakh crore in the year to March 31, 2021 (2020-21 fiscal) from Rs 1.78 lakh crore a year back.

Excise collection in pre-pandemic 2018-19 was Rs 2.13 lakh crore.

- Joined

- Jun 23, 2020

- Messages

- 3,564

- Likes

- 9,414

i dont understand one thing about india

in case of china all their big cities are along sea coastline or along yangtze river 94% population lives close to coastline but so is not the case in india the most populated city in india is Delhi which is neither close to sea nor close to some river which drains in sea

landlocked areas are usually sparsly populated and costline of sea or rivers (which drains in sea) is densely populated all around the world but so is not the case in india and pakistan most populated city in pakistan is lahore which is completely landlocked just like Delhi

in case of china all their big cities are along sea coastline or along yangtze river 94% population lives close to coastline but so is not the case in india the most populated city in india is Delhi which is neither close to sea nor close to some river which drains in sea

landlocked areas are usually sparsly populated and costline of sea or rivers (which drains in sea) is densely populated all around the world but so is not the case in india and pakistan most populated city in pakistan is lahore which is completely landlocked just like Delhi

Last edited:

IndianYonko

Senior Member

- Joined

- Aug 21, 2020

- Messages

- 1,813

- Likes

- 7,918

Answer lies in alluvial soil of plains. Most of these cities are either very old or an offshooti dont understand one thing about india

in case of china all their big cities are along sea coastline or along yangtze river 94% population lives close to coastline but so is not the case in india the most populated city in india is Delhi which is neither close to sea nor close to some river which drains in sea

landlocked areas are usually sparsly populated and costline of sea or rivers (which drains in sea) is densely populated all around the world but so is not the case in india and pakistan most populated city in pakistan is lahore which is completely landlocked just like Delhi

- Joined

- Jun 23, 2020

- Messages

- 3,564

- Likes

- 9,414

not being close to river or sea might be the reason why indian cities are not as industrialized as chinese citiesAnswer lies in alluvial soil of plains. Most of these cities are either very old or an offshoot

in case of China The Yangtze River Economic Belt covers 11 provincial-level regions, including Shanghai, Jiangsu, Zhejiang, Anhui, Jiangxi, Hubei, Hunan, Chongqing, Sichuan, Yunnan and Guizhou. It occupies 2.05 million square kilometers, taking up 21 percent of the country’s total, and the population and economic aggregates both occupy over 40 percent of the country’s total.

The indian river which is equivalent to yangtze is the ganga river which has been the artery of trade for thousands of years but because of poor maintenance and neglect the ganga river economic belt lost its importance otherwise it would have been the engine of indian economy just like the yangtze of china

Last edited:

- Joined

- Aug 10, 2020

- Messages

- 29,517

- Likes

- 113,415

The way fuel prices are increasing ,it has started pinching. Ye government apne supporters ka kuch Jyada hi patience check Kar rahi hai

People will have to accept inflation; can't ask for decade-old fuel prices: BJP minister

People will have to accept inflation; can't ask for decade-old fuel prices: BJP minister

Madhya Pradesh Minister Mahendra Singh Sisodia stoked a controversy saying since the income of people has increased, they will have to accept the inflation as well.www.timesnownews.com

Ya'll Nibbiars if fuel touches 150 will still say the same.Inn ch***** ko free ka fuel mil raha hai. Kuch bhi bol sakte hai.

And, only the Basic Excise Duty component of the Central Excise Duty is shared with the states. This used to be a significant amount before 2014. Post-2014, additional cess Special Additional Excise Duty, Agriculture Infrastructure & Development Cess and AIDC and Additional Excise Duty Road and Infrastructure Cess were introduced and these are not shared with the states. The Basic Excise Duty on petrol is just Rs.1.4 whereas the rest of the excise duty amounts to Rs.31.5.

The below picture gives a comparison of how much the state share in excise duty has reduced in recent years.

In 2017, 44% Rs.9.48 out of 21.48 of the collected Excise Duty on petrol was passed on to states whereas in 2021 this share was reduced to a mere 4% Rs.1.4 out of Rs.32.9. In the case of diesel, the gap is even more. The state's share dropped from 65% in 2017 to 6%.

In the past few months, retail prices of petrol and diesel have consistently increased to all-time high levels. On October 16, 2021, the retail price of petrol in Delhi was Rs 105.5 per litre, and that of diesel was Rs 94.2 per litre. In Mumbai, these prices were even higher at Rs 111.7 per litre and Rs 102.5 per litre, respectively.

The difference in fuel retail prices in the two cities is due to the different tax rates levied by the respective state governments on the same products. And look at the tax components in the price structure of petrol and diesel, the variation in these across states, and the major changes in taxation of these products in the recent years. The changes in the retail prices over the past few years and how it compares vis a vis the global crude oil prices.

Public sector Oil Marketing Companies OMCs revise the retail prices of petrol and diesel in India on a daily basis, according to changes in the price of global crude oil. The price charged to dealers includes the base price set by OMCs and the freight price. As on October 16, 2021, the price charged to dealers makes up 42% of the retail price in the case of petrol, and 49% of the retail price in the case of diesel.

The break-up of retail prices of petrol and diesel in Delhi as on October 16, 2021, shows that around 54% of the retail price of petrol comprises central and states taxes. And In the case of diesel, this is close to 49%. The central government taxes the production of petroleum products, while states tax their sale. The central government levies an excise duty of Rs 32.9 per litre on petrol and Rs 31.8 per litre on diesel. These make up 31% and 34% of the current retail prices of petrol and diesel, respectively.

While excise duty rates are uniform across the country, states levy sales tax/ Value Added Tax VAT which varies across states. For instance, Odisha levies 32% VAT on petrol, while Uttar Pradesh levies 26.8% VAT or Rs 18.74 per litre, whichever is higher. In addition to the tax rates, many state governments, such as Tamil Nadu, also levy certain additional levies such as cess Rs 11.5 per litre.

The Sales tax / VAT rates levied by states on petrol and diesel as on October 1, 2021.

Note : The rates shown for Maharashtra are averages of the rates levied in the Mumbai Thane region and in the rest of the state. Only percentages are being shown in this graph.

Sources : Petroleum Planning and Analysis Cell, Ministry of Petroleum and Natural Gas, PRS.

Note that unlike excise duty, sales tax is an ad valorem tax, i.e., it does not have a fixed value, and is charged as a percentage of the price of the product. This implies that while the value of excise duty component of the price structure is fixed, the value of the sales tax component is dependent on the other three components, i.e., price charged to dealers, dealer commission, and excise duty.

Last edited:

Hari Sud

Senior Member

- Joined

- Mar 31, 2012

- Messages

- 3,800

- Likes

- 8,540

After so many failed efforts, one office tower high enough is finally coming up in Worli.Ya'll Nibbiars Parniee Billions. Office Building of 62 floors 260 meters coming in Worli. Launched in July 2021. Under Construction 10 floors alreday constructed.

View attachment 116797

Hari Sud

Senior Member

- Joined

- Mar 31, 2012

- Messages

- 3,800

- Likes

- 8,540

Bad argument of rivers advanced. It is the trillion dollar FDI from USA to China over 10-12 years earlier during the 1998 to 2010 and freedom to export without any restrictions to US made China the manufacturing hub. Europe and Japan followed US example. Now that manufacturing engine is slowing down; first mostly trash is being made in the name of low price and internal economic issues have begun to hurt.not being close to river or sea might be the reason why indian cities are not as industrialized as chinese cities

in case of China The Yangtze River Economic Belt covers 11 provincial-level regions, including Shanghai, Jiangsu, Zhejiang, Anhui, Jiangxi, Hubei, Hunan, Chongqing, Sichuan, Yunnan and Guizhou. It occupies 2.05 million square kilometers, taking up 21 percent of the country’s total, and the population and economic aggregates both occupy over 40 percent of the country’s total.

The indian river which is equivalent to yangtze is the ganga river which has been the artery of trade for thousands of years but because of poor maintenance and neglect the ganga river economic belt lost its importance otherwise it would have been the engine of indian economy just like the yangtze of china

- Joined

- Jul 12, 2014

- Messages

- 31,932

- Likes

- 148,140

On top of it the above state revenue.Ya'll Nibbiars if fuel touches 150 will still say the same.

And, only the Basic Excise Duty component of the Central Excise Duty is shared with the states. This used to be a significant amount before 2014. Post-2014, additional cess Special Additional Excise Duty, Agriculture Infrastructure & Development Cess and AIDC and Additional Excise Duty Road and Infrastructure Cess were introduced and these are not shared with the states. The Basic Excise Duty on petrol is just Rs.1.4 whereas the rest of the excise duty amounts to Rs.31.5.

The below picture gives a comparison of how much the state share in excise duty has reduced in recent years.

View attachment 116897

In 2017, 44% Rs.9.48 out of 21.48 of the collected Excise Duty on petrol was passed on to states whereas in 2021 this share was reduced to a mere 4% Rs.1.4 out of Rs.32.9. In the case of diesel, the gap is even more. The state's share dropped from 65% in 2017 to 6%.

In the past few months, retail prices of petrol and diesel have consistently increased to all-time high levels. On October 16, 2021, the retail price of petrol in Delhi was Rs 105.5 per litre, and that of diesel was Rs 94.2 per litre. In Mumbai, these prices were even higher at Rs 111.7 per litre and Rs 102.5 per litre, respectively.

The difference in fuel retail prices in the two cities is due to the different tax rates levied by the respective state governments on the same products. And look at the tax components in the price structure of petrol and diesel, the variation in these across states, and the major changes in taxation of these products in the recent years. The changes in the retail prices over the past few years and how it compares vis a vis the global crude oil prices.

Public sector Oil Marketing Companies OMCs revise the retail prices of petrol and diesel in India on a daily basis, according to changes in the price of global crude oil. The price charged to dealers includes the base price set by OMCs and the freight price. As on October 16, 2021, the price charged to dealers makes up 42% of the retail price in the case of petrol, and 49% of the retail price in the case of diesel.

The break-up of retail prices of petrol and diesel in Delhi as on October 16, 2021, shows that around 54% of the retail price of petrol comprises central and states taxes. And In the case of diesel, this is close to 49%. The central government taxes the production of petroleum products, while states tax their sale. The central government levies an excise duty of Rs 32.9 per litre on petrol and Rs 31.8 per litre on diesel. These make up 31% and 34% of the current retail prices of petrol and diesel, respectively.

While excise duty rates are uniform across the country, states levy sales tax/ Value Added Tax VAT which varies across states. For instance, Odisha levies 32% VAT on petrol, while Uttar Pradesh levies 26.8% VAT or Rs 18.74 per litre, whichever is higher. In addition to the tax rates, many state governments, such as Tamil Nadu, also levy certain additional levies such as cess Rs 11.5 per litre.

The Sales tax / VAT rates levied by states on petrol and diesel as on October 1, 2021.

View attachment 116898

Note : The rates shown for Maharashtra are averages of the rates levied in the Mumbai Thane region and in the rest of the state. Only percentages are being shown in this graph.

Sources: Petroleum Planning and Analysis Cell, Ministry of Petroleum and Natural Gas; PRS.

Note that unlike excise duty, sales tax is an ad valorem tax, i.e., it does not have a fixed value, and is charged as a percentage of the price of the product. This implies that while the value of excise duty component of the price structure is fixed, the value of the sales tax component is dependent on the other three components, i.e., price charged to dealers, dealer commission, and excise duty.

Centre will share 41% of the pie, but it has shrunk the pie itself

Read more at: https://www.deccanherald.com/specia...-but-it-has-shrunk-the-pie-itself-950991.html

- Joined

- Aug 10, 2020

- Messages

- 29,517

- Likes

- 113,415

Ya'll Nibbiars

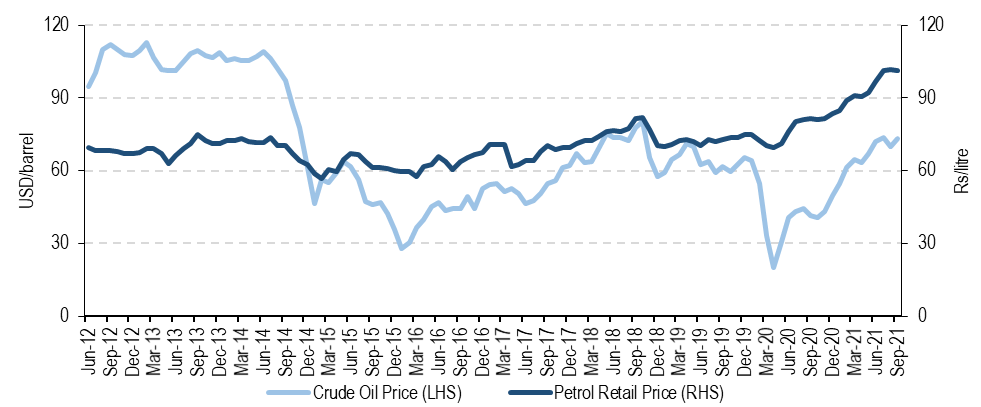

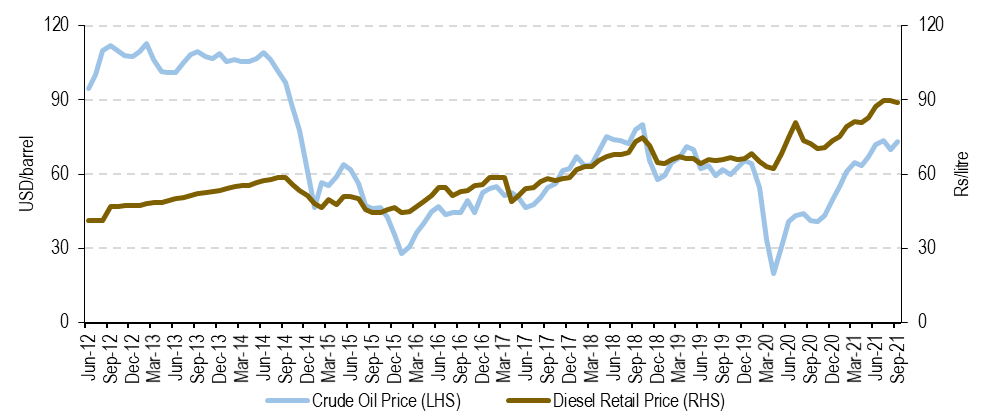

The Retail prices in India compared to global crude oil price.

India’s dependence on imports for consumption of petroleum products has increased over the years. For instance, in 1998-99, net imports of petroleum products were 69% of the total consumption, which increased to around 95% in 2020-21. Because of a large share of imports in the domestic consumption, any change in the global price of crude oil has a significant impact on the domestic prices of petroleum products. The two figures below show the trend in the price of global crude oil and retail prices of petrol and diesel in India, over the last nine years.

The Trend of the global crude oil price vis-à-vis retail prices of petrol and diesel in Delhi.

Note: Global Crude Oil Price is for the Indian basket. The Petrol and diesel retail prices are for Delhi.

Figures reflect average monthly price.

Sources : Petroleum Planning and Analysis Cell, Ministry of Petroleum and Natural Gas, PRS.

Between June 2014 and October 2018, the retail selling prices did not adhere to change in global crude oil prices. The global prices fell sharply between June 2014 and January 2016, and then subsequently increased between February 2016 and October 2018. However, the retail selling prices remained stable during the entire period. This disparity in the change in global and Indian retail prices was because of the subsequent changes in taxes. And For instance, central taxes were increased by Rs 11 and 13 between June 2014 and January 2016 on petrol and diesel respectively. The Subsequently, taxes were decreased by four rupees between February 2017 and October 2018petrol and diesel. Similarly, during January-April 2020, following a sharp decline of 69% in the global crude oil prices, the central government increased the excise duty on petrol and diesel by Rs 10 per litre and Rs 13 per litre, respectively in May 2020.

The Retail prices in India compared to global crude oil price.

India’s dependence on imports for consumption of petroleum products has increased over the years. For instance, in 1998-99, net imports of petroleum products were 69% of the total consumption, which increased to around 95% in 2020-21. Because of a large share of imports in the domestic consumption, any change in the global price of crude oil has a significant impact on the domestic prices of petroleum products. The two figures below show the trend in the price of global crude oil and retail prices of petrol and diesel in India, over the last nine years.

The Trend of the global crude oil price vis-à-vis retail prices of petrol and diesel in Delhi.

Note: Global Crude Oil Price is for the Indian basket. The Petrol and diesel retail prices are for Delhi.

Figures reflect average monthly price.

Sources : Petroleum Planning and Analysis Cell, Ministry of Petroleum and Natural Gas, PRS.

Between June 2014 and October 2018, the retail selling prices did not adhere to change in global crude oil prices. The global prices fell sharply between June 2014 and January 2016, and then subsequently increased between February 2016 and October 2018. However, the retail selling prices remained stable during the entire period. This disparity in the change in global and Indian retail prices was because of the subsequent changes in taxes. And For instance, central taxes were increased by Rs 11 and 13 between June 2014 and January 2016 on petrol and diesel respectively. The Subsequently, taxes were decreased by four rupees between February 2017 and October 2018petrol and diesel. Similarly, during January-April 2020, following a sharp decline of 69% in the global crude oil prices, the central government increased the excise duty on petrol and diesel by Rs 10 per litre and Rs 13 per litre, respectively in May 2020.

Last edited:

- Joined

- Aug 10, 2020

- Messages

- 29,517

- Likes

- 113,415

Ya'll NibbiarsOn top of it the above state revenue.

Centre will share 41% of the pie, but it has shrunk the pie itself

Read more at: https://www.deccanherald.com/specia...-but-it-has-shrunk-the-pie-itself-950991.html

As a result of the increase in excise duty in May 2020, the excise duty collection increased sharply from Rs 2.38 lakh crore in 2019-20 to Rs 3.84 lakh crore in 2020-21. The year-on-year growth rate of excise duty collection increased from 4% in 2019-20 to 67% in 2020-21. However, sales tax collections from petroleum products during that period remained more or less constant.

The Excise duty and sales tax/ VAT collection from petroleum products in Rs lakh crore.

Note : The excise duty component in the figure includes cess on crude oil.

Sources : Petroleum Planning and Analysis Cell, Ministry of Petroleum and Natural Gas, PRS.

Latest Replies

-

Indian Special Forces

- NoobWannaLearn

-

Indian Navy Developments & Discussions

- Blademaster

-

Failed Terrorist State of Pakistan: Idiotic Musings

- The Juggernaut

-

Idiotic Musings From Firangistan

- FalconSlayers

-

-

Infrastructure and Energy Sector

- thebakofbakchod

Global Defence

-

Small arms and Light Weapons

- NoobWannaLearn

-

Turkish defense industry news updates

- mamamia12

-

Aircraft Crash Notification

- vishnugupt

-

Drone swarms -India

- LETHALFORCE

-

F-35 Joint Strike Fighter

- blackjack

-

World Military/Paramilitary/Special Forces

- airborneCommando

-

New Naval Technology

- Blademaster

-

F-16 Viper

- MiG-29SMT

New threads

-

World Chess Championship 2024

- SwordOfDarkness

- Replies: 4

-

Chinese Lunar Exploration Program

- skywatcher

- Replies: 0

Articles

-

India Strikes Back: Operation Snow Leopard - Part 1

- mist_consecutive

- Replies: 9

-

Aftermath Galwan : Who holds the fort ?

- mist_consecutive

- Replies: 33

-

The Terrible Cost of Presidential Racism(Nixon & Kissinger towards India).

- ezsasa

- Replies: 40

-

Modern BVR Air Combat - Part 2

- mist_consecutive

- Replies: 22

-

Civil & Military Bureaucracy and related discussions

- daya

- Replies: 32