Budget 2023-24

- Thread starter ezsasa

- Start date

More options

Who Replied?TopWatcher

Senior Member

- Joined

- Feb 19, 2022

- Messages

- 1,700

- Likes

- 4,536

Anyone know ISRO budget ?

Abbey

Senior Member

- Joined

- Oct 28, 2022

- Messages

- 1,719

- Likes

- 6,906

Anyone know ISRO budget ?

TopWatcher

Senior Member

- Joined

- Feb 19, 2022

- Messages

- 1,700

- Likes

- 4,536

Then why we ask ISRO to do. With this budget, bus diwali rocket udaooo.

Becahare ISRO wale bhi has rahe hoon ge

Capex 10 Trillion, Up 33% For 2023/24

Capex Estimate was 9 Trillion Vs Actual 10 Trillion

•FISCAL DEFICIT 6.4 GDP VS GOAL 6.4% FY23

•FY 2023/24 TGT 5.9%

•FY 2025/26 TGT 4.5%

-Net Borrowing & Personal Income Tax

•Increase Rebate Limit To 7 Lakh,Surcharge Cut to 25% From 37.5%

•Current Borrowing 15.4 Trillion

•Next Year Estimate 11.8 Trillion

Capex Estimate was 9 Trillion Vs Actual 10 Trillion

•FISCAL DEFICIT 6.4 GDP VS GOAL 6.4% FY23

•FY 2023/24 TGT 5.9%

•FY 2025/26 TGT 4.5%

-Net Borrowing & Personal Income Tax

•Increase Rebate Limit To 7 Lakh,Surcharge Cut to 25% From 37.5%

•Current Borrowing 15.4 Trillion

•Next Year Estimate 11.8 Trillion

TopWatcher

Senior Member

- Joined

- Feb 19, 2022

- Messages

- 1,700

- Likes

- 4,536

I think we should tweet to PMO/PM regarding ISRO budget. Someone really pushing ISRO back,Then why we ask ISRO to do. With this budget, bus diwali rocket udaooo.

Becahare ISRO wale bhi has rahe hoon ge

TopWatcher

Senior Member

- Joined

- Feb 19, 2022

- Messages

- 1,700

- Likes

- 4,536

Means bus humara 10T ka budget hai.Capex 10 Trillion, Up 33% For 2023/24

Capex Estimate was 9 Trillion Vs Actual 10 Trillion

•FISCAL DEFICIT 6.4 GDP VS GOAL 6.4% FY23

•FY 2023/24 TGT 5.9%

•FY 2025/26 TGT 4.5%

-Net Borrowing & Personal Income Tax

•Increase Rebate Limit To 7 Lakh,Surcharge Cut to 25% From 37.5%

•Current Borrowing 15.4 Trillion

•Next Year Estimate 11.8 Trillion

Then how we are 3T$ economy ?

TopWatcher

Senior Member

- Joined

- Feb 19, 2022

- Messages

- 1,700

- Likes

- 4,536

Pak keh raha hoon ga hmara bhi allocate kar dete

Everything is ok on cursory glance except....Defence capital outlay 1.62 lakh crore

IA - 37241 Cr.

IN - 52804 Cr.

IAF - 57137 Cr.

View attachment 192024View attachment 192025View attachment 192026View attachment 192027

(Aircraft and aero engines for airforce) 23k Cr to 15K Cr ..

Tai be like pehle aircraft select kar lo tab paisa poochna.

Arihant Roy

Senior Member

- Joined

- Jan 25, 2018

- Messages

- 1,501

- Likes

- 12,549

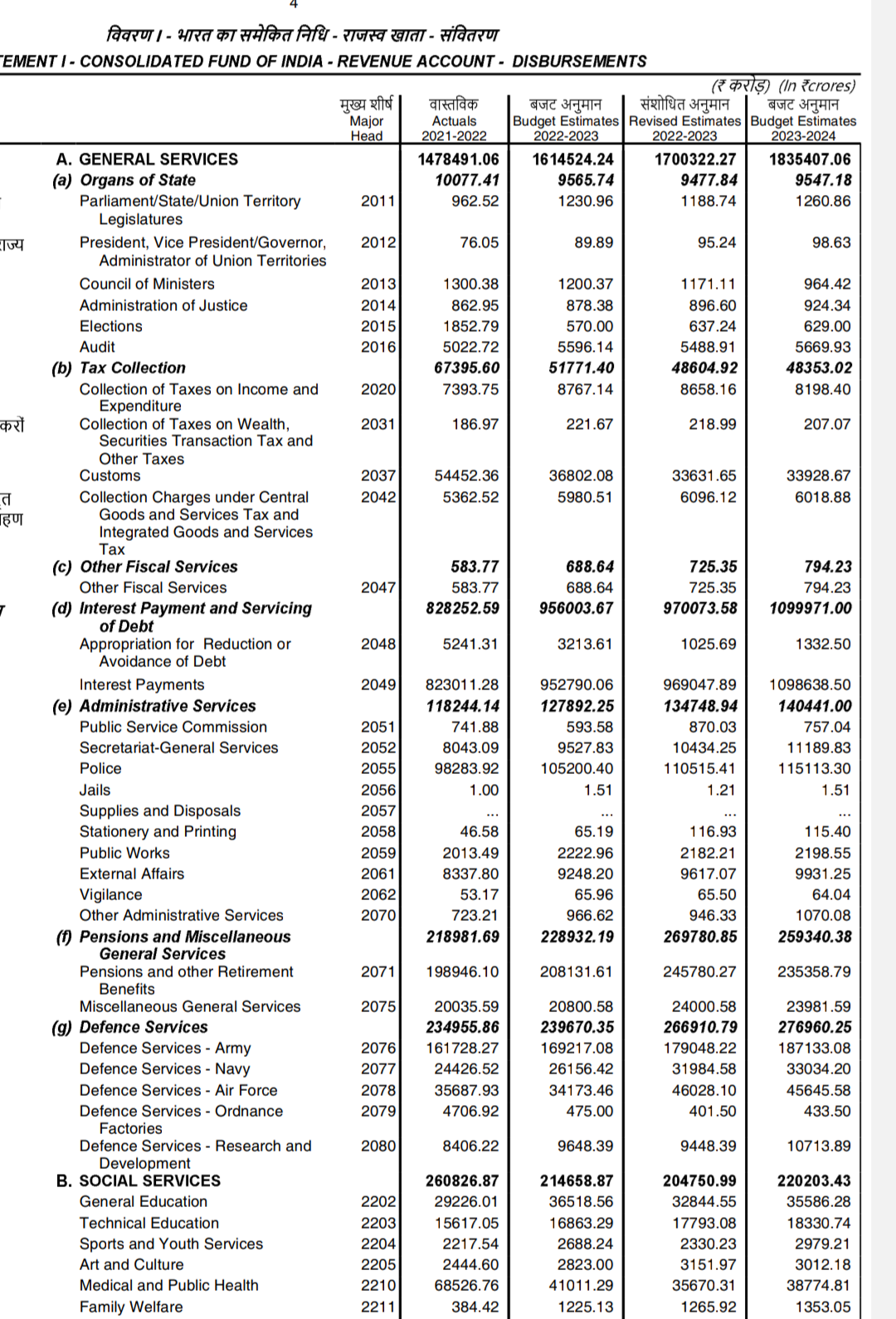

Here's are the main figures for Defense services. Excluded pensions.

Total allocation under Defense services head( Includes IA, IAF, IN, Ordnance factories, DRDO)

Actuals 2021-22 - 2,34,955.86

BE 2022-23 - 2,39,670.25

RE 2022-23 - 2,66,910.79

BE 2023-24 - 2,76,960.25

So per rise over BE 2022-23 - 27,240 .59 crores or 11.365 percent.

This rise of 11.365 comprises of CAPEX and OPEX and other miscellaneous cost but excludes pensions .

DRDO budget -

Actuals 2021-22 - 8406.22

BE 2022-23 - 9648.39

RE 2022-23 - 9448.39

BE 2023-24 - 10713.89

So increase in allocation over BE 2022-23 - 1065.5 crores or 11.04 percent

Total allocation under Defense services head( Includes IA, IAF, IN, Ordnance factories, DRDO)

Actuals 2021-22 - 2,34,955.86

BE 2022-23 - 2,39,670.25

RE 2022-23 - 2,66,910.79

BE 2023-24 - 2,76,960.25

So per rise over BE 2022-23 - 27,240 .59 crores or 11.365 percent.

This rise of 11.365 comprises of CAPEX and OPEX and other miscellaneous cost but excludes pensions .

DRDO budget -

Actuals 2021-22 - 8406.22

BE 2022-23 - 9648.39

RE 2022-23 - 9448.39

BE 2023-24 - 10713.89

So increase in allocation over BE 2022-23 - 1065.5 crores or 11.04 percent

Last edited:

SKC

Senior Member

- Joined

- Aug 16, 2014

- Messages

- 8,877

- Likes

- 30,565

Better tax slabs then earlier where there was flat 20% and 30% tax when you get even 1 rs more in higher tax slabs.The FM in her speech announced a rebate in n income tax limit to 7 lakh in new tax regime. She also reduced the number of slabs to 5, which will be:

0-3 lakh- nil

3-6 lakh -5%

6-9 lakh - 10%

9-12 lakh-15%

12-15 lakh -20%

Above 15 lakh - 30%

For big earners, the highest effective tax rate has been reduced from 42.7 percent to 39%. The FM left LTCG unchanged, cheering the bourses. Sops

have been offered to common man to move to the new tax regime by rejigging slabs and also bringing the peak rate down

Govt to reduce customs duty on shrimp feed to promote exports: FM Sitharaman

Taxes on cigarettes hiked by 16 percent

Basic import duty on compounded rubber increased to 25 percent from 10 percent.

Basic customs duty hiked on articles made from gold bars

Customs duty on kitchen electric chimney increased to 15 percent from 7.5 percent.

Customs duty on parts of open cells of TV panels cut to 2.5 percent.

Govt proposes to reduce customs duty on import of certain inputs for mobile phone manufacturing.

SKC

Senior Member

- Joined

- Aug 16, 2014

- Messages

- 8,877

- Likes

- 30,565

yes much better than flat slabs of 5-10 lakhs and 10-20 lakhs and 30 lakhs and above.budget is a populist one.

With new tax slabs, middle class and employees should be pretty happy.

It adds a decent amount to their savings monthly.

Kumata

Senior Member

- Joined

- Feb 27, 2019

- Messages

- 8,907

- Likes

- 34,528

wait buddy... devil lies in details .. Specifically for new tax regime...budget is a populist one.

With new tax slabs, middle class and employees should be pretty happy.

It adds a decent amount to their savings monthly.

you are celebrating early...There is nothing populist though.. there is a reason why market went up...

- Joined

- Sep 25, 2015

- Messages

- 9,703

- Likes

- 53,700

Market went up because this budget would soothe middle class a bit,wait buddy... devil lies in details .. Specifically for new tax regime...

you are celebrating early...There is nothing populist though.. there is a reason why market went up...

ergo, BJP would come back to power in 2024.

Let me tell you, market would have tanked if it gets even a wind of BJP losing power.

devil is always in details but fortunately for India, our tax regime is not that complicated, especially for middle class.

it is only the rich ones that have to circus to save monies.

Sanglamorre

Senior Member

- Joined

- Apr 4, 2019

- Messages

- 5,745

- Likes

- 26,366

I guess I know what I'm putting in my smokes from now.Govt to reduce customs duty on shrimp feed to promote exports: FM Sitharaman

Taxes on cigarettes hiked by 16 percent

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

|

|

Union Budget 2021 | Economy & Infrastructure | 253 | |

|

|

Indian Defense Budget 2021 | Defence & Strategy | 34 | |

|

|

Defence budget 2021-2022 | Defence & Strategy | 46 | |

|

|

Defence budget 2019- 2020 | Defence & Strategy | 33 |

Latest Replies

-

Small arms and Light Weapons

- Aditya Ballal

-

DRDO, PSU and Private Defence Sector News

- Knight0000

-

Indian Electronics and Semiconductor manufacturing industry

- thebakofbakchod

-

Jokes Thread

- patriots

-

Idiotic Musings From Firangistan

- Varoon2

-

India Pakistan conflict along IB and LoC (July 2021 onwards)

- airborneCommando

-

Russia Ukraine War 2022

- Overlord

-

Indian Special Forces

- Mr.Evil007

Global Defence

-

Small arms and Light Weapons

- Aditya Ballal

-

World Military/Paramilitary/Special Forces

- Zoid Raptor

-

Military Pics That go Hard

- RDXChauhan

-

Turkish defense industry news updates

- tfxkaanf23

-

Rafale in Croatian Air Force

- Picard

-

Drone swarms -India

- LETHALFORCE

-

Aircraft Crash Notification

- vishnugupt

-

F-35 Joint Strike Fighter

- blackjack

-

New Naval Technology

- Blademaster

Articles

-

India Strikes Back: Operation Snow Leopard - Part 1

- mist_consecutive

- Replies: 9

-

Aftermath Galwan : Who holds the fort ?

- mist_consecutive

- Replies: 33

-

The Terrible Cost of Presidential Racism(Nixon & Kissinger towards India).

- ezsasa

- Replies: 40

-

Modern BVR Air Combat - Part 2

- mist_consecutive

- Replies: 22

-

Civil & Military Bureaucracy and related discussions

- daya

- Replies: 32