- Joined

- Aug 20, 2010

- Messages

- 7,869

- Likes

- 23,263

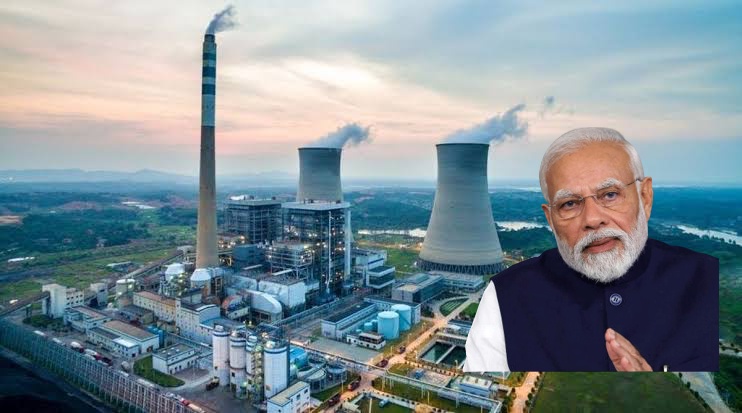

External financing for large-scale infrastructure projects is always easier than self-financing. This gives us as manufacturers and operators to refinance in case there are delays in projects without risking a significant amount of tax money.India can get funds on its own LCs. The problem remains workload where we have to take our nuclear energy 5 times by 2030.

NPCIL gets the most of work done by L&T, BHEL & Godrej (who have worked on one of these reactors) for building nuclear reactors and is moving faster than ever. Yet is far behind our own targets, let alone building reactors for others.

Given the "going concern" nature of our country, every international institution would be eager to lend us large sums of money.

I know we have a large external debt base internationally, but so do the US and more importantly, China. They are not going to pay anything back and neither are the Americans who literally control the financing currency. We should be brazen to use infrastructure where we can to create long-term self-capitalization plans.

India needs $$ and to get that, exports are the only way. The more we offset our costs with exports the more we grow faster with reduced liabilities in the long term. Small affordable nuclear reactors are in high demand due to their costs and ease of building and managing for smaller countries.

China got ahead by making literally everything under the sun. Today, if Algeria or Peru ask them to make a reactor and everything in it, they will be able to deliver these needs on a record scale. That's what we should be able to do in the next 5-10 years.

Since you said that the issue is the scale of domestic work, the problem is not unrealistic targets; it is a dangerous shortage of workforce qualified in nuclear science and engineering. This should be advertised nationwide so that educational institutes can take up courses to promote nuclear engineering as a preferred line of work.

How thick are these PSU guys to not realize that they need to start investing in more manpower?

I am 27 have a SUV and a lavish flat (paying EMI).

I am 27 have a SUV and a lavish flat (paying EMI).