GDP: India in the age of financialisation; to add $1 trillion every 18 months - The Economic Times

Aug 14, 2017, 11.26 AM IST

By Rashesh Shah, Chairman, Edelweiss Group

By 2025, India could possibly be a $5t economy, adding $1t every 18 months

It is a wonderful time for the Indian

economythe

markets are booming with rising participation from domestic investors, structural reforms like

GST,

BankruptcyCode and RERA are transforming the economic landscape and cyclical drivers, including corporate

earnings are expected to improve significantly going forward.

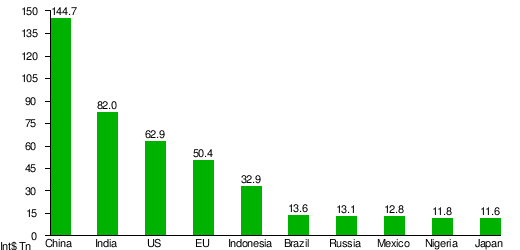

With a strong growth rate which should be sustainable for an extended period, India's large GDP, exceeding $2 trillion, should witness a massive compounding effect. By 2025, India could possibly be a $5 trillion economy , adding $1 trillion every 18 months thereon! It won't be a surprise to see India challenging the hegemony of countries like USA and

China, with a

GDPwhich could touch $20 trillion by 2040. This is truly, India's Golden Age of Compounding.

Savings-Investment paradox

Traditionally, India has experienced a unique savings-investments paradox while

Indiansare inveterate savers, this has not translated into financial

investments. However, rising financial literacy, simplification in

investment processes and growing understanding that long-term

wealth will accrue to investors and not savers is changing the way how Indians envisage financial investments.

Household leveraging

A household

balance sheet consists of assets (savings and other investments) and liabilities (loans). While the assets side is witnessing steady movement from savings to investments, we are seeing a shift in the liability-side behaviour of an Indian household.

Households are becoming more comfortable with the concept of leveraging, confident in their ability to invest and earn a better return than their cost of borrowing. This behaviour has been driven by the decline in

inflation and the consequent falling interest rate

environment that we are in.

With the interest rate trend to continue going forward, effectively, there are two tectonic shifts which will happen in India financialisation of savings on the assets side and the democratisation of credit on the liabilities side.

Financialisation of savings

Domestic flows into the equity

market have been rising incrementally over the last couple of years. While there have been surges in domestic flows into equity earlier, this time the change is structural.

This is due to a variety of factors sustained investment for an extended

duration of time, better performance of equity asset class compared to

real estate and

gold, lower equity ownership of Indian households compared to global peers, low share of savings in the household asset profile and increased awareness, access and belief in equity market opportunity.

This structural change is reflected in the numbers. Household savings in

shares and debentures are on the rise.

Mutual fundshave been a favoured avenues to invest in equity this is seen in the number of

MFfolios which have quadrupled in the last 3 years from 0.3 million to 1.3 million.

Monthly

SIP flows are now around Rs 4,500 crore an annual inflow of more than Rs 50,000 crore! Growing awareness in equity markets will have a collateral positive impact on investor interest in other financial assets like

insurance and bond markets.

With growing acceptance in the power of investing, retail investors will be

open to exploring newer avenues of investment. Regulators and organisations are making efforts to educate investors on financial investments. Under-penetration in sectors like insurance provides room for growth.

Democratisation of credit

The financialisation of assets is only one part of the India growth story. An equally important facet is around democratisation of credit allocation in the economy. Allocation of capital in equity and debt markets has undergone an evolutionary change.

Today, these markets allocate capital purely on fundamental strengths in the business of a company. However, 70 years after independence, a significant portion of banking credit is extended to top 100 business houses. There is a significant untapped opportunity in the retail lending side of the business. This would include loans to individuals and to SMEs.

The situation is changing now, particularly because of the sizeable leveraging ability of households. Today, the government balance sheet is being leveraged for considerable capex investments that are happening. The corporate balance sheets are at the tipping point or maybe over-leveraged. Indian households are the only segment with borrowing capacity.Coupled with falling interest rate, households are ready to borrow more.

The introduction of Aadhaar, coupled with the JAM trinity has helped bring a huge part of the population under the financial net. With continued strengthening in CIBIL, improved credit

underwriting mechanisms and the use of a wider variety of data points to assess the credit worthiness of individuals and small businesses, access to credit is expected to increase for the credit-deficient sections of society and lead to a broad-basing of credit allocation in the economy.

Future Optimism abounds

With such a wide variety of factors falling in

place, there is significant cause for optimism for India. Fundamental structural changes are re-shaping the economy and cyclicals are starting to become stronger.

With the global economy starting to recover, the cumulative effect should drive the economy to new heights. There are challenges which we need to be

cognizantof lack of job creation, impact of strengthening rupee on trade and challenges on agriculture.

To truly understand the India story needs a bifocal vision one which can cut through the short-term

volatility and challenges and look at the long-term trend, which has always been upwards. Because, the near-term volatility is inherently visible and the long-term growth usually invisible; a truly all-encompassing bifocal vision helps look at the economy in a rational manner.

The mantra should be to play the long-term positive trend and manage the short-term uncertain volatility, rather than the other way round. If the short-term is managed well and the long-term played to its optimum, it is a great time to be a part of the India growth story and to reap the growth

dividend along with the economy.

http://m.economictimes.com/markets/...lion-every-18-months/articleshow/60053379.cms

@IndianHawk @Willy2 @roma @Krusty @Defcon 1 @Ghanteshwar @raheel besharam @raja696 @Amr @AnkitPurohit

@Akshay_Fenix @aditya10r @airtel @aditya10r @ancientIndian @Bahamut @Berkut @Bornubus @Bengal_Tiger @ersakthivel @FRYCRY @Gessler @HariSud

@hit&run @hardip @indiandefencefan @IndianHawk @JayPatel

@Kshatriya87 @LETHALFORCE @Mikesingh @NavneetKundu

@OneGrimPilgrim @pmaitra @PaliwalWarrior @Pulkit @smestarz @SakalGhareluUstad

@Srinivas_K @ShashankSharma

@Superdefender @Screambowl @TacticalFrog

@Abhijat @A chauhan @Alien @alphacentury @Ancient Indian @Ankit Purohit@anupamsurey@armyofhind

@Bharat Ek Khoj @Bhumihar @blueblood @brational @Bangalorean @Blackwater @bose @Bullet @cobra commando @DingDong @DFI_COAS @dhananjay1 @F-14B @fooLIam @gpawar@guru-dutt

@here2where@hit&run@HariPrasad-1@Indx TechStyle@Kshatriya87

@jackprince @Kharavela@Illusive@I_PLAY_BAD@LETHALFORCE

@Lions Of Punjab @maomao @Mad Indian@OneGrimPilgrim

@Peter@piKacHHu@Pinky Chaudhary@porky_kicker

@Razor @raja696 @Rowdy @Sakal Gharelu Ustad @SanjeevM @saty @sydsnyper @Srinivas_K @Screambowl @sorcerer @Simple_Guy @Sylex21 @wickedone @tarunraju@TrueSpirit2

@thethinker @Tshering22 @vayuu1@VIP

@Vishwarupa@VIP@Varahamihira

@WARREN SS @Willy2 @3deffect