pmaitra

Senior Member

- Joined

- Mar 10, 2009

- Messages

- 33,262

- Likes

- 19,594

Do governments deliberately keep unemployment 'high?'

I have been introduced to a new idea, that governments have an interest in keeping unemployment high. Now, that is, hitherto, a subjective statement.; however, I shall attempt to establish the objectivity of that claim later. For the moment, let us assume this claim is true. Now the question arises, why would the governments want to keep unemployment high?

Now, let us revisit that the subjective claim that governments want to keep unemployment high. Yes, they do, but to a certain limit. What is the limit? To understand this, let us see how Milton Friedman explains this scenario:

What did we see here? Among others, we were introduced to the idea that there exists a cost to look for jobs, a cost of movement, etc.. Let us keep that aside, but we shall come back and explore this further. Now, to continue on the concept of 'natural rate of unemployment,' while Friedman did not give a hard number, there exists another metric, called NAIRU (Non-Accelerating Inflation Rate of Unemployment). Overall, many economists (for example Paul Krugman) agree, that the 'natural rate of unemployment' is said to be in the vicinity of 6%.[Ref:03]

Now that we have a established a proximate number for the 'desired' unemployment rate, we have established the objectivity of the claim made in the very first paragraph.

At this point, many of us probably content with the idea that two of the most important factors of any economy, unemployment and inflation, remain in equilibrium with 6% unemployed and 94% employed. However, this simplistic conclusion ignores the fact that the population is not made up of two demographics, unemployed and employed; and that, there exists yet a third demographic - the non-employed.

Now, let us refresh our memories about the passing reference I made to the cost of looking for jobs, and the cost of mobility. On close introspection, one can deduce, that these factors are, indeed, taken into account, thus representing the non-employed, when arriving at the 'natural rate of unemployment;' or at least, the inference thereof.

So who are the beneficiaries of inflation, and who are the losers?

So we see, that banks, who are loaners (or money lenders), do have an interest in keeping the inflation low, in order, not to make losses. Do note, that this is true in case of economies run on a Fiat Currency.

Therefore, it can be summarized that banks will gain by keeping inflation low, and one way to achieve this is by keeping unemployment high, thus establishing the possibility that banks might be tempted to encourage or induce governments to strive to keep a section of the population jobless, and also discourage yet another section from seeking jobs.

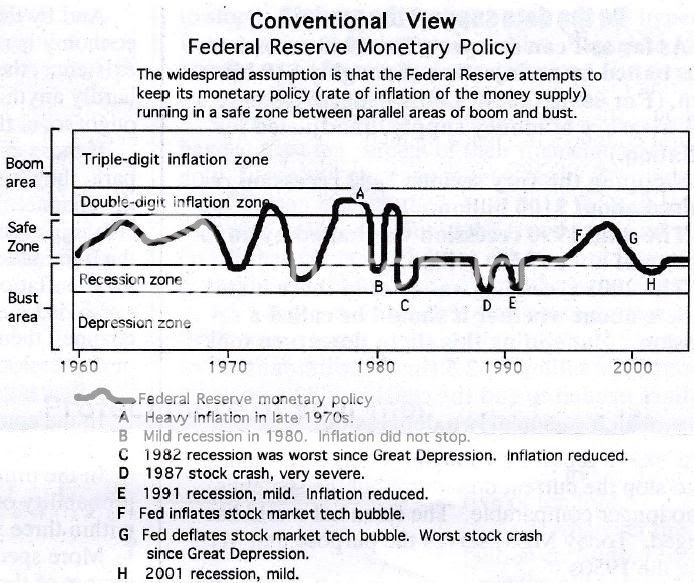

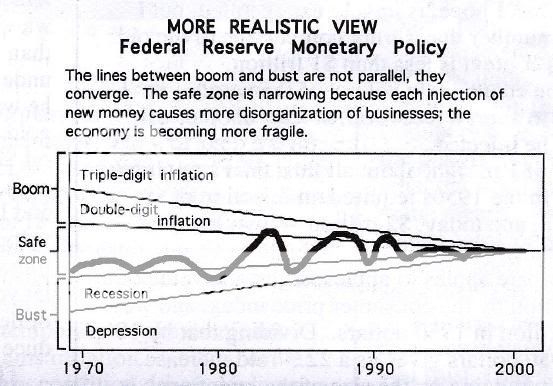

However, is this not a vicious cycle? Perhaps not. One explanation is that it is more of a cycle of repetitive crests and troughs, that happens over a temporal scale, while the economy, from the holistic view, continues to grow. This is shown by the curve below:

The readers are advised that many (perhaps all?) of the economists, and their theories, have been criticized. I am of the personal opinion, that one can get any number of mathematicians to agree, but it is virtually impossible to get two economists to agree. In a significant number of cases, IMHO, economists are best described, in less than generous terms, as charlatans, and their trade, economics, an art in debauchery.

[HR][/HR]

References:

[Ref:01]: SparkNotes: Measuring the Economy 2: The Tradeoff Between Inflation and Unemployment

[Ref:02]: http://www.stanford.edu/~rehall/Theory_Natural_Unemployment.pdf

[Ref:03]: NAIRU

[Ref:04]: 3 Lies About Jobs and the Unemployment Rate - Economic Intelligence (usnews.com)

[Ref:05]: Who Gains and Who Loses from Inflation? - Economics

[Ref:06]: Unemployment and Inflation

I have been introduced to a new idea, that governments have an interest in keeping unemployment high. Now, that is, hitherto, a subjective statement.; however, I shall attempt to establish the objectivity of that claim later. For the moment, let us assume this claim is true. Now the question arises, why would the governments want to keep unemployment high?

[Ref:01]Okun's Law describes a clear relationship between unemployment and national output, in which lowered unemployment results in higher national output. Such a relationship makes intuitive sense: as more people in a nation work it seems only right that the output of the nation should increase. Building on Okun's law, another economist, A. W. Phillips, discovered a relationship between unemployment and inflation. The chain of basic ideas behind this belief follows: as more people work the national output increases, causing wages to increase, causing consumers to have more money and to spend more, resulting in consumers demanding more goods and services, finally causing the prices of goods and services to increase. In other words, Phillips showed that unemployment and inflation shared an inverse relationship: inflation rose as unemployment fell, and inflation fell as unemployment rose. Since two major goals for economic policy makers are to keep both inflation and unemployment low, Phillip's discovery was an important conceptual breakthrough, but also posed a troublesome challenge: how to keep both unemployment and inflation low, when lowering one results in raising the other?

The Phillips Curve: Phillips' discovery can be represented in a curve, called, aptly, a Phillips curve.

Now, let us revisit that the subjective claim that governments want to keep unemployment high. Yes, they do, but to a certain limit. What is the limit? To understand this, let us see how Milton Friedman explains this scenario:

[Ref:02]The 'natural rate of unemployment' . . . is the level that would be ground out by the Walrasian system of general equilibrium equations, provided there is [embedded] within them the actual structural characteristics of the labor and commodity markets, including market imperfections, stochastic variability in demands and supplies, the cost of gathering information about job vacancies and labor availabilities, the cost of mobility, and so on.

What did we see here? Among others, we were introduced to the idea that there exists a cost to look for jobs, a cost of movement, etc.. Let us keep that aside, but we shall come back and explore this further. Now, to continue on the concept of 'natural rate of unemployment,' while Friedman did not give a hard number, there exists another metric, called NAIRU (Non-Accelerating Inflation Rate of Unemployment). Overall, many economists (for example Paul Krugman) agree, that the 'natural rate of unemployment' is said to be in the vicinity of 6%.[Ref:03]

Now that we have a established a proximate number for the 'desired' unemployment rate, we have established the objectivity of the claim made in the very first paragraph.

At this point, many of us probably content with the idea that two of the most important factors of any economy, unemployment and inflation, remain in equilibrium with 6% unemployed and 94% employed. However, this simplistic conclusion ignores the fact that the population is not made up of two demographics, unemployed and employed; and that, there exists yet a third demographic - the non-employed.

[Ref:04]We think of people as being either employed or unemployed, but there is a third classification: nonemployed. If you don't have a job but are looking, you are unemployed. If you take a break from looking, perhaps because you keep coming up empty, you become a "discouraged worker" and classified as nonemployed. The "labor force" is the number of employed and unemployed people. The nonemployed people don't count.

Now, let us refresh our memories about the passing reference I made to the cost of looking for jobs, and the cost of mobility. On close introspection, one can deduce, that these factors are, indeed, taken into account, thus representing the non-employed, when arriving at the 'natural rate of unemployment;' or at least, the inference thereof.

So who are the beneficiaries of inflation, and who are the losers?

[Ref:05]Borrowers benefit from a general increase in prices or a reduction in purchasing power.

[HR][/HR]

Lenders and savers both lose when inflation exceeds expectations.

So we see, that banks, who are loaners (or money lenders), do have an interest in keeping the inflation low, in order, not to make losses. Do note, that this is true in case of economies run on a Fiat Currency.

Therefore, it can be summarized that banks will gain by keeping inflation low, and one way to achieve this is by keeping unemployment high, thus establishing the possibility that banks might be tempted to encourage or induce governments to strive to keep a section of the population jobless, and also discourage yet another section from seeking jobs.

However, is this not a vicious cycle? Perhaps not. One explanation is that it is more of a cycle of repetitive crests and troughs, that happens over a temporal scale, while the economy, from the holistic view, continues to grow. This is shown by the curve below:

[Ref:06]

The four phases of the business cycle:

Unemployment increases during business cycle recessions and decreases during business cycle expansions (recoveries). Inflation decreases during recessions and increases during expansions (recoveries).

- A peak is when business activity reaches a temporary maximum, unemployment is low, inflation high.

- A recession is a decline in total output, unemployment rises and inflation falls.

- The trough is the bottom of the recession period, unemployment is at its highest, inflation is low.

- Expansion (recovery) is when output is increasing, unemployment begins to fall and later inflation begins to rise.

The readers are advised that many (perhaps all?) of the economists, and their theories, have been criticized. I am of the personal opinion, that one can get any number of mathematicians to agree, but it is virtually impossible to get two economists to agree. In a significant number of cases, IMHO, economists are best described, in less than generous terms, as charlatans, and their trade, economics, an art in debauchery.

[HR][/HR]

References:

[Ref:01]: SparkNotes: Measuring the Economy 2: The Tradeoff Between Inflation and Unemployment

[Ref:02]: http://www.stanford.edu/~rehall/Theory_Natural_Unemployment.pdf

[Ref:03]: NAIRU

[Ref:04]: 3 Lies About Jobs and the Unemployment Rate - Economic Intelligence (usnews.com)

[Ref:05]: Who Gains and Who Loses from Inflation? - Economics

[Ref:06]: Unemployment and Inflation