amoy

Senior Member

- Joined

- Jan 17, 2010

- Messages

- 5,982

- Likes

- 1,849

China Steps Up Plans To Develop Sichuan Basin Shale Gas_Shale Gas Portal Webisite of China_China Unconventional Oil & Gas

UpDate: 2012-06-13 Author: Brian O'Connell Source: Click: 47

Energy analysts say that it should take three to five years for a shale gas well to start paying off, so energy companies operating in China are barely in the starter's block.

China's leading energy company, Sinopec, is behind the first shale gas production campaign in the Far East giant. Industry observers say the Sichuan find could be huge, and could change the face of global natural gas. What does it mean to investors?

First off, China's second round of shale natural gas auctions means that the formerly communist country is stone-cold serious about developing its natural gas reserves. The auction, scheduled to take place later in 2012, is open to Chinese energy companies with $47 million in capital to qualify for the auction.

International companies can't directly participate in the auction, but they can cut exploration deals with Chinese companies. There's plenty at stake on that front. According to the Chinese government, the country has 800 trillion cubic feet in shale natural gas reserves. The Chinese government has set a goal of producing 230 billion cubic feet of shale gas annually during the next three years.

To date, shale gas exploration in the country has been scarce. In 2011, there were only 50 natural gas wells actively worked in China (compared to 1,300 per month in the U.S.), and the country only invested $222 million in shale gas last year, compared to $9.5 billion for its traditional oil and gas market, according to a report from China's Ministry of Land and Resources.

Those numbers leave western energy companies to drool over the prospect of getting into the huge Chinese sale gas market -- literally -- on the ground floor.

Energy analysts say that it should take three to five years for a shale gas well to start paying off, so energy companies operating in China are barely in the starter's block. The Western companies that might fare best, for themselves and their investors, are the ones who can bring a shale gas discovery blueprint from the U.S. and transport it to China.

That's exactly what Royal Dutch Shell is planning to do. In March, the oil giant inked a shale gas exploration pact with PetroChina to develop shale gas in the Sichuan Basin. It's philosophy on drilling for shale is a simple one.

"We've taken to China what we've learned in shale fracing in the United States," Royal Dutch Shell Plc CEO Peter Voser said in recent comments to The Dallas Morning News. "The geology's pretty similar. We can use the same skills and equipment."

Shell isn't alone. Chevron, too, is about to reach a deal in China to develop shale gas reserves in the country's Guizhou province. And, in 2011, Exxon Mobil began a study review of shale gas reserves in Sichuan in collaboration with Petrochemical Corp.

The Sichuan Basin, in particular, is a hotbed for shale gas that has drawn the attraction of a myriad of Western oil and gas companies. Take the Shell deal. RDS says it's technology know-how, including its fracing technology, can make a big difference for China National Petroleum in its effort to dig shale out of the Fushun-Yongchuan section of the 1,350 square-mile Sichuan.

That's a big deal for Shell investors. The company bills the production-sharing contract with CNPC as the "first shale gas PSC ever signed in China". That gives Shell a leg up on the competition, and is a big reason Shell may be on the radar screen of investors looking to capitalize on the coming Chinese shale gas boom.

"China has huge shale gas potential and we are committed to making a contribution in bringing that potential into reality," Voser said in a news release.

Investors would do well to research energy companies who have used the Shell blueprint to get into China. RDS laid the groundwork for its CNPC deal with a 2010 arrangement where Shell would come in on a research and advisory capacity to estimate potential reserves in the Fushun-Yongchuan block.

That led to the eventual exploration deal, where Shell has already begun drilling in a few select wells in the block.

Consequently, Shell has a head start in China shale, as its competitors are working off the same types of assessment deals that Shell has already superseded with the PSC deal, which was announced on March 20, 2012.

For investors, there are, as always, some caveats that need to be addressed before betting on any China shale plays using Western oil companies as a gateway.

A recent research report from Bernstein Research says that the PSC component could be problematic for oil and gas companies. Here are select reasons why, according to Bernstein:

How will the financial end work? -- Bernstein says that China is likely to use a royalty system on its PSC deals, but nothing is etched in stone. Investors don't like uncertainty, and with good reason. Consequently, it might be a good idea to see what the Chinese government decides on its PSC payment structure.

Regulated or unregulated? – The research report also points to a bit of a conundrum for the Chinese government, and for oil and gas companies looking to cash in on China shale. Will shale gas prices be regulated or unregulated? In China, conventional natural gas prices are regulated by the government, but coal-based methane is not. Bernstein calls the PSC pricing and regulation issue "cumbersome", and it may be troublesome as energy companies and the investors who buy shares in those companies don't have "clarity" on shale gas pricing in China.

Operational Issues? – Aside from pricing concerns, one long-standing issue for gas drillers in China is operational. Specifically, lack of direct access to infrastructure could be a problem for Western energy companies. In particular, drilling and pipeline equipment are at a premium in China which may be a big reason why Shell wanted the right to use its own technology in the Sichuan deal.

Some clarity may have already been revealed, and it could balance out the uncertainty cited by Bernstein Research. Some observers believe that China may be feeling its way along on shale gas contracts with Western companies, and it may be using the Shell deal as a template -- for now.

"I think the terms of this latest PSC are probably unique to the block and negotiated between Shell and CNPC, in order to give Shell the confidence to commit to investing in the block," says one upstream analyst in comments to Platts right after the Shell deal was announced. "It is probably a more formal agreement in order for it to cover its costs."

Nobody is saying these are obstacles that companies like Shell or Chevron can't overcome. The reality is nobody knows how things will work out in the China shale fields, and it could take some time for investors to earn a profit. But make no mistake, the profit potential is there--otherwise, Shell, and ExxonMobil wouldn't be.

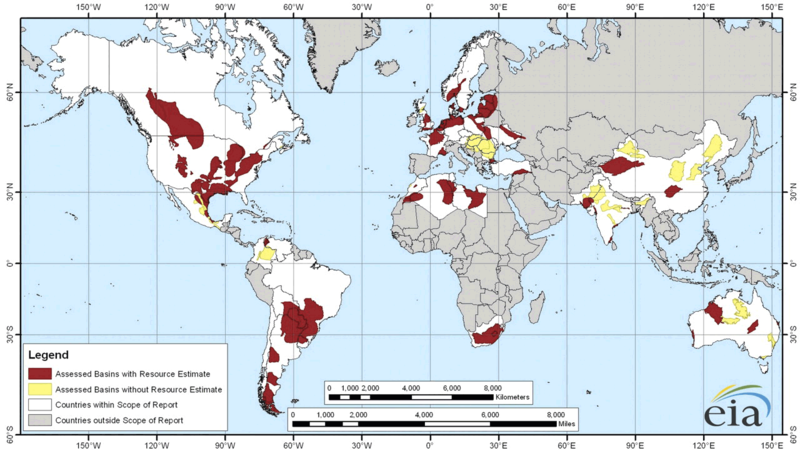

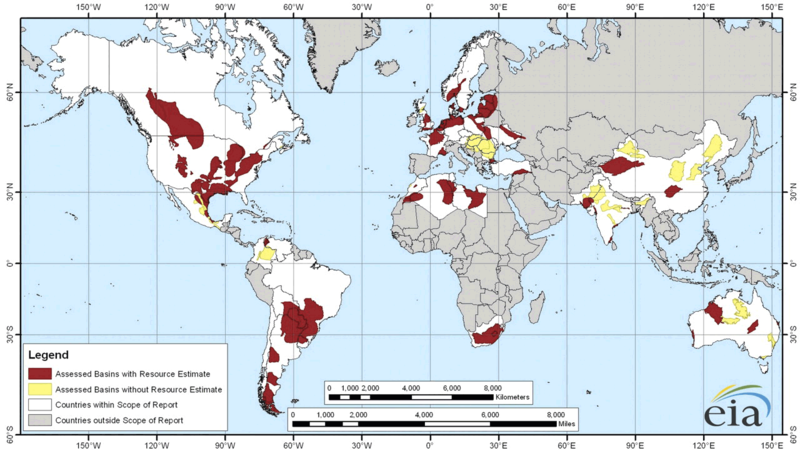

Sichuan and Xinjiang seem to hold the most of Chinese "accessed basins with resources estimated". And Pakistan is potential.

Shale gas - Wikipedia, the free encyclopedia

UpDate: 2012-06-13 Author: Brian O'Connell Source: Click: 47

Energy analysts say that it should take three to five years for a shale gas well to start paying off, so energy companies operating in China are barely in the starter's block.

China's leading energy company, Sinopec, is behind the first shale gas production campaign in the Far East giant. Industry observers say the Sichuan find could be huge, and could change the face of global natural gas. What does it mean to investors?

First off, China's second round of shale natural gas auctions means that the formerly communist country is stone-cold serious about developing its natural gas reserves. The auction, scheduled to take place later in 2012, is open to Chinese energy companies with $47 million in capital to qualify for the auction.

International companies can't directly participate in the auction, but they can cut exploration deals with Chinese companies. There's plenty at stake on that front. According to the Chinese government, the country has 800 trillion cubic feet in shale natural gas reserves. The Chinese government has set a goal of producing 230 billion cubic feet of shale gas annually during the next three years.

To date, shale gas exploration in the country has been scarce. In 2011, there were only 50 natural gas wells actively worked in China (compared to 1,300 per month in the U.S.), and the country only invested $222 million in shale gas last year, compared to $9.5 billion for its traditional oil and gas market, according to a report from China's Ministry of Land and Resources.

Those numbers leave western energy companies to drool over the prospect of getting into the huge Chinese sale gas market -- literally -- on the ground floor.

Energy analysts say that it should take three to five years for a shale gas well to start paying off, so energy companies operating in China are barely in the starter's block. The Western companies that might fare best, for themselves and their investors, are the ones who can bring a shale gas discovery blueprint from the U.S. and transport it to China.

That's exactly what Royal Dutch Shell is planning to do. In March, the oil giant inked a shale gas exploration pact with PetroChina to develop shale gas in the Sichuan Basin. It's philosophy on drilling for shale is a simple one.

"We've taken to China what we've learned in shale fracing in the United States," Royal Dutch Shell Plc CEO Peter Voser said in recent comments to The Dallas Morning News. "The geology's pretty similar. We can use the same skills and equipment."

Shell isn't alone. Chevron, too, is about to reach a deal in China to develop shale gas reserves in the country's Guizhou province. And, in 2011, Exxon Mobil began a study review of shale gas reserves in Sichuan in collaboration with Petrochemical Corp.

The Sichuan Basin, in particular, is a hotbed for shale gas that has drawn the attraction of a myriad of Western oil and gas companies. Take the Shell deal. RDS says it's technology know-how, including its fracing technology, can make a big difference for China National Petroleum in its effort to dig shale out of the Fushun-Yongchuan section of the 1,350 square-mile Sichuan.

That's a big deal for Shell investors. The company bills the production-sharing contract with CNPC as the "first shale gas PSC ever signed in China". That gives Shell a leg up on the competition, and is a big reason Shell may be on the radar screen of investors looking to capitalize on the coming Chinese shale gas boom.

"China has huge shale gas potential and we are committed to making a contribution in bringing that potential into reality," Voser said in a news release.

Investors would do well to research energy companies who have used the Shell blueprint to get into China. RDS laid the groundwork for its CNPC deal with a 2010 arrangement where Shell would come in on a research and advisory capacity to estimate potential reserves in the Fushun-Yongchuan block.

That led to the eventual exploration deal, where Shell has already begun drilling in a few select wells in the block.

Consequently, Shell has a head start in China shale, as its competitors are working off the same types of assessment deals that Shell has already superseded with the PSC deal, which was announced on March 20, 2012.

For investors, there are, as always, some caveats that need to be addressed before betting on any China shale plays using Western oil companies as a gateway.

A recent research report from Bernstein Research says that the PSC component could be problematic for oil and gas companies. Here are select reasons why, according to Bernstein:

How will the financial end work? -- Bernstein says that China is likely to use a royalty system on its PSC deals, but nothing is etched in stone. Investors don't like uncertainty, and with good reason. Consequently, it might be a good idea to see what the Chinese government decides on its PSC payment structure.

Regulated or unregulated? – The research report also points to a bit of a conundrum for the Chinese government, and for oil and gas companies looking to cash in on China shale. Will shale gas prices be regulated or unregulated? In China, conventional natural gas prices are regulated by the government, but coal-based methane is not. Bernstein calls the PSC pricing and regulation issue "cumbersome", and it may be troublesome as energy companies and the investors who buy shares in those companies don't have "clarity" on shale gas pricing in China.

Operational Issues? – Aside from pricing concerns, one long-standing issue for gas drillers in China is operational. Specifically, lack of direct access to infrastructure could be a problem for Western energy companies. In particular, drilling and pipeline equipment are at a premium in China which may be a big reason why Shell wanted the right to use its own technology in the Sichuan deal.

Some clarity may have already been revealed, and it could balance out the uncertainty cited by Bernstein Research. Some observers believe that China may be feeling its way along on shale gas contracts with Western companies, and it may be using the Shell deal as a template -- for now.

"I think the terms of this latest PSC are probably unique to the block and negotiated between Shell and CNPC, in order to give Shell the confidence to commit to investing in the block," says one upstream analyst in comments to Platts right after the Shell deal was announced. "It is probably a more formal agreement in order for it to cover its costs."

Nobody is saying these are obstacles that companies like Shell or Chevron can't overcome. The reality is nobody knows how things will work out in the China shale fields, and it could take some time for investors to earn a profit. But make no mistake, the profit potential is there--otherwise, Shell, and ExxonMobil wouldn't be.

Sichuan and Xinjiang seem to hold the most of Chinese "accessed basins with resources estimated". And Pakistan is potential.

Shale gas - Wikipedia, the free encyclopedia

In 2000 shale gas provided only 1% of U.S. natural gas production; by 2010 it was over 20% and the U.S. government's Energy Information Administration predicts that by 2035, 46% of the United States' natural gas supply will come from shale gas.[2]

Some analysts expect that shale gas will greatly expand worldwide energy supply.[3] China is estimated to have the world's largest shale gas reserves.[4] A study by the Baker Institute of Public Policy at Rice University concluded that increased shale gas production in the US and Canada could help prevent Russia and Persian Gulf countries from dictating higher prices for the gas they export to European countries.[5]