huaxia rox

Senior Member

- Joined

- Apr 4, 2011

- Messages

- 1,401

- Likes

- 103

S&P cuts India, China GDP growth forecast, U.S. sentiment hit | Real Time News, India

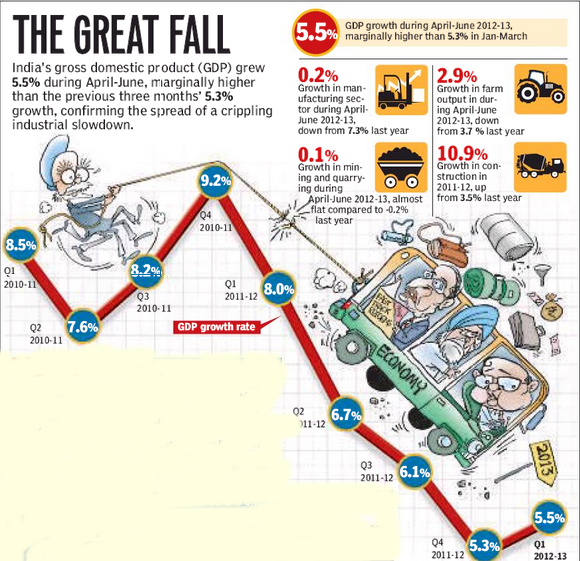

Global credit rating agency Standard & Poor's has cut its GDP growth estimate for India by 1 percentage point to 5.5% and for China by 0.5 percentage point to 7.5%.

The cut in India's outlook was prompted by poor monsoon and negative investor sentiment, while in China's case, it was caused by the Central Government's decision not to pump money into the Chinese economy to stimulate growth.

"The lack of monsoon rains has affected India, for which agriculture still forms a substantial part of the economy. Additionally, the more cautious investor sentiment globally has seen potential investors become more critical of India's policy and infrastructure shortcomings," S&P said in a report on the Asia Pacific today.

India has one of the worst infrastructure in the world, making the movement of people and goods across the country inefficient and expensive. The Indian government is yet to make big investments in building roads and ports, unlike in China.

India's infrastructure challenges was recently highlighted by the power outage in early August that affected 20 of India's 28 states, S&P said.

India has also been grappling with negative investor sentiment after former finance minister Pranab Mukherjee brought in a 'retrospective' law to tax foreign companies for capital gains on their assets in the country.

S&P, however, expects growth to pick up to 6.5% in 2013 and to 7% in 2014 (see chart above.)

India used to have growth in the range of 9% before the global recession hit.

S&P also revised the growth estimates for several other countries in the region. China is now seen growing at 7.5% this year and by 8.2% in the next and in 2014.

"Our lower forecast for China recognizes that the central government had elected not to inject an economic stimulus of a size and speed necessary for an 8% growth rate. It appears that the approach by the Chinese authorities remains influenced by the unpleasant experience of the inflationary effect, particularly on real estate prices, of the stimulus they initiated in late 2008-2009 to counter the global economic slowdown following the Lehman's collapse," it said.

As a result of the Chinese slowdown, export-oriented Asian economies of Japan, Korea and Taiwan, and the trading port cities of Hong Kong (in particular) and Singapore will also see slower growth, it said.

It also revised its sentiment for Europe and the United States downward.

"In Europe our base case GDP scenario for the Eurozone as a whole is that GDP will decline by 0.6% in 2012 and grow by just 0.4% in 2013, compared with zero and 1% growth, respectively, in our previous base case scenario," it said.

It now sees a 25% chance for the U.S. economy to slip back into recession

within the next year--up from 20% in February.

"Economic activity has downshifted sharply from earlier this year, with hiring and consumer spending growth slowing in the spring. Public sector retrenchment is continuing to drag down growth as well.

"And while the U.S. housing sector has shown signs of bottoming out, we don't expect home prices to recover strongly soon. At the same time, possible contagion from the European debt crisis, the potential so-called "fiscal cliff" (the collection of expiration of Bush-era tax cuts, payroll tax cut, and other tax relief programs), and the risk of a hard landing for China's economy have added greater uncertainty to U.S. economic prospects in upcoming months," it said.

It's estimate for U.S. GDP growth is about 2.1% for this year and 1.8% for 2013.

Global credit rating agency Standard & Poor's has cut its GDP growth estimate for India by 1 percentage point to 5.5% and for China by 0.5 percentage point to 7.5%.

The cut in India's outlook was prompted by poor monsoon and negative investor sentiment, while in China's case, it was caused by the Central Government's decision not to pump money into the Chinese economy to stimulate growth.

"The lack of monsoon rains has affected India, for which agriculture still forms a substantial part of the economy. Additionally, the more cautious investor sentiment globally has seen potential investors become more critical of India's policy and infrastructure shortcomings," S&P said in a report on the Asia Pacific today.

India has one of the worst infrastructure in the world, making the movement of people and goods across the country inefficient and expensive. The Indian government is yet to make big investments in building roads and ports, unlike in China.

India's infrastructure challenges was recently highlighted by the power outage in early August that affected 20 of India's 28 states, S&P said.

India has also been grappling with negative investor sentiment after former finance minister Pranab Mukherjee brought in a 'retrospective' law to tax foreign companies for capital gains on their assets in the country.

S&P, however, expects growth to pick up to 6.5% in 2013 and to 7% in 2014 (see chart above.)

India used to have growth in the range of 9% before the global recession hit.

S&P also revised the growth estimates for several other countries in the region. China is now seen growing at 7.5% this year and by 8.2% in the next and in 2014.

"Our lower forecast for China recognizes that the central government had elected not to inject an economic stimulus of a size and speed necessary for an 8% growth rate. It appears that the approach by the Chinese authorities remains influenced by the unpleasant experience of the inflationary effect, particularly on real estate prices, of the stimulus they initiated in late 2008-2009 to counter the global economic slowdown following the Lehman's collapse," it said.

As a result of the Chinese slowdown, export-oriented Asian economies of Japan, Korea and Taiwan, and the trading port cities of Hong Kong (in particular) and Singapore will also see slower growth, it said.

It also revised its sentiment for Europe and the United States downward.

"In Europe our base case GDP scenario for the Eurozone as a whole is that GDP will decline by 0.6% in 2012 and grow by just 0.4% in 2013, compared with zero and 1% growth, respectively, in our previous base case scenario," it said.

It now sees a 25% chance for the U.S. economy to slip back into recession

within the next year--up from 20% in February.

"Economic activity has downshifted sharply from earlier this year, with hiring and consumer spending growth slowing in the spring. Public sector retrenchment is continuing to drag down growth as well.

"And while the U.S. housing sector has shown signs of bottoming out, we don't expect home prices to recover strongly soon. At the same time, possible contagion from the European debt crisis, the potential so-called "fiscal cliff" (the collection of expiration of Bush-era tax cuts, payroll tax cut, and other tax relief programs), and the risk of a hard landing for China's economy have added greater uncertainty to U.S. economic prospects in upcoming months," it said.

It's estimate for U.S. GDP growth is about 2.1% for this year and 1.8% for 2013.