pmaitra

Senior Member

- Joined

- Mar 10, 2009

- Messages

- 33,262

- Likes

- 19,594

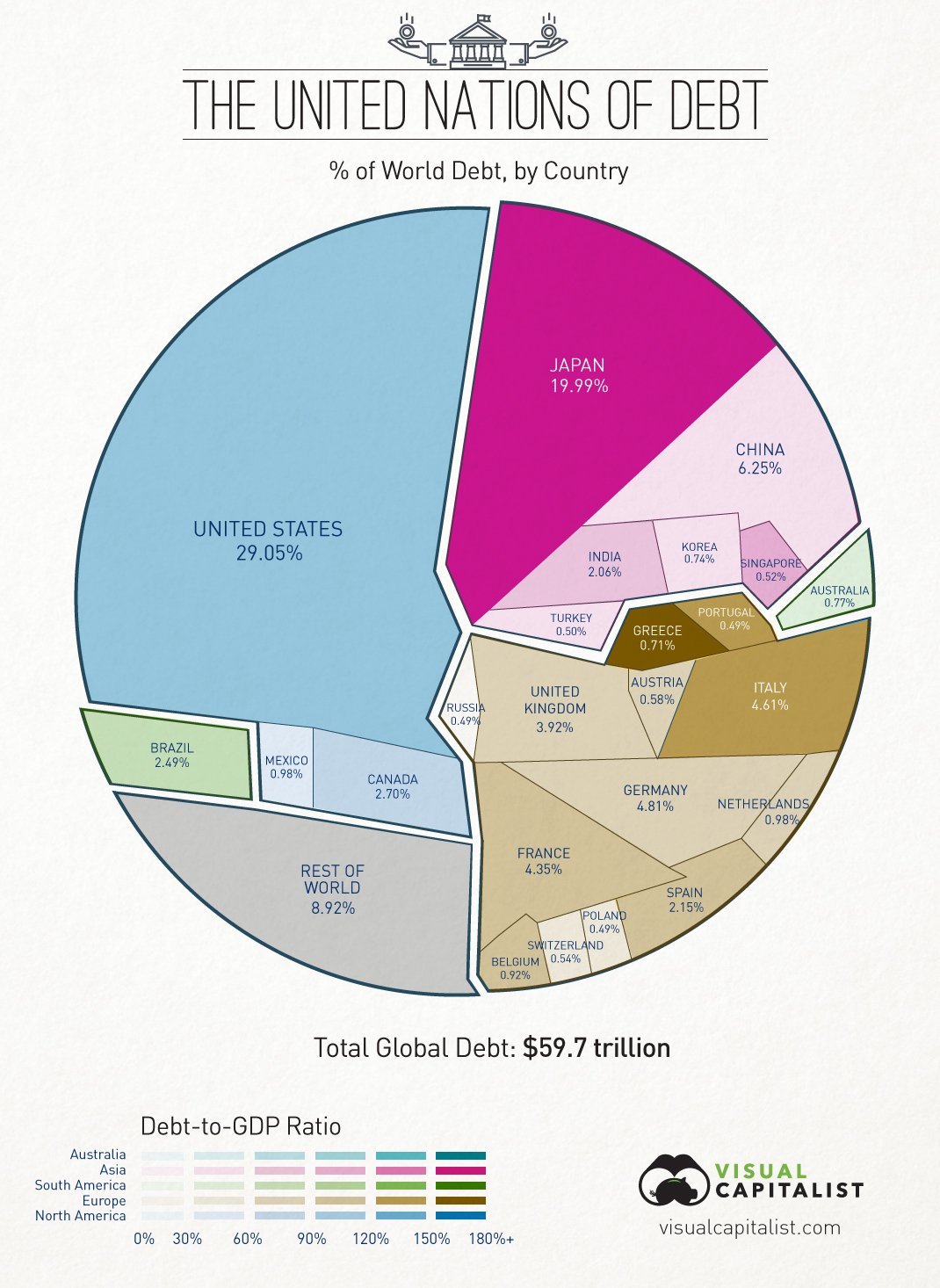

The United Nations of Debt

Someone jokingly remarked that the G7 like to tout themselves as the seven most wealthiest nations in the world because together they represent three quarters of the world’s debt.

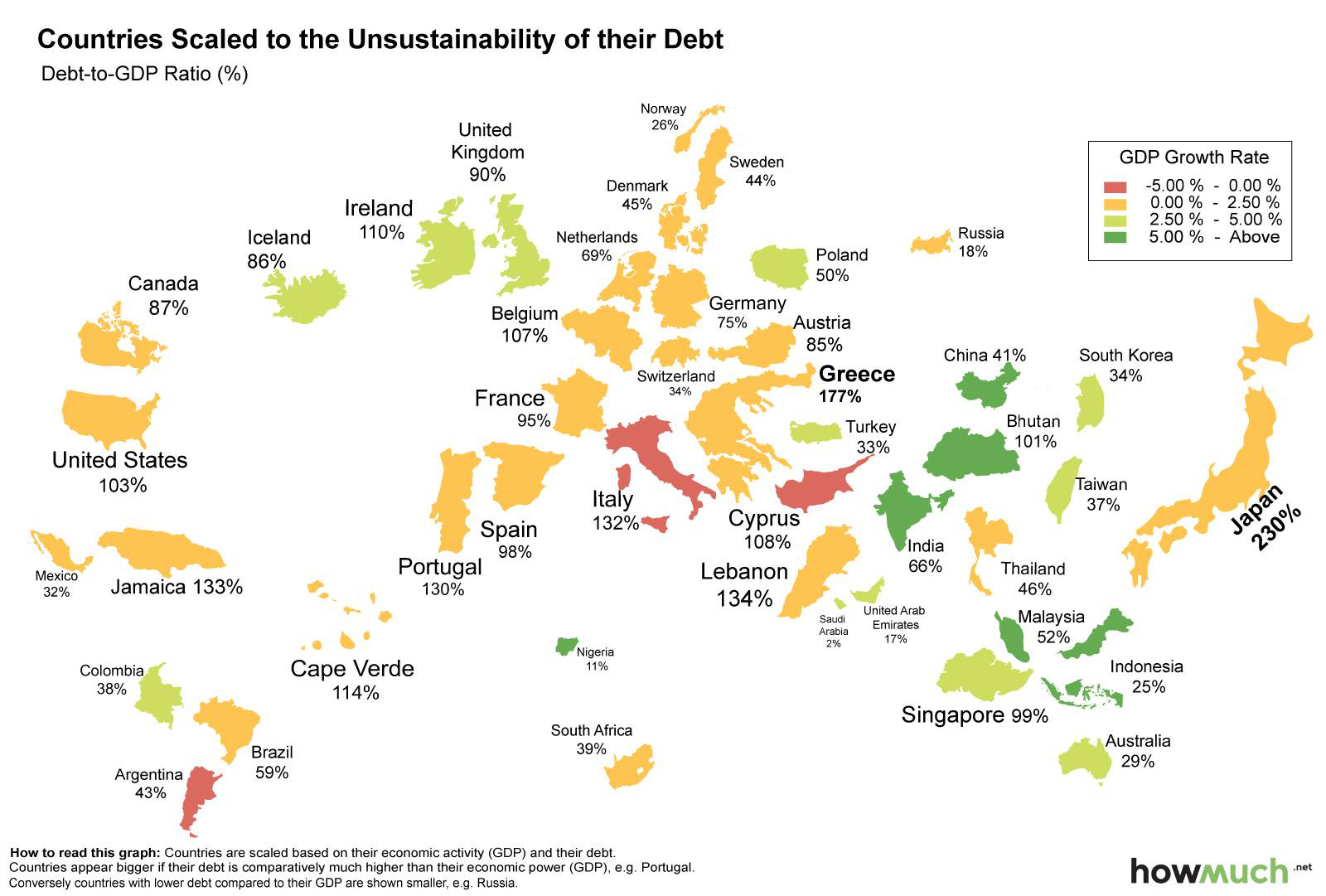

While it is possible for a country to be in debt and yet manage to service it debt by maintaining a high enough Gross Domestic Product, the question is, is it sustainable?

I have two visualizations from the source “Visual Capitalist.”

The United Nations of Debt

Countries Scaled to the Unsustainability of their Debt

This incites curiosity:

Someone jokingly remarked that the G7 like to tout themselves as the seven most wealthiest nations in the world because together they represent three quarters of the world’s debt.

While it is possible for a country to be in debt and yet manage to service it debt by maintaining a high enough Gross Domestic Product, the question is, is it sustainable?

I have two visualizations from the source “Visual Capitalist.”

The United Nations of Debt

Countries Scaled to the Unsustainability of their Debt

This incites curiosity:

- Are these economies indeed unsustainable?

- What could happen if the major indebted countries were to default?

- Who are the creditors?

- Are the creditors that powerful that they can have countries and governments indebted?