NutCracker

Senior Member

- Joined

- Jun 17, 2022

- Messages

- 5,046

- Likes

- 27,099

"peaked" means its gonna slow down in fy24 as per Namura's Verma.

Edit: wtf is that sad emoji for?

"peaked" means its gonna slow down in fy24 as per Namura's Verma.

Edit: wtf is that sad emoji for?

Isn't that obvious?"peaked" means its gonna slow down in fy24 as per Namura's Verma.

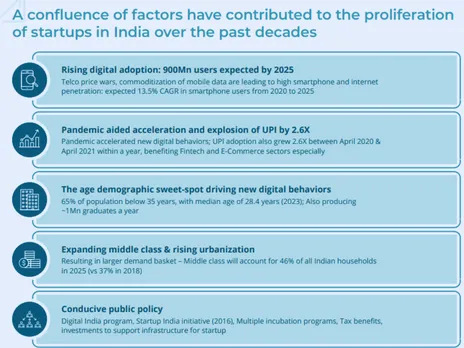

Startup?how does current startup and digital payments ecosystem fit into this statement?

startups : other than what is considered strategic industries/verticals, govts anywhere in the world do not fund startups directly, at best there will be university grants at initial stages just like in India. it is always private sector which does the heavy lifting because they know the market better. yes, there was free $ money floating around before 2021 and some of it came our way.Startup?

I think most startup are reaping the benefits of startup boom across the world, some trickle down to india as well. I don't think you can point me a particular startup that is majority gov funded as all have more or less venture capital investment.

UPI: credit where Cresit is due but you have to take into account tat Developnet of UPI had little to no babu interference.

It was buit buy a team headed by Sanjay Jain and Pramod Verma

Other than that the chief of payment mobility solution Sanjeev Palghiri who is no babu.

Infact he is a electronics engineer.

Most managerial post even in NPCI is filled with technocrats such as previous Relations managers at HDFC or Chief of Security infra at CISCO.

UPSC, IES, CHSL, SCC are the entities eating away from the country.

All babus need to be roped.

https://www.businessinsider.in/startup-friendly-bengaluru/articleshow/49816015.cmsAccording to reports, India would have some 11,500 startups by 2020, and Bengaluru would be a leading name in that.

www.tice.news

www.tice.news

Sir devil lies in the smallest Most insignificant detail and here is the detail.there were 57k new startups in 2022, 92k total in 2023

of the five reasons identified, GoI and state governments has direct or indirect role in four of them.

Authority figures who are out of Touch with intricacies of startup infra pen down unnecessary regulations that complicates otherwise a single window system.In no other situation is this partial break more evident than in the income tax benefits for startups and for investors into startups, Section 54GB of the Indian Income Tax Act, 1961. Touted before the budget as a tax break for investing into Indian startups, section 54GB can best be summed up from Macbeth, Act 5, Scene 5 – “full of sound and fury, signifying nothing.”

This paper tiger of a clause exudes the erstwhile License Raj of India – a byzantine series of needless complications which seem attractive in theory but are untenable in practice.

In principle, the clause gives a tax exemption of INR 50 lakhs (a small sum) for the investment of any capital gains into an eligible startup. But where it errs is in the compendium of conditions that dilute the effect this clause would have had in galvanising startup investment in India:

Restriction on the type of gains eligible:

The proceeds that can be invested should arise only from the sale of residential property or land (not any other asset)

Restriction on the company that can be invested into:

The investment needs to be made into an eligible startup, defined as any private limited company incorporated after April 1, 2016 and who has received IMB approval (so far, the success rate for this is around 1%)

Restriction on the security issuable:

The investment can only be made into equity shares (not preference shares, which is the preferred instrument for all startup investments)

Restriction on minimum ownership:

The investor should own 50% of the voting power of the start-up for the Rs 50 lakh invested! (no founder will ever part with 50% of their company for Rs 50 lakh)

Restriction on the use of funds:

The amount invested should be utilised by the eligible startup to purchase a new asset (plant and machinery), but specifically excludes any and all computers and computer software (clearly technology startups, which constitutes the bulk of all Indian startups, were never meant to be covered by this)

Any portion of the investment not used within 1 year of the investment to purchase said asset will be treated as income in the hands of the investor

Restriction on exits:

The tax exemption lapses if the Company or shares is sold within 5 years and the entire amount invested becomes taxable

Whereas the rest of the world has simple schemes without any of the associated red tape, such as:

UK – Seed Enterprise Investment Scheme (SEIS)

US – Section 1202

Singapore – Angel Investment Tax Deduction Scheme (AITD Scheme)

If the government is serious about galvanising Startup investment, which has already declined 48% in terms of the number of unique investors from 2015 to 2018, it needs to cut through all the red tape:

Remove the need for IMB Certification (its success rate is abysmal and shrinks the eligible pool)

Remove the restriction on the type of securities (non-redeemable securities will suffice)

Remove the restriction of minimum ownership (50% control for 50 lakhs is a complete non-starter)

Remove the restriction of use of funds (no tech startup will buy plant and machinery and not computers or software)

Have a carve out for the sale or merger of the entire company to an unrelated entity

The angel tax (section 56(2)(viib)) has hurt the confidence of Indian entrepreneurs and is leading to them shirking domestic investors for foreign ones, thus accelerating India’s descent into a digital colony where all our innovative companies are wholly owned by foreign investors. Measures such as Section 54GB, that are supposed to boost domestic investment, are mere lip-service, destined to fail from the get-go.

In India, startups and entrepreneurs have succeeded in spite of such inadequate policies, not because of it. But we all still live with the eternal hope that this gets reversed.

When we say gov did not do anything we don't mean the ministers or schemes introduced by the ministers but we generally mean the competency and sensibility of thr Authority/Beuracrat and their performance.UPI : technologies are always created in advance, there are always many new technologies always floating around. until either the govt or market decides to give it backing. in this case, govt decided that it will solve some of their governance issues. paytm and plastic cards existed before UPI, the adoption rate of UPI is exponential compared to what could have been achieved otherwise. and let's not forget, UPI is an entirely different model that didn't exist anywhere in the world. UPI tech is free, owned by government, used by private players. NPCI is like ISRO, their job is to create technologies and handhold the ecosystem.

the role of the govt is not just about funding, it is also about facilitating an ecosystem, and step back from over regulating if the industry asks for it. giving the message that start it's ok to fail a few times is a big deal in Indian way of thinking about businesses.

both in the case of startups and UPI, govt giving a signal that they are fully backing these ecosystems made a tremendous difference in their expansion, since the current numbers in both these numbers are at world leading scale, it does say something about happens when govts is involved and backs an ecosystem.

conversations and policy negotiations between Industry and Governments will continue to happen, as long as there is a dialogue and direction is positive, it is fine.Sir devil lies in the smallest Most insignificant detail and here is the detail.

India’s Only Startup Investment Incentive Is More Red Tape Than Red Carpet

Section 54GB gives a tax exemption of INR 50 lakhs but has its share of loopholes as well. Also, the angel tax has hurt the confidence of Indian entrepreneurs.inc42.com

Authority figures who are out of Touch with intricacies of startup infra pen down unnecessary regulations that complicates otherwise a single window system.

Futher yiu shoukd also considers the valauation swell of the 95000 startups, if they wont swell up than that menas a significant chunk is a ponzi startup meant only for collecting gov grants. Any data as to how much real time value these startup produced over the years?

Any significant benefactor of these schemes? There must be some exceptional ones at the very least?

Any ones that further attracted venture capital?

When we say gov did not do anything we don't mean the ministers or schemes introduced by the ministers but we generally mean the competency and sensibility of thr Authority/Beuracrat and their performance.

Benefit of doubt since the BJP gov is an exceptional one when it comes to buisness the bureaucracy also gets a trikle down effect but in the absence of the gov I'm not sure.

A good policy is a policy that retain its ingenuity even when the gob flops several time.

We cannot rely on gov to look and back everything.

Arre that's why sad emoji by @TejbrahmastraIsn't that obvious?

Had said so - Retail Ambani ko khayega. Bachha Ambani's don't know the perils of overambitious expansion, more so when there's continuous negative publicity against Reliance retail by the usual suspects.Ya'll Nibbiars 7 colleges who left my firm and joined the various RIL subsidiary are under the threat of getting fired. The next 14 days will be more dangerous for them.

Mukesh Ambani, Isha Ambani firm to sack 9000 employees days after Rs 2,850 crore deal

Reliance Retail, the parent company, is led by Isha Ambani, Mukesh Ambani's daughter. Mukesh Ambani is Asia's richest man.www.dnaindia.com

Exclusive: Reliance JioMart fires 1,000, a bigger layoff round likely

This is part of a larger cost-cutting measure over the next few weeks which will include reducing the 15,000 workforce in the wholesale division by two-thirds, three officials privy to the development told ET.m.economictimes.com

Source - DCM MH Twitter

This was the whole assembled screen without the backlight( used to be tube-light looking lights back in the day , now it's LED ), not the Vedanta thing, they were/are going to fabricate the whole LCD layer( Tech partner was/is InnoLux of Taiwan ), that's the core component, basically it's semiconductor fabrication like, other parts like glass, digitizer etc come later and are assembled into the screen.That open cell tv panel is the key component of any LCD / LED TV set . Ideally we should've subsidised its mfg in India to begin with . As of now imposing an import duty only burdens the consumer & doesn't do anything to aid its manufacture in India which is to say such a duty makes sense if we've a domestic mfg base to protect it from imports .

We lack any domestic panel manufacturers which is what Vedanta was planning to get into from 2015 if I'm not mistaken. Recent news was he's still interested & I think they've sent an offer across to the GoI. I'm assuming it's covered under the PLI scheme.

If we lack the base for mfg of vital sub components of these systems I fail to see how can we succeed in exports unless we heavily subsidise these exports in which case it makes more sense to get these sub components manufacturers here & subsidise them heavily. The assemblers would automatically show up unless we plan to have a holistic solution wherein we subsidise both the assemblers & those ancillary / sub component manufacturers for exports or include domestic production too.

since high end ICs, Displays, DRAM fabrication has been kept out of their reach by ebul westies, this is inspite of rampant industrial espionage, the closest "high-tech" and "cutting-edge" plant they have is a Samsung plant in Xian that manufactures NAND Flash ICs.

since high end ICs, Displays, DRAM fabrication has been kept out of their reach by ebul westies, this is inspite of rampant industrial espionage, the closest "high-tech" and "cutting-edge" plant they have is a Samsung plant in Xian that manufactures NAND Flash ICs.Random anecdote but the only EV i see on roads is the Tata Nexon line, so could be related to that, wouldn't be surprised if it's the #1 selling EV model in the country.If I am not wrong this is the fifth company to set up a gigafactory in India after Ola electric, Reliance, Amara Raja, Exide.

Tata has multiple options and within much better budget.Random anecdote but the only EV i see on roads is the Tata Nexon line, so could be related to that, wouldn't be surprised if it's the #1 selling EV model in the country.

Direct competition from Telangana. That’s why. These are literally a copy of Telangang’s policy including M-Hub which is a copy of T-Hub. Competition is always good, I say.

MH finally upping its game, showing how it bankrolls half the nation...

This is not going to happen. Our exports will become non-competitive. RBI band for 2023 is 80-82.If there is a real possibility that the Rupee somehow gets to 74 in a short time vs 82 where it is now, then India's nominal GDP growth in dollar terms would be 12% + 10% rupee evaluation = 22 fucking percent.

That'll be a GDP of 4.5 trillion USD nominal in 2024 (FY 25).

But Vietnam exports 6 times TN’s exports with the same population. Need to compare South Indian states with ASEAN countries, not Pakshitstan.Ha ha ha ha!!!! For comparison's sake, Pakistan's exports were $23B for a population of 260 million people while Tamil Nadu exported twice of Pakistan and only has a population of 84 million people.

Edit: I look forward to the day where the smallest state of India (population wise) beats Pakistan in all economic indicators such as GDP, exports, per capita, HDI, etc.