Hope you got a TOILET in your home. So start using it and stop SHITing in the forum.....Indian economy is house of cards. All fake numbers from Feku Modi.

in India unemployment is increasing at really high rate. Poor people are dying in streets. No toilets for 40% population.

Indian Economy: News and Discussion

- Thread starter Tuco

- Start date

More options

Who Replied?lcafanboy

Senior Member

- Joined

- Mar 24, 2013

- Messages

- 5,802

- Likes

- 37,216

Reliance Industries LTD. (RIL) has more turn over than entire GDP of PAKISTAN. Mukesh Ambani alone can buy out Porkistan and still he would have enough money to develop it.Indian economy is house of cards. All fake numbers from Feku Modi.

in India unemployment is increasing at really high rate. Poor people are dying in streets. No toilets for 40% population.

So use some senses before commenting.

Also that FEKU is giving sleepless nights to Porki and Lizard establishment, why?

- Joined

- Apr 29, 2015

- Messages

- 18,276

- Likes

- 56,181

Go few pages back @ news I posted. It actually declined from 9.35% to 4.5% last month.in India unemployment is increasing at really high rate.

Global Hunger Index:Poor people are dying in streets.

Percentage of Stunted population due to food shortage:

India: 15.2%

Pakistan: 22%

34% from 47% of 2 years back in 2014 is for India.No toilets for 40% population.

40% is number for Pakistan.

In fact, no exact number does exist for Pakistani socio economics because Pakistan has not counted it's population or any statistics since last 30 years.

So, better shut your mouth.

- Joined

- Jan 1, 2015

- Messages

- 7,950

- Likes

- 7,908

they had census this year finally, must be editing itPakistan has not counted it's population or any statistics since last 30 years.

- Joined

- Apr 29, 2015

- Messages

- 18,276

- Likes

- 56,181

They had only population census, that even leaving large part of less developed areas like Balochistan and PoK.they had census this year finally, must be editing it

They still aren't having economic details. They may just count their real population, IRS between 218-240 millions I guess.

- Joined

- Jan 1, 2015

- Messages

- 7,950

- Likes

- 7,908

I have opened a thread ...They had only population census, that even leaving large part of less developed areas like Balochistan and PoK.

They still aren't having economic details. They may just count their real population, IRS between 218-240 millions I guess.

http://defenceforumindia.com/forum/threads/pakistan-census-2017-watch-thread.78979/#post-1290263

- Joined

- Apr 29, 2015

- Messages

- 18,276

- Likes

- 56,181

- Joined

- Apr 17, 2017

- Messages

- 984

- Likes

- 1,969

Arun Jaitley says implementing GST will boost GDP, help India's economic growth

BusinessPTI Apr, 23 2017 17:52:05 IST

Washington:India continues to be the fastest growing major economy in the world and its growth will accelerate further due to factors like implementation of GST, Finance Minister Arun Jaitley said.

The minister also said the scrapping of old Rs 500 and Rs 1,000 notes will increase tax compliance and reduce threat of counterfeit currency.

"India continues to be the fastest growing major economy in the world...The currency reform initiative will move the Indian economy to a less cash trajectory, increase tax compliance and reduce the threats from counterfeit currency which acts as a source of terror funding," he said.

Union Finance Minister Arun Jaitley. PTI

He was speaking at the International Monetary and Financial Committee (IMFC) meeting in Washington DC on Saturday.

The minister said growth is expected to gain strength in the coming years due to externalities derived from deep structural reforms implemented by the government and robust aggregate demand.

Talking about the new indirect tax regime, Jaitley said the government is "fully on course to implement the Goods and Services Tax (GST)" by 1 July.

"The GST will deliver significant externalities by way of improved taxation efficiency and ease of doing business and will convert India into one common market," he added.

As per provisional estimates, real GDP grew by 7.9 percent in 2015-16 compared with 7.2 percent in 2014-15.

The second advance estimate for GDP growth for 2016-17 is placed at 7.1 percent.

The Indian government in November last year scrapped Rs 500 and Rs 1000 notes to curb blackmoney and terror funding as well as to promote digital transactions.

http://www.firstpost.com/business/a...-gdp-help-indias-economic-growth-3400034.html

BusinessPTI Apr, 23 2017 17:52:05 IST

Washington:India continues to be the fastest growing major economy in the world and its growth will accelerate further due to factors like implementation of GST, Finance Minister Arun Jaitley said.

The minister also said the scrapping of old Rs 500 and Rs 1,000 notes will increase tax compliance and reduce threat of counterfeit currency.

"India continues to be the fastest growing major economy in the world...The currency reform initiative will move the Indian economy to a less cash trajectory, increase tax compliance and reduce the threats from counterfeit currency which acts as a source of terror funding," he said.

Union Finance Minister Arun Jaitley. PTI

He was speaking at the International Monetary and Financial Committee (IMFC) meeting in Washington DC on Saturday.

The minister said growth is expected to gain strength in the coming years due to externalities derived from deep structural reforms implemented by the government and robust aggregate demand.

Talking about the new indirect tax regime, Jaitley said the government is "fully on course to implement the Goods and Services Tax (GST)" by 1 July.

"The GST will deliver significant externalities by way of improved taxation efficiency and ease of doing business and will convert India into one common market," he added.

As per provisional estimates, real GDP grew by 7.9 percent in 2015-16 compared with 7.2 percent in 2014-15.

The second advance estimate for GDP growth for 2016-17 is placed at 7.1 percent.

The Indian government in November last year scrapped Rs 500 and Rs 1000 notes to curb blackmoney and terror funding as well as to promote digital transactions.

http://www.firstpost.com/business/a...-gdp-help-indias-economic-growth-3400034.html

Trinetra

Regular Member

- Joined

- Jan 30, 2017

- Messages

- 260

- Likes

- 552

PM Modi backs January-December fiscal year

NEW DELHI: Prime Minister Narendra Modi on Sunday indicated his backing for a January-to-December fiscal year, a move that could entail a reworking of dates for budget presentation and your financial calendar, including filing of tax returns.

"Stating that in a country where agricultural income is exceedingly important, budgets should be prepared immediately after the receipt of agricultural incomes for the year... he (Modi) said there have been suggestions to have the financial year from January to December. He urged states to take the initiative in this regard," an official statement on the PM's closing remarks at Niti Aayog's governing council meeting said. The PM said GST would go down in history as a great symbol of federalism. He also urged CMs to carry forward the debate on simultaneous Lok Sabha and assembly elections. The budget presentation date was advanced from the last day of February to February 1 this year. Modi had also set up a committee to examine the possibility of changing the financial year, which begins on April 1.

PM Narendra Modi batted for a shift to a January-December fiscal year at a meeting of the Niti Aayog's governing council meeting on Sunday. The current financial year in India — April to March — was adopted in 1867, principally to align the Indian financial year with that of the British government. Earlier, India's financial year used to commence on May 1. While Modi did not set a deadline for the transition in the financial year, he urged the states to make legislative arrangements "without delay" for the rollout of Goods and Services Tax (GST) from July 1.

The statement is significant as a section of industry is lobbying for deferring the implementation to September. Modi said that the consensus between the Centre and the states on GST reflected the spirit of "one nation, one aspiration, one determination". Noting that the consensus on GST will go down in history as a great illustration of cooperative federalism, Modi urged CMs to carry forward the debate and discussion on simultaneous elections. Pointing out that the CMs did not have to come to Niti Aayog for approval of budgets or plans, the PM said that while there has been a 40% increase in overall fund allocation to states between 2014-15 and 2016-17, the percentage of funds tied to central schemes has declined from 40% to 25%. Calling upon states to "speed up capital expenditure and infrastructurecreation" to spur economic growth, Modi said the vision of 'New India' can only be realised through the combined efforts and cooperation of all the states.

"Team India" has assembled here to discuss and reflect on ways to prepare the country for changing global trends, Modi said. It is the collective responsibility of this gathering to envision the India of 2022 - the 75th anniversary of Independence - and see how the nation can swiftly move forward to achieve these goals, he added. Speaking of the historic change in budget presentation date, the PM said this would enable timely availability of funds at the beginning of the financial year.

Modi mentioned the ending of the distinction between plan and non-plan expenditure, based on the recommendation of the Rangarajan Committee in 2011, which had found the distinction to be counter-productive. "Several important items of expenditure were included as 'non-plan' and hence neglected. Hereafter the emphasis would be on distinguishing between development and welfare expenditure on one hand, and administrative overheads on the other," he said. As several CMs raised the issue of regional imbalance, Modi agreed that the issue has to be addressed on priority, both nationally, and within states. He said the use of technologies such as BHIM and Aadhaar would result in significant savings for the states.

NEW DELHI: Prime Minister Narendra Modi on Sunday indicated his backing for a January-to-December fiscal year, a move that could entail a reworking of dates for budget presentation and your financial calendar, including filing of tax returns.

"Stating that in a country where agricultural income is exceedingly important, budgets should be prepared immediately after the receipt of agricultural incomes for the year... he (Modi) said there have been suggestions to have the financial year from January to December. He urged states to take the initiative in this regard," an official statement on the PM's closing remarks at Niti Aayog's governing council meeting said. The PM said GST would go down in history as a great symbol of federalism. He also urged CMs to carry forward the debate on simultaneous Lok Sabha and assembly elections. The budget presentation date was advanced from the last day of February to February 1 this year. Modi had also set up a committee to examine the possibility of changing the financial year, which begins on April 1.

PM Narendra Modi batted for a shift to a January-December fiscal year at a meeting of the Niti Aayog's governing council meeting on Sunday. The current financial year in India — April to March — was adopted in 1867, principally to align the Indian financial year with that of the British government. Earlier, India's financial year used to commence on May 1. While Modi did not set a deadline for the transition in the financial year, he urged the states to make legislative arrangements "without delay" for the rollout of Goods and Services Tax (GST) from July 1.

The statement is significant as a section of industry is lobbying for deferring the implementation to September. Modi said that the consensus between the Centre and the states on GST reflected the spirit of "one nation, one aspiration, one determination". Noting that the consensus on GST will go down in history as a great illustration of cooperative federalism, Modi urged CMs to carry forward the debate and discussion on simultaneous elections. Pointing out that the CMs did not have to come to Niti Aayog for approval of budgets or plans, the PM said that while there has been a 40% increase in overall fund allocation to states between 2014-15 and 2016-17, the percentage of funds tied to central schemes has declined from 40% to 25%. Calling upon states to "speed up capital expenditure and infrastructurecreation" to spur economic growth, Modi said the vision of 'New India' can only be realised through the combined efforts and cooperation of all the states.

"Team India" has assembled here to discuss and reflect on ways to prepare the country for changing global trends, Modi said. It is the collective responsibility of this gathering to envision the India of 2022 - the 75th anniversary of Independence - and see how the nation can swiftly move forward to achieve these goals, he added. Speaking of the historic change in budget presentation date, the PM said this would enable timely availability of funds at the beginning of the financial year.

Modi mentioned the ending of the distinction between plan and non-plan expenditure, based on the recommendation of the Rangarajan Committee in 2011, which had found the distinction to be counter-productive. "Several important items of expenditure were included as 'non-plan' and hence neglected. Hereafter the emphasis would be on distinguishing between development and welfare expenditure on one hand, and administrative overheads on the other," he said. As several CMs raised the issue of regional imbalance, Modi agreed that the issue has to be addressed on priority, both nationally, and within states. He said the use of technologies such as BHIM and Aadhaar would result in significant savings for the states.

- Joined

- Jul 9, 2014

- Messages

- 2,149

- Likes

- 1,377

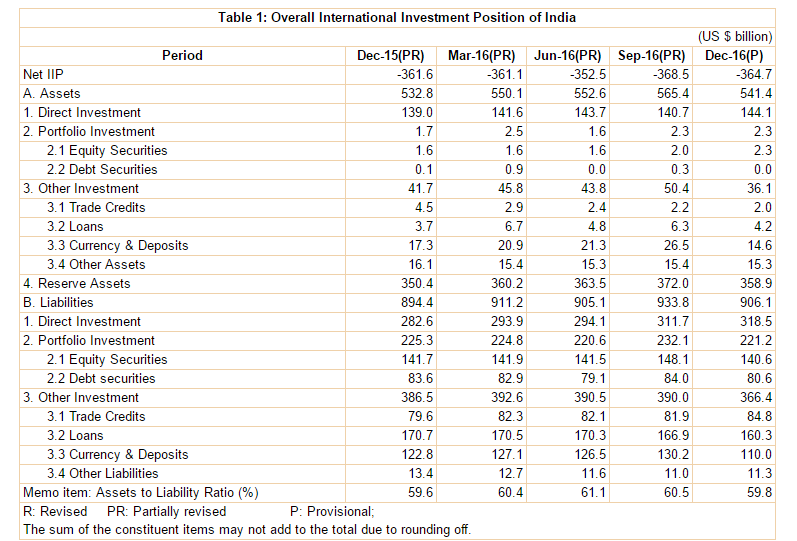

India's Net International Investment Position.We need to decrease the Liabilities as soon as possible.

By two ways decrease in imports and increasing imports.Two by investing in overseas and creating assets.

See the liabilities from june-16 to dec-16,there is a big swing.

By two ways decrease in imports and increasing imports.Two by investing in overseas and creating assets.

See the liabilities from june-16 to dec-16,there is a big swing.

- Joined

- Apr 17, 2017

- Messages

- 984

- Likes

- 1,969

Exports will increase by strong industrial base. GOI is very bullish on infra and also working to reduce net energy imports meanwhile cutting the red tape. Slowly you will see the change.India's Net International Investment Position.We need to decrease the Liabilities as soon as possible.

By two ways decrease in imports and increasing imports.Two by investing in overseas and creating assets.

See the liabilities from june-16 to dec-16,there is a big swing.

View attachment 15338

- Joined

- Sep 19, 2016

- Messages

- 2,226

- Likes

- 7,024

Imported smartphones may get costlier by 5-10% as govt plans to levy customs duty

In an effort to make manufacturing the engine of growth and employment, India is pushing for Make in India products. The government is now contemplating to levy customs duty on imported mobile phones after the roll-out of Goods and Services Tax (GST), reports The Economic Times.

The move is aimed at giving teeth to local manufacturing and encourage companies like Apple to make phones in the country. However, this may lead to rise in prices of imported smartphones by 5-10 percent.

Domestic handset makers are already enjoying few exemptions like no countervailing duty on imported electronic components but they will not remain in the picture once GST is implemented.

Government is arguing that no customs duty will not help the Make in India case hence, the imposition of import duty is essential.

The ministry of electronics and information technology is ensuring that charging customs duty will not flout the Information Technology Agreement (ITA), an international pact which mandates signatory countries to allow duty-free imports of certain electronics products. It is also seeking legal opinion from the attorney-general.

An official from the ministry said that not all phones are covered under ITA and the government concurs the same. Also, to analyse the issue an inter-ministerial committee, comprising representatives from the finance, commerce, and telecom and IT ministries, has been set up.

After many discussions for collaboration with Apple, India gave a go ahead to the i-Phone maker to assemble phones in India in February. This makes India the third country globally to produce Apple phones.

http://www.moneycontrol.com/news/bu...-govt-plans-to-levy-customs-duty-2265857.html

Currently 70% mobiles are made in India and 30% imported(mainly from China).

Good. No matter how patriotic you are and no matter how much gyan you give about buying made in India products, people will still by the cheaper product.

Come make in India and sell it at market rate.

In an effort to make manufacturing the engine of growth and employment, India is pushing for Make in India products. The government is now contemplating to levy customs duty on imported mobile phones after the roll-out of Goods and Services Tax (GST), reports The Economic Times.

The move is aimed at giving teeth to local manufacturing and encourage companies like Apple to make phones in the country. However, this may lead to rise in prices of imported smartphones by 5-10 percent.

Domestic handset makers are already enjoying few exemptions like no countervailing duty on imported electronic components but they will not remain in the picture once GST is implemented.

Government is arguing that no customs duty will not help the Make in India case hence, the imposition of import duty is essential.

The ministry of electronics and information technology is ensuring that charging customs duty will not flout the Information Technology Agreement (ITA), an international pact which mandates signatory countries to allow duty-free imports of certain electronics products. It is also seeking legal opinion from the attorney-general.

An official from the ministry said that not all phones are covered under ITA and the government concurs the same. Also, to analyse the issue an inter-ministerial committee, comprising representatives from the finance, commerce, and telecom and IT ministries, has been set up.

After many discussions for collaboration with Apple, India gave a go ahead to the i-Phone maker to assemble phones in India in February. This makes India the third country globally to produce Apple phones.

http://www.moneycontrol.com/news/bu...-govt-plans-to-levy-customs-duty-2265857.html

Currently 70% mobiles are made in India and 30% imported(mainly from China).

Good. No matter how patriotic you are and no matter how much gyan you give about buying made in India products, people will still by the cheaper product.

Come make in India and sell it at market rate.

Butter Chicken

Senior Member

- Joined

- Oct 6, 2016

- Messages

- 9,571

- Likes

- 68,592

Currently 70% of mobiles sold in India are assembled here.Many are even exported to ME&Africa market.But value addition is 15-20%,rest of the components are imported from East Asian countries.Hopefully with this duty all phones will be made in India,and value addition will grow which will reduce our imports from China

Trinetra

Regular Member

- Joined

- Jan 30, 2017

- Messages

- 260

- Likes

- 552

India on track to knock Britain out of world's top 5 economies

India will overtake Germany in 2022 as the world's fourth-largest economy and push Britain out of the top five, based on analysis of growth projections by the International Monetary Fund. But the challenges the South Asian nation must surmount to get there are many.

These include executing a wide-ranging overhaul of the tax system, sorting out the biggest pile of distressed assets among major economies, reviving lackluster productivity, substantially increasing employment employment opportunities, encouraging corporate investment and overcoming a significant infrastructure shortfall.

India's economy is still recovering from a cash ban that sucked out 86 percent of currency in circulation near the end of last year. And then there's the likely near-term disruptions from the implementation of a nationwide goods and sales tax; indeed the government has already missed an April deadline for putting the tax in place and is now working against the clock to meet its new July 1 goal.

While there is little doubt the GST will be beneficial in the long run, economists are concerned about India's banking system and the overall health of its public finances -- both seen as lightning rods for global credit agencies that already rate Indian debt just above "junk' status.

Bad loans, restructured debt and advances to companies that can't service their debt have risen to about 16.6 percent of total loans, government data show. That spike in bad loans has forced banks to focus on recovering bad debts. As a result, loan growth has fallen to near record lows, posing a challenge to Prime Minister Narendra Modi's government as it seeks to revive investment and boost employment.

Apart from slowing investment, India's labor productivity has been weakening, limiting growth and employment opportunities.

Labor productivity per person employed eased from 10 percent in 2010 to 4.8 percent in 2016 as reforms sputtered. According to the International Labour Organisation, output per worker is projected at $3,962 for India in 2017, a fraction of Germany's $83,385.

Still, the potential remains. Ranking countries and regions on their gross domestic product, for 2017 and 2022 based on IMF forecasts, India, growing at 9.9 percent a year in nominal terms, will surpass Germany by 2022 as the world's fourth largest economy, with the U.K dropping out of the top five after 2017.

Some seven decades after independence, India may outshine its former colonial master.

India will overtake Germany in 2022 as the world's fourth-largest economy and push Britain out of the top five, based on analysis of growth projections by the International Monetary Fund. But the challenges the South Asian nation must surmount to get there are many.

These include executing a wide-ranging overhaul of the tax system, sorting out the biggest pile of distressed assets among major economies, reviving lackluster productivity, substantially increasing employment employment opportunities, encouraging corporate investment and overcoming a significant infrastructure shortfall.

India's economy is still recovering from a cash ban that sucked out 86 percent of currency in circulation near the end of last year. And then there's the likely near-term disruptions from the implementation of a nationwide goods and sales tax; indeed the government has already missed an April deadline for putting the tax in place and is now working against the clock to meet its new July 1 goal.

While there is little doubt the GST will be beneficial in the long run, economists are concerned about India's banking system and the overall health of its public finances -- both seen as lightning rods for global credit agencies that already rate Indian debt just above "junk' status.

Bad loans, restructured debt and advances to companies that can't service their debt have risen to about 16.6 percent of total loans, government data show. That spike in bad loans has forced banks to focus on recovering bad debts. As a result, loan growth has fallen to near record lows, posing a challenge to Prime Minister Narendra Modi's government as it seeks to revive investment and boost employment.

Apart from slowing investment, India's labor productivity has been weakening, limiting growth and employment opportunities.

Labor productivity per person employed eased from 10 percent in 2010 to 4.8 percent in 2016 as reforms sputtered. According to the International Labour Organisation, output per worker is projected at $3,962 for India in 2017, a fraction of Germany's $83,385.

Still, the potential remains. Ranking countries and regions on their gross domestic product, for 2017 and 2022 based on IMF forecasts, India, growing at 9.9 percent a year in nominal terms, will surpass Germany by 2022 as the world's fourth largest economy, with the U.K dropping out of the top five after 2017.

Some seven decades after independence, India may outshine its former colonial master.

Prashant12

Senior Member

- Joined

- Aug 9, 2014

- Messages

- 3,027

- Likes

- 15,002

India's Forex Reserves Surge by $1.25 Billion: RBI Data

In this file photo, the Reserve Bank of India (RBI) seal is pictured on a gate outside the RBI headquarters in Mumbai. (Photo: Reuters)

Mumbai: India's foreign exchange (Forex) reserves rose by $1.25 billion as on April 21, 2017, official data showed on Friday.

According to the Reserve Bank of India's weekly statistical supplement, the overall Forex reserves increased to $371.13 billion from $369.88 billion reported for the week ended April 14.

India's Forex reserves comprise of foreign currency assets (FCAs), gold, special drawing rights (SDRs) and the RBI's position with the International Monetary Fund (IMF).

Segment-wise, FCAs -- the largest component of the Forex reserves -- augmented by $1.23 billion to $347.48 billion during the week under review.

Besides the US dollar, FCAs consist of nearly 20-30 percent of major (non-US) global currencies. The FCAs also include investments in US Treasury bonds, bonds of other selected governments, deposits with foreign central and commercial banks.

The country's gold reserves were stagnant at $19.86 billion.

However, SDRs' value gained $5 million to $1.45 billion. The country's reserve position with the IMF inched higher by $7.7 million to $2.33 billion.

http://www.news18.com/news/business...s-surge-by-1-25-billion-rbi-data-1386823.html

In this file photo, the Reserve Bank of India (RBI) seal is pictured on a gate outside the RBI headquarters in Mumbai. (Photo: Reuters)

Mumbai: India's foreign exchange (Forex) reserves rose by $1.25 billion as on April 21, 2017, official data showed on Friday.

According to the Reserve Bank of India's weekly statistical supplement, the overall Forex reserves increased to $371.13 billion from $369.88 billion reported for the week ended April 14.

India's Forex reserves comprise of foreign currency assets (FCAs), gold, special drawing rights (SDRs) and the RBI's position with the International Monetary Fund (IMF).

Segment-wise, FCAs -- the largest component of the Forex reserves -- augmented by $1.23 billion to $347.48 billion during the week under review.

Besides the US dollar, FCAs consist of nearly 20-30 percent of major (non-US) global currencies. The FCAs also include investments in US Treasury bonds, bonds of other selected governments, deposits with foreign central and commercial banks.

The country's gold reserves were stagnant at $19.86 billion.

However, SDRs' value gained $5 million to $1.45 billion. The country's reserve position with the IMF inched higher by $7.7 million to $2.33 billion.

http://www.news18.com/news/business...s-surge-by-1-25-billion-rbi-data-1386823.html

Butter Chicken

Senior Member

- Joined

- Oct 6, 2016

- Messages

- 9,571

- Likes

- 68,592

Very good article on mobile manufacturing in India.Do read.

Government's approval to PMP in assembling mobile parts will boost investment

Read more at:

http://economictimes.indiatimes.com...ofinterest&utm_medium=text&utm_campaign=cppst

By 2020,value addition will be almost 50%

Government's approval to PMP in assembling mobile parts will boost investment

Read more at:

http://economictimes.indiatimes.com...ofinterest&utm_medium=text&utm_campaign=cppst

By 2020,value addition will be almost 50%

Prashant12

Senior Member

- Joined

- Aug 9, 2014

- Messages

- 3,027

- Likes

- 15,002

India's forex reserves hit lifetime high of $372.7 billion

Buoyed by sustained dollar inflows into debt and equity markets, India's foreign exchange reserves rose $1.59 billion to reach an all time high of $372.73 billion.

U.S. dollar notes are seen in front of a stock graph in this November 7, 2016 picture illustration.Reuters file

India's foreign exchange reserves hit a lifetime high of $372.73 billion as of April 28, 2017, after a net inflow of $1.59 billion, according to Reserve Bank of India (RBI) data released on Friday. The rise comes on the back of $1.25 billion increase for the week ended April 21.

The earlier all-time high was $371.99 billion reported for the week ended September 30, 2016.

To put things in another perspective, the reserves stood at $312.38 billion on May 30, 2014, four days after the Narendra Modi government was sworn-in.

The increase in foreign exchange reserves as of April 28 was mainly on account of the $1.56 billion rise in foreign currency assets that rose to $349 billion. Gold reserves remained unchanged at $19.87 billion, according to the weekly statistical supplement released by the RBI on Friday evening.

Though foreign institutional investors (FIIs/FPIs), who have been investing in a big way in Indian debt and equity markets and in the process strengthening the rupee, they were net sellers during the week under review.

Kotak Economic Research said in a note a few days ago that the net inflows into debt and equity markets was $2.9 billion for April 2017. The inflows were $3 billion in debt while it was an outgo of $200 million in equities.

However, the overall inflows remained positive for most part of the month as also for the January-April 2017 period). "The equity markets saw inflows of $6.4 billion, double the $3.2 billion in the corresponding period last year. The debt market has seen inflows of $7.6 billion in 2017 so far, againt of $7.6 billion in 2016," Teresa John, analyst at brokerage Nirmal Bang Institutional Equities, told International Business Times, India edition.

On Friday (May 5), FIIs were net sellers of Indian equities worth Rs 364 crore, according to provisional data published by the National Stock Exchange (NSE).

On May 4, 3 and 2 also, they were net sellers of Indian stocks worth Rs 601 crore, Rs 518 crore and Rs 612 crore, respectively.

On Friday, the BSE Sensex closed at 29,859, down 267 points while the NSE Nifty shed 75 points to end at 9,285.

The fall was attributed to profit-booking by investors. "There was profit booking which pulled down the market into negative territory. Weak global cues had negative impact in the market. Both Asian and European markets declined ahead of French election result (7th May)," brokerage Motilal Oswal Securities said in a note.

http://www.ibtimes.co.in/indias-forex-reserves-hit-lifetime-high-372-7-billion-725642

Buoyed by sustained dollar inflows into debt and equity markets, India's foreign exchange reserves rose $1.59 billion to reach an all time high of $372.73 billion.

U.S. dollar notes are seen in front of a stock graph in this November 7, 2016 picture illustration.Reuters file

India's foreign exchange reserves hit a lifetime high of $372.73 billion as of April 28, 2017, after a net inflow of $1.59 billion, according to Reserve Bank of India (RBI) data released on Friday. The rise comes on the back of $1.25 billion increase for the week ended April 21.

The earlier all-time high was $371.99 billion reported for the week ended September 30, 2016.

To put things in another perspective, the reserves stood at $312.38 billion on May 30, 2014, four days after the Narendra Modi government was sworn-in.

The increase in foreign exchange reserves as of April 28 was mainly on account of the $1.56 billion rise in foreign currency assets that rose to $349 billion. Gold reserves remained unchanged at $19.87 billion, according to the weekly statistical supplement released by the RBI on Friday evening.

Though foreign institutional investors (FIIs/FPIs), who have been investing in a big way in Indian debt and equity markets and in the process strengthening the rupee, they were net sellers during the week under review.

Kotak Economic Research said in a note a few days ago that the net inflows into debt and equity markets was $2.9 billion for April 2017. The inflows were $3 billion in debt while it was an outgo of $200 million in equities.

However, the overall inflows remained positive for most part of the month as also for the January-April 2017 period). "The equity markets saw inflows of $6.4 billion, double the $3.2 billion in the corresponding period last year. The debt market has seen inflows of $7.6 billion in 2017 so far, againt of $7.6 billion in 2016," Teresa John, analyst at brokerage Nirmal Bang Institutional Equities, told International Business Times, India edition.

On Friday (May 5), FIIs were net sellers of Indian equities worth Rs 364 crore, according to provisional data published by the National Stock Exchange (NSE).

On May 4, 3 and 2 also, they were net sellers of Indian stocks worth Rs 601 crore, Rs 518 crore and Rs 612 crore, respectively.

On Friday, the BSE Sensex closed at 29,859, down 267 points while the NSE Nifty shed 75 points to end at 9,285.

The fall was attributed to profit-booking by investors. "There was profit booking which pulled down the market into negative territory. Weak global cues had negative impact in the market. Both Asian and European markets declined ahead of French election result (7th May)," brokerage Motilal Oswal Securities said in a note.

http://www.ibtimes.co.in/indias-forex-reserves-hit-lifetime-high-372-7-billion-725642

- Joined

- Apr 17, 2017

- Messages

- 984

- Likes

- 1,969

CII predicts 7.5-8% growth for Indian economy

IANS | New Delhi May 4, 2017 Last Updated at 18:12 IST

Industry body Confederation of Indian Industry (CII) on Thursday predicted that India's economic growth rate for 2017-18 will range between 7.5 and eight per cent.

According to newly elected CII President Shobana Kamineni, country's strong economic fundamentals and introduction and implementation of key reforms such as the Goods and Services Tax (GST) system will be the key growth drivers during the current fiscal.

Kamineni, also the Executive Vice-Chairperson of Apollo Hospitals Enterprise (AHEL), said the growth rate band will also depend on normal monsoon and a slight improvement in the global economic environment.

"The growth band that we are looking at is 7.5 to eight per cent. This is based on a normal monsoon, somewhat improved global climate, and India's own strong macroeconomic fundamentals," Kamineni said.

"The global GDP (gross domestic product) growth is a major determinant of our growth, and unfortunately, the world has not fully recovered from the global financial crisis. In this context, the Indian government's proactive reform policies are opening up new opportunities and new space for growth."

Further, Kamineni predicted that India's growth rate can build up to a 10 per cent over the next three years.

"It is possible to target one per cent additional growth each year to reach 10 per cent in the next three years," Kamineni said.

"The drivers for this step up in growth would include the benefits from implementation of GST, greater participation of women in the labour force, the urbanisation process which will drive greater economic activity in areas such as construction and government spending of up to Rs 30 trillion in various infrastructure projects over the next few years."

On the implementation of the GST, She said that the industry is completely ready for the introduction of the landmark tax reform from July 1, 2017.

"CII has been calling for a single national tax for the last ten years and we will try to make its implementation as smooth as possible," the newly elected CII President said.

The industry chamber's observed that investment slowdown needs to be reversed for the economy to move at a higher growth pace.

"CII would continue to request the government for quick action in reducing corporate income taxes for all corporates. This has become urgent given the lowering of tax rates across many other countries," the CII President said.

"The 25 per cent rate is currently applicable only for companies with turnover up to Rs 50 crore. Eventually, the corporate tax rate could be brought down to 18 per cent together with the removal of all incentives. CII believes this will lead to much better tax compliance."

http://www.business-standard.com/ar...growth-for-indian-economy-117050400951_1.html

IANS | New Delhi May 4, 2017 Last Updated at 18:12 IST

Industry body Confederation of Indian Industry (CII) on Thursday predicted that India's economic growth rate for 2017-18 will range between 7.5 and eight per cent.

According to newly elected CII President Shobana Kamineni, country's strong economic fundamentals and introduction and implementation of key reforms such as the Goods and Services Tax (GST) system will be the key growth drivers during the current fiscal.

Kamineni, also the Executive Vice-Chairperson of Apollo Hospitals Enterprise (AHEL), said the growth rate band will also depend on normal monsoon and a slight improvement in the global economic environment.

"The growth band that we are looking at is 7.5 to eight per cent. This is based on a normal monsoon, somewhat improved global climate, and India's own strong macroeconomic fundamentals," Kamineni said.

"The global GDP (gross domestic product) growth is a major determinant of our growth, and unfortunately, the world has not fully recovered from the global financial crisis. In this context, the Indian government's proactive reform policies are opening up new opportunities and new space for growth."

Further, Kamineni predicted that India's growth rate can build up to a 10 per cent over the next three years.

"It is possible to target one per cent additional growth each year to reach 10 per cent in the next three years," Kamineni said.

"The drivers for this step up in growth would include the benefits from implementation of GST, greater participation of women in the labour force, the urbanisation process which will drive greater economic activity in areas such as construction and government spending of up to Rs 30 trillion in various infrastructure projects over the next few years."

On the implementation of the GST, She said that the industry is completely ready for the introduction of the landmark tax reform from July 1, 2017.

"CII has been calling for a single national tax for the last ten years and we will try to make its implementation as smooth as possible," the newly elected CII President said.

The industry chamber's observed that investment slowdown needs to be reversed for the economy to move at a higher growth pace.

"CII would continue to request the government for quick action in reducing corporate income taxes for all corporates. This has become urgent given the lowering of tax rates across many other countries," the CII President said.

"The 25 per cent rate is currently applicable only for companies with turnover up to Rs 50 crore. Eventually, the corporate tax rate could be brought down to 18 per cent together with the removal of all incentives. CII believes this will lead to much better tax compliance."

http://www.business-standard.com/ar...growth-for-indian-economy-117050400951_1.html

Latest Replies

-

ITCM cruise missiles

- brat4

-

Turkish defense industry news updates

- tfxkaanf23

-

Indian Special Forces

- NoobWannaLearn

-

Infrastructure and Energy Sector

- zathura98

-

Israel - Hamas Gaza Conflict Oct-2023

- Corvus Splendens

Global Defence

-

Turkish defense industry news updates

- tfxkaanf23

-

F-35 Joint Strike Fighter

- blackjack

-

New Naval Technology

- Blademaster

-

Small arms and Light Weapons

- Arjun Mk1A

-

World Military/Paramilitary/Special Forces

- Zoid Raptor

-

F-16 Viper

- MiG-29SMT

-

Sukhoi PAK FA

- StealthFlanker

-

Japan Self Defense Forces - Pictures & Videos

- Love Charger

New threads

-

Boston Dynamics showed flexible new robot Atlas

- Soldier355

- Replies: 1

-

An Indian Admiral and a pakistani Air Commodore

- Zoid Raptor

- Replies: 0

-

First Asian on the Moon will be a Japanese astronaut

- skywatcher

- Replies: 0

-

Iran Israel conflict

- patriots

- Replies: 43

Articles

-

India Strikes Back: Operation Snow Leopard - Part 1

- mist_consecutive

- Replies: 9

-

Aftermath Galwan : Who holds the fort ?

- mist_consecutive

- Replies: 33

-

The Terrible Cost of Presidential Racism(Nixon & Kissinger towards India).

- ezsasa

- Replies: 40

-

Modern BVR Air Combat - Part 2

- mist_consecutive

- Replies: 22

-

Civil & Military Bureaucracy and related discussions

- daya

- Replies: 32