mrmetaxis

Yesterday 09:30 PM

Idiocy piled on idiocy. Did you notice the guy from the IoD, or the CBI or whatever who said today that as well as buying gilts, the BoE should buy bank and business equities?

That's right : "Engulf and Devour's business plan is failing because they're a bunch of profligate buffoons who think they deserved mega-bonuses for delivering nothing? Then let's get savers to lose their hard-earned wealth in order to bail them out!".

We've reached the endgame for this phony, crony system that's developed in the last 15 years and we're all going to hell in a hand-basket, aren't we?

[HR][/HR]

AuTrader

Yesterday 09:47 PM

"We've reached the endgame for this phony, crony system that's developed in the last 15 years and we're all going to hell in a hand-basket, aren't we?"

It's actually been 40 years in the making, but yes; we are reaching the endgame now. Debt has been growing in an almost perfectly exponential curve for the last 40 years, and like all exponential functions, for a long time nothing seems to happen, then at the end you get a sudden massive move - a classic 'Hockeystick' pattern.

Spend a few minutes googling charts of the national debt growth since 1971/2 of almost any country you care to think of and you'll see what I mean. Hockeysticks galore. Completely unsustainable and ripe for implosion.

[HR][/HR]

andycfc

Yesterday 10:18 PM

"Spend a few minutes googling charts of the national debt growth since 1971/2"

Try going back further and you will see you are talking garbage as usual. The UK for instance even now is low by historical standards... you are taking the headline figure but thats meaningless.

[HR][/HR]

AuTrader

Yesterday 10:23 PM

One could go back further, but then one would be talking about either an economy run under a formal gold standard, or an economy run under the quasi-gold standard Bretton Woods system.

Debt levels have been higher, admittedly, when the world was busy laying waste to large parts of Europe, but surely you are not suggesting that, after decades of 'Boom' we are currently in a similar position?

Face it mate. You know nothing useful about economics.

[HR][/HR]

andycfc

Yesterday 10:31 PM

Money still a store of value then? havent laughed as much in ages when you said that.

Right lets look

United Kingdom National Debt Charts

oh dear destroyed your argument hasnt it, another one who doesnt like facts getting in the way.

[HR][/HR]

AuTrader

Yesterday 10:37 PM

I asked you this before, but you never answered. If, as you say, money is not a store of value, what do you use to store your wealth? Magic beans?

Maybe you would care to answer this time?

Money is, by definition, a store of value. It is a means of moving wealth through time so that you can do work today, and buy things you need in the future when you may be unable to work. This is the essence of our great advance from the barter system where people swapped that they had NOW for what they needed NOW.

Currency is something else.

The big fraud we face today is that governments (in the west anyway) have convinced people that a paper currency, which is nothing more than a convenient means of exchange, is also money. It isn't. The BoE today proposed top create £50bn in new currency, but what wealth backs this? None.

BTW - your graphs prove my point. debt has been higher when the entire economy was focused on all-out war. What, pray tell, have we been doing recently that is comparable to that? Running up massive debt to maintain our lifestyle doesn't really compare.

Edit: 1 hour has passed and Andy has refused to answer. Confused about his beliefs or incapable of answering? I don't know.

[HR][/HR]

andycfc

Yesterday 11:45 PM

You have assets AU... yes including gold, ive never said thats a bad asset class, stocks,bonds etc etc... you want a return but cash is never going to give you that as its not designed to be.. get that?

[HR][/HR]

AuTrader

Today 12:00 AM

Money does not provide a return. It cannot. True Money carries no risk and therefore no return. It is a fundamental principle of capitalism that there can be no return without risk.

'Cash' in the bank carries a return (At least until the BoE reduces rates to zero) only because it is NOT money. Many people do not realise that when you deposit money in the bank, it legally becomes the bank's property. That is why they pay you interest. You are loaning them your wealth to speculate with, in return for which you are paid a pittance in interest.

But, if one does not want a return, but merely to preserve one's wealth, what vehicle does one use? Physical cash is one option, but it carries counterparty risk. For example, the issuers of the cash may decide to print £50bn more of it on any given Thursday and thereby dilute the value of your cash.

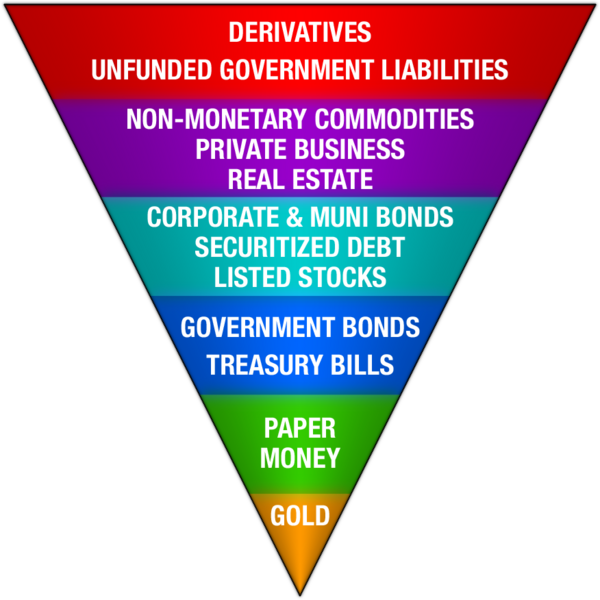

I refer you to Exters pyramid.

John Exter - Wikipedia, the free encyclopedia

[HR][/HR]

andycfc

Today 12:05 AM

" Many people do not realise that when you deposit money in the bank, it

legally becomes the bank's property. That is why they pay you interest.

You are loaning them your wealth to speculate with, in return for

which you are paid a pittance in interest."

Ah now i see where you are coming from your whole understanding of banking is wrong, that deposit you gave the bank is a liability to the bank, they dont have "ownership" its purely an accounting entry. Banks dont loan deposits... your model is over a 100 years out of date.