trackwhack

Senior Member

- Joined

- Jul 20, 2011

- Messages

- 3,757

- Likes

- 2,590

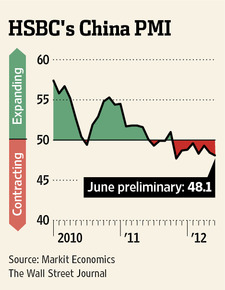

The Official Chinese PMI for March was 53.1. HSBC on the other hand said - 48.3. An article with a subtle conclusion.

China's economic direction puzzles investors

China's economic direction puzzles investors

http://www.ft.com/intl/cms/s/0/f90783f6-821a-11e1-9242-00144feab49a.htmlThe health of China's manufacturing sector, which is the source of most of the world's T-shirts, iPads and fertiliser, is a crucial indicator for anyone wanting a snapshot of the state of the global economy.

As investors pore over the statistics, the picture has been complicated by two competing indicators of production released by the Chinese government and HSBC that tell almost the opposite story.

In March, China's purchasing managers' index surged to 53.1 – its highest level in a year – while HSBC's measure fell to 48.3. A reading over 50 means factory activity increased, while one below points to contraction.

So is the Chinese manufacturing sector expanding at its fastest pace in a year, or is it contracting at an accelerated rate? That is what everyone, from Australian mining companies to Chinese executives, is trying to answer.

"The economy is just sucking wind right now," says one senior Chinese auto industry executive, who asked not to be named because he did not want to damage relations with powerful government officials by talking to the foreign press. "It's clear there's a slowdown under way, but whether that gets much worse or not depends on three things – Europe, the [domestic] real estate market and whether the government boosts infrastructure investment again."

China's manufacturing sector is less export-orientated than it was at the onset of the financial crisis in 2008, but it remains heavily dependent on trade. Many economists see a recession in Europe, its single largest export market, as a key risk to Chinese growth this year.

Trade data for March are set for release on Tuesday, but in the first two months Chinese exports to Europe fell 1 per cent from the same period last year, after growing 7 per cent in December. Overall exports rose just 6.9 per cent from a year earlier, down from 13.4 per cent growth in December.

Investment in real estate construction directly accounted for about 13 per cent of China's economic growth last year. But thanks in large part to strict government purchase restrictions, transactions and prices are sliding and new construction is expected to follow.

"The property market is the most important part of the economy, it affects almost every other industry," said the owner of one of China's largest cotton processing companies, who also asked not to be named. "If nobody's building or buying apartments, then they aren't buying curtains or sheets and that really hurts my business."

During the global financial crisis in 2008, as the Chinese real estate market wobbled and exports plummeted, Beijing launched a huge economic stimulus package, channelling trillions of renminbi worth of bank loans into infrastructure projects to boost growth. New roads, airports, railways and apartments sprang up across the country and the manufacturing sector quickly rebounded from its slump.

Some economists believe Beijing is likely to repeat that trick this year, albeit on a smaller scale, by loosening monetary policy and stimulating growth through new infrastructure projects. Largely in expectation of this, many analysts have recently upgraded their gross domestic product growth forecasts, with the consensus falling somewhere between 8 and 9 per cent for the year, compared with 9.2 per cent in 2011.

On the other hand, the government's official GDP growth target has been lowered to 7.5 per cent for the year, the first time it has been less than 8 per cent in seven years.

China is expected to release first-quarter GDP figures on Friday, with expectations that the world's second-largest economy grew 8.4 per cent in the first three months compared with a year ago.

But some economists with the ear of top policy makers say Beijing does not have the will or the capacity to stimulate the economy again.

"According to the Chinese economic model the government can only boost growth by easing monetary policy and pumping up infrastructure spending but there is no way to do that this year," says Yuan Gangming, an influential economist at Tsinghua University. "All the bullets were spent a couple of years ago, infrastructure investment has already peaked and monetary policy is already loose."

Many analysts agree that on this occasion HSBC's PMI is probably closer to the mark than the official reading. There appear to be problems with how the government's PMI is adjusted for seasonal variations. And weak data in everything from industrial company profits to power usage in the first two months of the year support the more bearish picture presented by HSBC.

That is bad news for anyone looking for evidence that the world's workshop is revving up again and that the global economy is on the road to real recovery.