https://economictimes.indiatimes.co...ns-european-think-tank/videoshow/64717561.cms

CPEC – an unfair deal for common Pakistanis?

“

This will be my first visit to Pakistan, but I feel as if I am going to visit the home of my own brother”. With these words the Chinese President, Xi Jinping, described his first state visit to Islamabad on the eve of formalizing the historic agreement of the multibillion-dollar project, designated as the China Pakistan Economic Corridor (CPEC), in April 2015. Under this grand strategy, China began to finance numerous energy, transport and infrastructural development projects, advertised as being essential to improving Pakistan’s economic progress, social growth and regional connectivity.

Now, after more than three years since the CPEC has officially commenced, it is high time for an assessment on how Pakistan and China have managed so far to advance this colossal, fifteen-year project, valued currently at $62 billion. This article will analyse whether Beijing indeed treats its

‘all-weather friend’ as a brother or more like a subordinate. It will evaluate the progress of the ongoing projects and compare the profits and losses of the two ‘

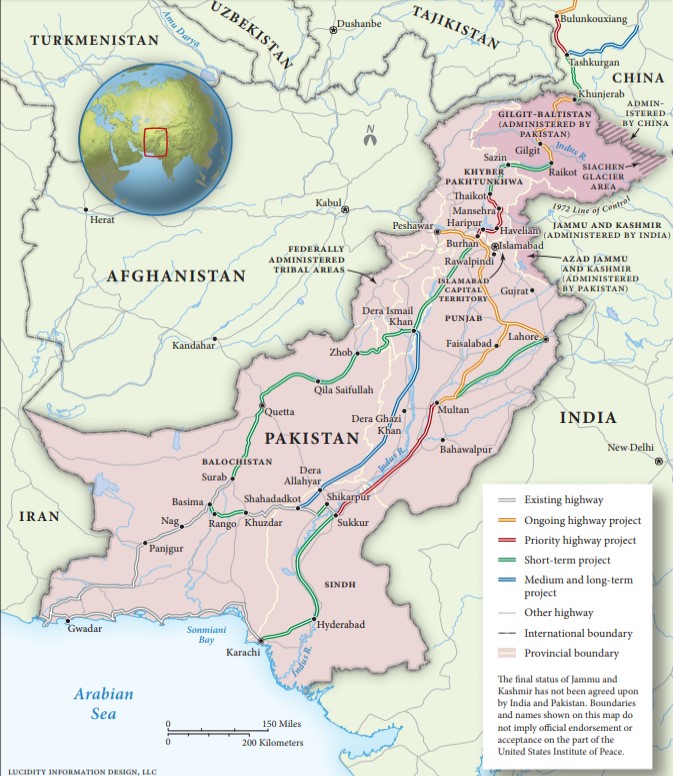

shareholders’. This article will also discuss the benefits derived, or lack thereof, from this venture, using the perspective of the common people, emphasizing the fact that undoubtedly the CPEC will bring money to Pakistan, yet it is unclear whether it will actually positively impact the standard of life of the local population. Despite being fully aware of the legal issues surrounding the building of this corridor with regard to the disputed territories of Gilgit-Baltistan and Pakistan Administered Jammu & Kashmir, ongoing terrorism in the Federally Administered Tribal Areas (FATA) and an insurgency in Balochistan, this article will specifically focus only on the economic implications of the CPEC in order to explain in financial terms how it will influence the lives of common Pakistani people.

In order to achieve that, the article will thoroughly examine the actual job distribution and control over the CPEC projects, the levels of consensus between the two parties, and the interest rates imposed on Pakistan, by using few of the current energy projects as case studies. The Chinese cultural invasion will be further reviewed and forecasts related to its long-term impact will be generated. The article will conclude with calling for greater transparency and public awareness in regard to the implementation of the projects, invoking the greater involvement of the population into the decision-making process and effective accomplishment of the action plan.

CPEC in numbers

In 2014, China initiated a massive economic development project called One Belt One Road (OBOR). This initiative involves China spending between $4-8 trillion during the next several decades on various projects in nearly 70 countries. The ultimate objective is to recreate the old Silk Road, which connected China with the Middle East, Africa, and Europe through Central and South Asia. When completed, this new Silk Road initiative will link China to Europe and Africa using roads, railways, airports, pipelines, telecommunication networks, fibre-optic connections, seaports and other types of utility grids. According to China, the Belt and Road Initiative (BRI) tackles an infrastructural gap and therefore aims to accelerate the economic growth of various countries around the world, by simultaneously developing major industrial, agriculture, and energy centres in the participating countries, yet all linked to Chinese institutions.

By the time of its estimated completion in 2050, OBOR will stretch from the edge of East Asia all the way to East Africa and Central Europe, and it will impact 62% of the world’s population and 40% of its economic output. Its ultimate strategy is of becoming the guardian of a new platform for social and cultural connectivity, international trade, financial cooperation and political dominion.

One of the most important countries in this initiative is Pakistan, since currently the crown jewel of Beijing’s

‘One Belt, One Road’ is the China Pakistan Economic Corridor. CPEC is a 3,218 km-long route (2000 miles), to be built over the next several years, consisting of highways, railways and pipelines, which span from Gwadar port in Pakistan to Kashgar in the Xinjiang Uygur Autonomous Region of China. The agreement was signed on 20 April 2015; the actual estimated cost of the project is expected to be $75 billion, out of which $45 billion shall be spent to support a vision to make the corridor operational by 2030 and the remaining funds shall be invested on energy generation and infrastructural development. Projects have been categorised under four phases:

‘Early Harvest’ (priority) - to be completed by 2018;

short-term projects, or actively promoted projects - to be completed by 2020–2023;

medium-term ones by 2025; and

long-term projects to be completed by 2030.

With regard to infrastructure, according to the project’s action plan, a 1,100 kilometre long motorway will be constructed between the cities of Karachi and Peshawar, while the Karakoram Highway between Rawalpindi and the Chinese border will be further reconstructed. The Karachi-Lahore-Peshawar main railway line (1,872 km) will also be entirely overhauled. Numerous roads will be established in the province of Khyber Pakhtunkhwa (KPK), which will eventually connect it with Balochistan. A network of pipelines to transport liquefied natural gas and oil will also be laid as part of the project, including a $2.5 billion pipeline between Gwadar and Nawabshah to eventually transport gas from Iran. In addition, Pakistan's railway network will be extended to connect it with China's Southern Xinjiang province. According to the Government of Pakistan’s official website, all of these projects will be financed through Chinese Government Concessional Loan (GCL) and among the sponsoring companies will be China State Construction Engineering Corporation and China Communications Construction Company Ltd, while the rest of the work will be awarded through open bidding of Engineering, Procurement and Construction contracts.

In relation to energy projects, around $30 billion worth of energy infrastructure will be constructed by private consortia and up to 15,000 MW of energy generating capacity will be brought in order to help alleviate Pakistan's chronic energy shortages, which regularly amount to over 4,500 MW. While demand during the peak summer months is around 24,000 MW, power generation is less than 1,600 MW, with some regions suffering from 20–22 hours of power cuts every day. Electricity from these projects will primarily be generated from fossil fuels, though hydroelectric and wind-power projects are also included, as well is the construction of one solar farm. Since most of the energy project contracts were

‘won’ by Chinese companies that have taken over the engineering, procurement and construction of them, the necessary power equipment will be imported from China, for which Pakistan will have to pay duly. According to the Pakistani Bureau of Statistics, “…

in the first five months of this fiscal year, the import of power generation machinery stood at US$1.4 billion”.

CPEC also includes a number of initiatives in Pakistan that are not only economic in nature, but also have cultural and civic implications. For instance, the Safe Cities Project is such an initiative, which is related to the security and surveillance of Pakistani cities. The objective is to train police, military personnel, city administration and other related departments to manage the city effectively, especially with regard to the threat of terrorism. Nevertheless, what is important to mention is that the initiative was primarily designed to safeguard Chinese workers from Pakistani terrorists, hence exposing the one-sidedness and dissymmetry of the initiative.

Therefore, on paper, it might be explicitly and profoundly explained how the CPEC is being constructed in order to fulfil the needs and wishes of the Pakistani population, yet the following section will portray how the reality greatly differs from what is being said or written. As time will show, Pakistan is at risk of carrying the CPEC on its shoulders as the burden of Atlas - bearing the heavy weight of this shrewd Chinese masterplan, while Beijing devours the lush fruits of its venture.

Credits: Based on Planning Commission of Pakistan. Redrawn by Robert Cronan/Lucidity Information Design, LLC for USIP

Financial Implications

Electric power projects constitute the largest share of the CPEC portfolio in terms of cost, since the country experiences its greatest deficiencies in this sector. However, Pakistan’s desperate pursuit of electricity exhibits the collective irrationality and precipitance of its Pakistani contractors, since its electric power shortfall might diminish in the upcoming years, yet it will be much more expensive compared to regional competitors. For example, the acknowledged tariff of the 1320 MW Port Qasim Coal Power Project ($0.0836/kWh) is higher than similar projects in Bangladesh involving Chinese sponsors, such as the 1224 MW Banshkahli Coal Power Project ($0.08259/kWh) and the 1320 MW Payra Coal Power Project ($0.083089/kWh). CPEC security surcharges added to the electricity bills of Pakistani consumers will make the new electric power even more expensive. Furthermore, there are major disparities considering the financing of those energy projects. First, many of them are funded by loans from China and are not actual investments, which could obstruct Pakistan’s ability to pay back. For example, until January 2017, the proportion of foreign direct investments (FDI) from China was only $750 million and the remaining $2.2 billion was in the form of loans. Additionally, the interest rates charged by the China Development Bank and the China EXIM Bank reveal that with an estimated debt-equity ratio of 80%-20%, and investments guaranteeing a 17% to 20% rate of return on their equity, China could recover its investment in less than 3 years, while ripping off Pakistan for at least the upcoming quarter of a century. Not only that, such hugely expensive electricity could paralyze Pakistan’s already fragile economy.

The current scenario draws quite striking parallels with China’s involvement in Sri Lanka. In December 2017, Sri Lanka had to formally hand over its southern sea port of Hambantota to China on a 99-year lease, after being unable to repay its debt. Hence, the debt trap Sri Lanka has found itself should provide some useful lessons for Pakistan. First, CPEC might come at the expense of national sovereignty and independence if Islamabad does not carefully review the financial agreements it abides to; and second, the imposition of China’s terms and conditions could be hardly interpreted as a

‘win-win’ situation. The Gwadar Port deal vividly illustrates those claims, since the profits will be 91% in favour of China in the following 40 years.

Given the above picture, it is possible to forecast the astronomical burden on Pakistan’s payment capacity in the coming years. The impact this debt-financed project will have on Pakistan has been discussed by various international and supranational bodies. In its recently concluded review of the project, the International Monetary Fund (IMF) has also warned Pakistan of the

‘looming CPEC bill’ that Islamabad will have to defray in the end. The IMF has expressed its concerns about the adverse implications of repayments of loans and profit repatriations to China, which could place the Pakistani economy in a lot of trouble than actually encouraging its development.

In the initial year, the impact of the CPEC-related outflow was estimated at only 0.1% of GDP per annum by Pakistani authorities. Yet, according to the IMF, those repayments will peak after seven years, reaching between $3.5 billion and $4.5 billion in a single year. The IMF assessed that the CPEC-related outflow would reach 1.6% of GDP per annum by 2024. In addition, Pakistan had an external debt of $75.747 billion in the first quarter of 2017, which is expected to grow to $110 billion in the next four years according to Pakistani economists. All of that, coupled with the fact that Pakistan’s repayment capacity remains weak, due to lack of any vast increases in terms of exports and due to the volatility of the Pakistani Rupee against the US dollar, appears as an issue of great concern.

Job Opportunities

In such a heavily congested and poor country like Pakistan, the CPEC will certainly be evaluated in regards to any employment opportunities it could provide. Currently, the population of Pakistan is more than 200 million, with people in their 20-30s as a majority, which means a large working age populace. Therefore, for many of those young people, the CPEC might have appeared as a favourable possibility of finding a job.

Both Pakistani and Chinese officials and media news outlets constantly give employment figures for different projects, yet hardly any of those numbers are substantiated by a formal governmental document. For example, Pakistani newspapers reported that the Suki-Kinari hydropower project in Khyber Pakhtunkhwa is expected to create more than 4,000 jobs, while the Sahiwal power plant, southwest of Lahore in Punjab province

‘hired 3,000 locals’. Port Qasim Coal Power project is reported to have created job opportunities for 5,000 Pakistanis, whereas the Sahiwal Coal Power Plant Project and Zonergy Solar Power Project - 3,000 jobs each. The KKH Phase II Havelian has been said to provide jobs to 2071 locals, while the Orange Line Metro Lahore - 956 people and Fiber Optic project - 580.

Chinese Deputy Head of Mission Zhao Lijian, who was recently named as the focal person on CPEC power projects, said that around 60,000 Pakistanis are working on different Chinese projects in Pakistan. Similarly, Fawad Khalid Khan, a senior engineer working with the China National Electric Engineering Company as a deputy commercial manager in Pakistan, believes that at least 100,000 jobs will be created over the next few years under the power and infrastructure projects of CPEC alone. Additionally, Pakistani mainstream media stated that the construction of the 392km highway from Multan in Punjab to Sukkur in Sindh is expected to create some 9,800 local jobs.

Nevertheless, none of these claims have been put on paper. Even ostensibly detailed reports of the CPEC actually provide no specific data on actual job figures, which is highly alarming considering the ongoing public resentment and suspicion regarding who is the de facto benefactor of the CPEC.

Yet, the informational eclipse does not end here. There is scarcity of information on the types of jobs that will be created, what skills will be required, what their duration will be, which projects will be included and what will be the amount of the salaries. Currently, the rates of unemployment in Pakistan stand at 5,9%, which accounts for more than 3 and half million of the population. Therefore, even if those job prospects are taken at face value, they are still nowhere near to satisfy the overall demand.

Considering the fear expressed by many Chinese citizens in regard to security, earlier highlighted by the Safe Cities Project, one could speculate that a big proportion of these jobs, in fact, will be in the security domain. Currently, the figures cited for Pakistani individuals employed in this sector range from 15,000 to 18,000 personnel, all hired to protect Chinese investments and citizens. The December 2017 disappearance of the Chinese engineer Pingzhi Liu, who was located at the Karot Hydropower Plant, justified the fears of Chinese officials for the necessity of more stringent surveillance and security. Shortly after the incidence, the Chinese Embassy warned all “

Chinese-invested organisations and Chinese citizens to increase security awareness, strengthen internal precautions, reduce trips outside as much as possible, and avoid crowded public spaces”.

What also must not be forgotten is that resulting from the China Pakistan Free Trade Agreement (FTA), many jobs have been moved from Pakistan to China, which further poses the question whether Beijing will replace those lost jobs. There are similar fears about the CPEC that it might lead to a loss of jobs because of the influx of cheaper Chinese goods that would drive Pakistani products out of the market. China is now the largest source of Pakistan’s imports, which stands at almost 30%. Many industry leaders have complained that the FTA has left them in a disadvantaged position against their Chinese competitors. Between 2012 and 2017, Pakistan’s trade deficit with China tripled, going from $4 billion to $12.7 billion. Various Pakistani business groups have complained that products in which Pakistan enjoys a competitive advantage are not covered by the Chinese side, which enjoys far wider access to Pakistan’s markets.

Appropriation of Land

Using the Suki Kinari Hydropower Project as a case study, another alarming issue surfaces. The Hydropower Station is being established in the region of Khyber Pakhtunkhwa and has an estimated cost of more than $1,800 million, which will finance the formation of a 3.1 kilometre long reservoir with a capacity of 9 million cubic meters of water, where turbines will generate approximately 870 MW of electricity. For the purposes of the project, the divisional administration has promised to ensure the acquisition of 4,418 kanals of land (1 kanal = 505.857 m²), including 1,200 kanals of reserved forest and 30 kanals of State land. Pakistan’s SK Hydro group and China’s Gezhouba Group developed the dam, and in April 2015, the developers and the Exim Bank of China and Industrial and Commercial Bank of China signed an agreement for 75% of financing costs. Subsequently, the Government of Pakistan agreed to purchase electricity from SK Hydro at a cost of $8.8415 cents per kilowatt-hour for the upcoming 30 years. Yet, despite that the aforementioned stakeholders appear to have achieved a consensus on the price and tariffs, one of the major stakeholders – the Pakistani people – have been unceremoniously neglected. In March 2018, the landowners, whose land was acquired for the implementation of this project, forcibly stopped the construction works on the dam in the Rajwal area of the Kaghan valley. As Mian Ashraf, the Chairman of Tahaffuz-i-Haqooq Balakot committee argued:

"

We want market price for our land acquired for the dam. The government signed agreements with us but now it does not honour commitments".

He claimed that Tahaffuz-i-Haqooq Balakot Committee had decided to obstruct the district administration to acquire land anywhere in the entire tehsil, as it was not fixing appropriate prices of their lands. According to the landowners, the government had set a price of Pakistani Rupees (PKR) 800,000 per kanal, yet the actual per square metre value of the property was not more than PKR 8,000, while there are over 505 square metres in each kanal of land. As a result, the owners have been offered a five times lower price than the actual commercial value of the property. Considering that those people were having very few other sources of livelihood due to the rough terrain, the unjust appropriation of their land has come as a direct violation of their human rights.

The same situation is visible in other areas, which are part of the project. For example, in the disputed territory of Gilgit Baltistan (part of Jammu & Kashmir), the local residents are concerned about the land grabbing, demographic shift and environmental pollution, which the CPEC inflicts to the region. Although the Pakistani government claims that the multibillion megaproject will bring economic prosperity to the area, the indigenous people remain sceptic since they further perceive the endeavour as a threat to their unique culture, as the majority of them are Shia Muslims, unlike the majority of Pakistanis, who are Sunni Muslims.

Cultural Invasion

Apart from the Chinese financial invasion, which constitutes securing jobs for its workers at the expense of locals, and flooding the market with cheap goods, which suffocates the domestic business, the adverse dimensions of the cultural exchange between the two countries should also be considered; In July-August 2015, a group of Pakistani teachers were part of a 15-day Chinese language training programme. The fact that these teachers have been trained to teach Chinese to Pakistani students implies that many jobs offered will involve dealing with Chinese staff in Pakistan. Currently, the abundance of Chinese language courses across Pakistan suggests that with the advent of the CPEC there will be sufficiently large numbers of Chinese citizens present in Pakistan, which in the long run might trigger cultural friction.

Such cultural frictions and language controversies have exercised far-reaching effects on the history of Pakistan in the past. Behind the separation of East Pakistan from West Pakistan and the establishment of Bangladesh was exactly the imposition of Urdu as a State language, neglecting the Bengali language, despite the fact that the number of Bengali speakers (56%) was higher than the number of Urdu speakers (7%). Language has been closely connected to power and ideology in Pakistan, since Urdu was considered the language of the elite. Currently Punjabi is the most widely spoken (48%), yet it still does not have an official status in law. Pakistan submitting to the socio-cultural impact of the introduction of the Chinese language, at the expense of its local languages, could appear as evidence how the country slowly is becoming a satellite State of China.

The rising numbers of Pakistani students going to China for higher education is another aspect of contemporary Sino-Pak relations. In fact, Pakistani students are now being sponsored for studies in China not just by the Chinese government but also by Chinese companies. In 2017, around 2,500 Pakistani students were enrolled in different Chinese universities, bringing the total number of Pakistani students in China to 22,000. With such a large number of students from Pakistan studying in Chinese universities, China has now become the largest destination for Pakistani students seeking overseas studies. According to statistics from 2016 released by the Chinese Ministry of Education, more than 200,000 students from 64 countries along the Belt and Road Initiative were studying in China. The number of students studying in China from countries along the Silk Road project has increased greatly under a series of preferential policies and scholarships.

In general, enrolling in a foreign university - building a wider network and facing a greater diversity in terms of experience - enhances one’s knowledge and position on a global scale; yet, for Pakistan it could also mean confronting a

‘brain drain’where its biggest and brightest talents flood out of the country, and as a result the economy experiences even more severe downfall.

Conclusion

The current analysis portrays the mechanisms of the CPEC according to which it operates and it discusses the various complexities originating from the lack of agreement and information on what the actual costs and benefits are likely to be. It argues that despite the abundance of Chinese, Pakistani and international reports which lay out figures and statistics, seldom the data matches, highlighting the absence of transparency and clarity.

The Chinese master plan conceives a picture where the majority of Pakistani socio-economic sectors are deeply penetrated by Chinese companies and Chinese culture; thus, Islamabad puts itself at risk of facing its finances and societal structure experiencing a colossal wreck. The combination of high upfront tariffs, interest rates and surcharges will complicate Pakistan’s efforts to repay its loans, forcing the State to increase its domestic and export prices, making it difficult to compete with neighbouring and other countries which maintain lower prices.

The borrower is always servant to the lender. The 15-year megaproject illuminates how Pakistan voluntarily is becoming progressively subjugated by China and its terms and conditions. Following Beijing’s history of trade relations with African countries, it is evident that China will be very careful about its investments and thereafter quite rigid in receiving its money back. Islamabad might have signed the CPEC agreement believing it would be advantageous to its country but it actually subscribed to an unfair deal for which common Pakistanis will eventually suffer.

Although China advertises Pakistan as its brother and ‘

all-weather friend’, the truth is that their ‘

friendship’ has always had an embedded enduring imbalance; Pakistan is in China’s debt and the debt will only deepen.

China has exclusively taken advantage of the fact that Pakistan has managed to isolate itself from the world due to wide allegations of sponsoring terrorism and Beijing might currently act as the Godfather assuring Islamabad that it will serve its interests, yet is fully aware that this patronising attitude will only turn Pakistan into a colony which will always require China for its day-to-day survival. As long as Pakistan operates in the shadow of another East India Company and does not realize the importance of protecting its national interests, which in essence are the people of Pakistan, any attempts for national development will transform into national calamity.