IMF: Euro-zone companies face massive 'debt overhang'

April 17

Euro-zone companies face a massive "debt overhang" that could prolong the region's downturn and risk a return to a more acute crisis, the International Monetary Fund warned Wednesday in a sobering report on risks that may be accumulating in the world financial system.

The IMF estimated that as much as one-fifth of the corporate bonds and loans issued by major European corporations are "unsustainable" and will force the firms to default or scale back, cutting capital expenditures, eliminating shareholder dividends or taking other steps to conserve cash to make debt payments.

Either alternative could create problems — with defaults damaging the banks or others who have lent money or bought corporate bonds, and capital investment cuts or other spending reductions affecting the ailing economy.

The data were released ahead of IMF spring meetings, where the fate of the euro zone remains a central issue. The information presents a quandary. Although some corporations in Europe have taken on too much debt, small- and medium-size businesses are finding it hard to borrow, further impeding any economic rebound.

"The slump in Europe is worrisome," said IMF chief economist Olivier Blanchard, who suggested that European banks be allowed to bundle loans to small businesses into marketable securities to encourage them to lend.

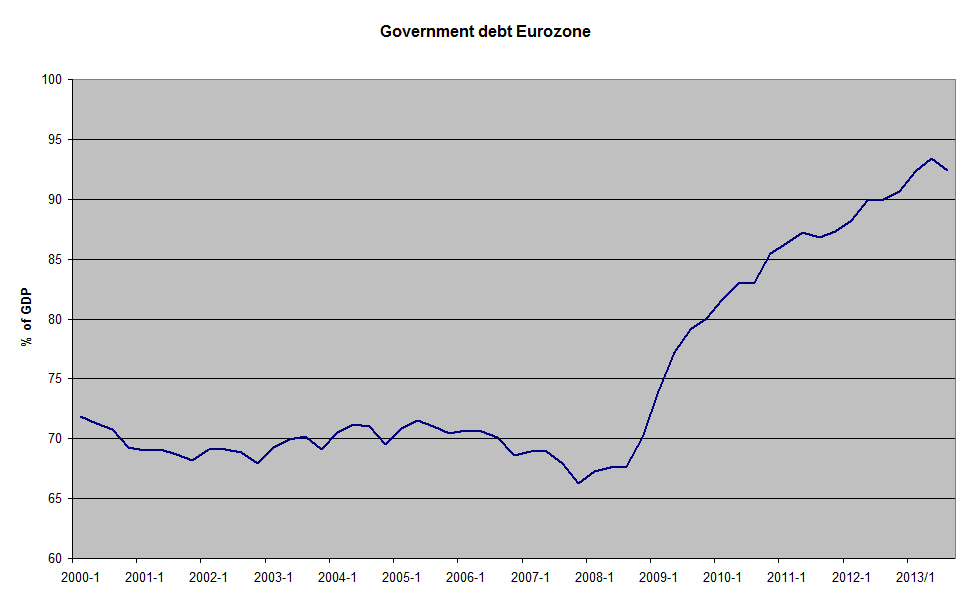

The region has been consumed for three years in a crisis revolving around debt, and it is reeling from the subsequent "fiscal consolidation," as nations cut spending or raise taxes to stabilize finances.

The potential corporate debt crisis could unleash the same dynamic in the private sector, whose debts sometimes dwarf the size of the surrounding economy. The IMF, which studied a sample of Europe's largest firms, said the situation is probably worse than its survey indicated, because the companies were among the region's strongest.

Just like their government counterparts, euro-zone firms gorged on cheap money that the establishment of the currency union provided to countries such as Italy and Spain, and they are paying it back amid a recession.

"Firms in the euro area periphery have built a sizeable debt overhang during the credit boom, on the back of high profit expectations and easy credit conditions," the IMF said in its latest Global Financial Stability Report. Larger firms may skirt the problem by selling unneeded assets, "but further reductions in operating costs, dividends and capital expenditures may also be required, posing additional risks to growth."

The warning on corporate debt is only one of the problems the fund sees on the horizon for the world financial system, particularly Europe. Years into a crisis that early on identified the banking sector as a particular weakness, the euro zone has not adequately recapitalized its banks, forced them to restructure and shed weak loans, or finished work on what many consider a necessity: a banking union that would unify financial supervision and share the risks of bank failures.

In one startling statistic, the IMF said euro-zone banks were only about halfway through a process of "deleveraging" — or bringing their obligations more closely in line with their assets. The fund estimated that euro-zone financial institutions still need to cut $1.5 trillion from their books, an amount that may increasingly crimp local lending because some of the easier steps, such as pulling out of overseas operations, have been done.

In many ways, worldwide financial conditions have improved in recent months. U.S. banks in particular, the fund said, have rebounded from the crisis, the euro zone has skirted the acute risk of breakup, and emerging markets have absorbed a large influx of capital without serious problems.

But the IMF, which was criticized for not saying more in advance about the circumstances that led to the U.S. financial crisis in 2008, is now using an abundance of caution. :ranger:

Pension funds in the United States are undertaking a "gamble for resurrection" by trying to overcome shortfalls with ever-riskier investments. Pension funds without enough to pay expected future benefits have placed as much as 25 percent of their money in "alternative investments," such as hedge funds and other riskier but potentially higher-return vehicles, the IMF reported.

U.S. firms have issued record levels of bonds in the low-interest-rate environment, but the money raised "is increasingly geared toward less productive use," such as buying back company stock.

Central banks, looking at weak growth and high unemployment rates, may feel the need to keep interest rates low and money flowing. But the fund said financial regulators may have to be aggressive and perhaps start forcing financial institutions to set aside more money to cover potential losses.

"Tension is building between the ongoing need for extraordinary monetary policy accommodation and credit markets that are maturing more quickly than in typical cycles," the IMF wrote. "High unemployment and low inflation may justify an accommodative monetary policy stance. But other tools need to be employed to counteract undesirable excesses in credit."

In remarks on Wednesday at Johns Hopkins University, Treasury Secretary Jack Lew insisted that the world economy must do more to stimulate domestic spending and generate economic growth. And he said the United States cannot be the sole supporter of growth across the globe.

"There is now broad agreement that we cannot return to a pattern of global growth that is built on the U.S. being the world's importer of first and last resort," Lew said. "Looking ahead, the United States must raise national savings, and emerging and more rapidly growing parts of the world, like Asia, must increasingly rely on domestic demand."

IMF: Euro-zone companies face a massive debt overhang - The Washington Post