High Debt Risk in US

Abstract

America is on a dangerous budget path. Current spending and debt are dangerously high, and future spending and debt are on track to rise even higher in large part due to increasing entitlement spending. Academic research shows that advanced economies like the United States are at risk of significant and prolonged reductions in economic growth when public debt reaches levels of 90 percent of GDP. High public debt threatens to drive interest rates up, to crowd out private investment, and to raise price inflation. The implications would be severe and pronounced for all Americans, but most especially for the poor, the elderly, and the middle class. U.S. policymakers should learn from Greece and Japan and avoid a fiscal crisis and economic stagnation brought about by public debt overhang.

Growing federal debt also would increase the probability of a sudden fiscal crisis, during which investors would lose confidence in the government's ability to manage the budget and the government would thereby lose its ability to borrow at affordable rates. Such a crisis would"¦probably have a very significant negative impact on the country.

-Congressional Budget Office, 2012 Long-Term Budget Outlook

-Congressional Budget Office, 2012 Long-Term Budget Outlook

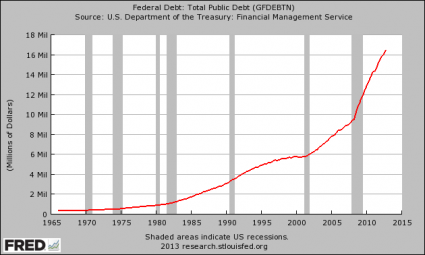

U.S. federal spending in 2013, combined with depressed receipts from a weak economy, is on track to result in a deficit of $850 billion. Publicly held debt in the United States will exceed 76 percent of gross domestic product (GDP) in 2013, and chronic deficits are projected to push U.S. debt to 87 percent of the economy in 10 years.[1] Debt is projected to grow even more rapidly after 2023. Recent economic research, especially the work of Carmen Reinhart, Vincent Reinhart, and Kenneth Rogoff, confirms that federal debt at such high levels puts the United States at risk for a number of harmful economic consequences, including slower economic growth, a weakened ability to respond to unexpected challenges, and quite possibly a debt-driven financial crisis.[2]

The federal government is quickly exhausting its ability to manage its bills, with debt having already reached the statutory debt ceiling.

The resulting debate should focus on the need to reduce federal spending immediately and over the long term by making necessary and prudent reforms to the nation's major entitlement programs, and thus reduce the continued buildup of debt and the expected harmful consequences increasingly confirmed by academic research.

The resulting debate should focus on the need to reduce federal spending immediately and over the long term by making necessary and prudent reforms to the nation's major entitlement programs, and thus reduce the continued buildup of debt and the expected harmful consequences increasingly confirmed by academic research.Vulnerable Budget Path

In the contentious 2011 debate over the U.S. debt limit, President Barack Obama and Congress agreed to raise the debt ceiling by $2.1 trillion in exchange for specified spending reductions over 10 years. The Budget Control Act allowed the President to raise the limit in three increments from $14.29 trillion to $16.39 trillion.[3] At the time, the United States lost its seemingly permanent AAA rating from Standard & Poor's, starkly affirming the risk arising from the nation's budget path.[4]

America's budget problems are twofold: (1) spending and debt are dangerously high today, and (2) future spending and debt are on track to rise even higher.

America's budget problems are twofold: (1) spending and debt are dangerously high today, and (2) future spending and debt are on track to rise even higher.=> The US Debt Piles Up

=> U.S. National Debt Clock

=> U.S. National Debt Clock : Real Time

As dangerous as these trends are, the long-term unfunded obligations in the nation's major entitlement programs loom like an even darker cloud over the U.S. economy. Demographic and economic factors are expected to combine to drive spending in Medicare and Social Security to unsustainable heights. The major entitlements and interest on the debt are on track to devour all tax revenues by in less than one generation.[5]

While tax revenues are expected to return to their historically average levels of 18.5 percent, total federal spending driven in large part by entitlements is projected to hover well above the historical level of about 20 percent in the near term.[6] In a mere 25 years, federal spending under current policy is projected to consume as much as 36 percent of GDP.[7]

America's entitlement programs, by definition, span generations. It is vital in assessing their sustainability to consider their long-term implications. Over the 75-year long-term horizon, the combined unfunded obligations arising from promised benefits in Medicare and Social Security alone exceed $48 trillion.[8] The federal unfunded obligations arising from Medicaid and even from veterans' benefits are unknown, but would likely add many trillions more to this figure.

The International Monetary Fund,[9] the intergovernmental organization of 188 member states that seeks to ensure the stability of the international monetary system, warned that the U.S. lacks a "credible strategy" to stabilize its mounting public debt.[10] Such a strategy must begin with putting entitlement spending on a more sustainable long-term path. The sooner policymakers act, the less severe and the more gradual the necessary policy changes can be. Policymakers should not delay, since the economic consequences, particularly the impact on individuals in or planning retirement, would be pronounced and severe.

Research Confirms Danger of High Government Debt

Recent research confirms the dangers posed by high levels of government debt. Reinhart, Reinhart, and Rogoff examined over 110 years of economic data to conclude that advanced economies whose debt levels reach 90 percent of GDP face much slower economic growth.[11]

In 2009, Carmen Reinhart and Rogoff wrote This Time Is Different, a book The Economist called "a magisterial work on the causes and consequences of crises stretching back 800 years."[12] Their conclusions were based on a vast new accumulation of cross-country data, covering 66 countries across all regions of the world and spanning eight centuries. This dataset made it possible to study country debt episodes and crises much more comprehensively. Reinhart, Reinhart, and Rogoff's recent work on the impact of high public debt on growth and interest rates is based on this groundbreaking dataset.

The economists follow a descriptive approach, comparing economic variables for different countries as averages for debt-to-GDP ratios below and above 90 percent of GDP. Measures of comparison include averages for real GDP growth, real (inflation-adjusted) short-term interest rates, and real long-term interest rates. Public debt overhang episodes are analyzed for the causes of the debt, whether from specific wars, financial crises and economic depression, domestic turmoil, or other factors. The researchers refer to sustained periods of gross country debt persisting above 90 percent of GDP for five years or more as "public debt overhang episodes." Identifying 26 such episodes, of which 20 lasted for more than a decade, the research shows that even if such episodes begin with short-lived dramatic events, such as war or a financial crisis, the negative impact from high debt on growth lasts far beyond such events.

The authors' results should serve as a sobering wake-up call for policymakers. Reinhart, Reinhart, and Rogoff discovered that the average growth rate in countries experiencing public debt overhang is 1.2 percentage points lower than in periods with debt below 90 percent of GDP.[13] These public debt overhang episodes last an average of about 23 years. Thus, the cumulative effect of lower growth by one percentage point or more means that national income at the end of the period would be lower by roughly one-fourth. The growth rate of countries with exceptionally high levels of debt—more than 120 percent of the economy—drops even lower, by an average of 2.3 percentage points, which is roughly two-thirds.

These figures indicate just how dire the U.S. situation could become: According to the Congressional Budget Office baseline economic forecast, U.S. GDP is projected to be $25.9 trillion in fiscal year 2023. U.S. publicly held debt is projected to reach nearly 90 percent of GDP that year. Assuming a 2.2 percent growth rate over 23 years, U.S. GDP would reach $42.7 trillion in 2046 if there was no impact from the debt overhang. Applying the crude assumption that GDP would be reduced by 1.2 percentage points, in each year of the assumed 23-year debt overhang period, U.S. GDP growth would be slashed by more than half to a mere 1 percent. This would reduce U.S. GDP by more than $10 trillion, to only $32.6 trillion in 2046. The cumulative effect from the debt overhang would result in a level of GDP lower by nearly one-quarter at the end of the period.

The researchers also note that in addition to vast amounts of public debt, other measures of country debt, such as levels of state and local government debt, private debt, external debt (government and private debt owed to foreigners), and the unfunded obligations from retirement and medical care programs, have risen to unprecedented heights in advanced economies, including the United States.

In the U.S., the total amount of debt held by all 50 state governments combined amounted to $4.17 trillion in 2012. If one adds state debt to the U.S. gross national debt of $16.4 trillion, the combined state and federal debt exceeds $20.5 trillion. Moreover, the long-term unfunded obligations for Social Security and Medicare totaled $48 trillion in 2012—three times the current U.S. gross national debt. Even this measure does not include other federal obligations in the form of Medicaid or veterans' benefits, for example. While data across countries of these debt measures is difficult to obtain, other government debt certainly adds to the risks faced by countries with high public debt levels.

A Significant and Prolonged Drag on Economic Growth

Debt overhang reduces economic growth significantly and for a prolonged period of time in three main ways.

1. Higher Interest Rates. Creditors may lose confidence in the country's ability to service its debt and demand higher interest rates to offset the additional risk. Or, interest rates may rise simply because the government is attempting to sell more debt than private bondholders are willing to buy at current prices. Either way, higher interest rates raise the cost of the debt, and the government must then either tax its citizens more, which would reduce economic activity; reduce government spending in other areas; or take on even more debt, which could cause a debt spiral.

Higher interest rates on government bonds also lead to higher rates for other domestic investments, including mortgages, credit cards, consumer loans, and business loans. Higher interest rates on mortgages, car loans, and other loans would make it more costly for families to borrow money. Families may then have to delay purchasing their first home and other means of building financial security. For many Americans, the dream of starting a business would no longer be in reach. Higher interest rates have a real and pronounced impact on the lives of ordinary citizens and translate into less investment and thus slow growth in the rest of the economy. A weaker economy in turn would provide fewer career opportunities and lower wages and salaries for workers.

However, higher interest rates do not always materialize in countries suffering a debt overhang. According to Reinhart, Reinhart, and Rogoff, in 11 of the 26 cases where public debt was above 90 percent of GDP, real interest rates were either lower, or about the same, as during years of lower debt ratios. Soaring debt matters for economic growth even when market actors are willing to absorb it at low interest.[14]

Interpreted another way, in more than half of debt overhang cases, interest rates rose. In the case of the U.S., the Federal Reserve's policy of repeated quantitative easing has contributed to interest rates dropping to historical lows. Interest rates will likely rise at some point over the next several years. The Congressional Budget Office predicts that interest costs on the debt will more than double before the end of the decade, rising from 1.4 percent of GDP in 2013 to 2.9 percent as early as 2020.[15] High levels of U.S. public debt could push interest rates even higher with severe impacts for the American economy.

2. Higher Inflation. The United States has, as do other countries with independent currencies, an additional option to monetize its debts: replacing a substantial portion of outstanding debt with another form of federal liability—currency. The government could, through the Federal Reserve, inflate the money supply. The resulting increase in the rate of price inflation would devalue the principal of the remaining public debt. The resulting inflation would also destabilize the private economy, increase uncertainty, increase real interest rates, and slow economic growth markedly.

Inflation is particularly harmful for those Americans on fixed incomes, such as the elderly who rely on Social Security checks, pensions, and their own savings in retirement. By raising the cost of essential goods and services, like food and medical care, inflation can push seniors into poverty. Inflation and longer life expectancies can mean that some seniors run out of their savings sooner than anticipated, then becoming completely dependent on Social Security. Inflation inflicts the most pain on the poor and middle class by reducing the purchasing power of the cash savings of American families. Inflation also means that everyone has to pay more for goods and services, including essentials like food and clothing.

Moreover, severe inflation could dethrone the U.S. dollar as the world's primary reserve currency. Thus far, a major saving grace for the U.S. government has been that, in comparison with other advanced nations with major currencies, such as Europe and China, the U.S. dollar has retained its status as the best currency option for finance and commerce.[16] If Washington policies continue on their current path of ever-higher sovereign debt and a risky Federal Reserve policy, both of which lack a credible crisis coping strategy, confidence in the U.S. economy and monetary policy regime could erode. Such a development would be unprecedented in size and magnitude and the impact on Americans and the economy would be massive and severe.

For all these reasons, the Federal Reserve and central banks of all industrialized countries have adopted a policy favoring low and stable inflation, though the means by which they pursue this policy can vary substantially and their success is often spotty. Reversing this policy in favor of a policy of debt monetization and high inflation would be a radical departure in policy and practice. It would be the economic equivalent of a scorched earth policy, and its adoption is thus extremely unlikely.

How High U.S. Debt Levels Would Hurt Americans

High U.S. Debt Levels Risk"¦

Higher Interest Rates

- Higher interest rates on mortgages, car loans, and other loans would make it more costly for families to borrow

- money.

- Families may have to delay purchasing their first home and other means of building financial security.

- For many Americans, the dream of starting a business would no longer be in reach.

Higher Inflation

- Inflation reduces the purchasing power of the cash savings of American families, inflicting the most pain on the

- poor and middle class by eroding the value of their rainy day fund.

- Inflation raises the prices on essential goods and services, like food, clothing, and medical care, and is particularly

- harmful for the poor and those on fixed incomes, like the elderly.

- Higher inflation and longer life expectancies together can mean that some seniors run out of their savings sooner

- than anticipated, leaving them completely dependent on Social Security. Some may even end up in poverty.

Crowding Out Private Investment

- Government deficit spending and its associated debt subtracts from the amount of private saving available for private

- investment, leading to slower economic growth.

- Less economic growth means fewer jobs, lower wages and salaries, and fewer opportunities for career

- advancement.

- Less private investment means fewer opportunities for innovation and the creation of productivity enhancing technologies,

- putting the U.S. at a disadvantage with competing trading nations.

Solution

U.S. debt is quickly approaching economically damaging debt levels. U.S. lawmakers should delay no more. Congress and the President should take firm and immediate steps to balance the budget within 10 years, by cutting spending and reforming the entitlements.

3. Crowding Out Private Investment. Economic growth, especially increasing per capita income, depends on the proper functioning of prices to signal and markets to respond, but it also depends fundamentally on increasing the amount and quality of productive capital available to the workforce. The amount of capital employed in the economy needs to increase at least to keep pace with the growth in the labor force to maintain current living standards, and must grow even faster—to increase the amount of capital per worker—to raise worker productivity and thus wages and salaries.

Government deficit spending and its associated debt subtracts from the amount of private saving available for private investment, leading to slower economic growth. Unlike what staunch believers of government spending for economic stimulus claim, government stimulus spending does the opposite of growing the economy. Less economic growth caused by high government spending and debt results in fewer available jobs, lower wages and salaries, and fewer opportunities for career advancement.

Prolonged debt overhang in the United States, even at low interest rates, would be a massive drag on economic growth, leading to significantly reduced prosperity for Americans. In the words of Reinhart, Reinhart, and Rogoff: "This debt-without-drama scenario is reminiscent for us of T. S. Eliot's (1925) lines in The Hollow Men: 'This is the way the world ends / Not with a bang but a whimper.'"[17]

Europe's Fiscal Crisis: Precursor for the United States?

Europe is experiencing an extended fiscal and economic crisis with no end in sight. In addition to adopting a common currency regime lacking most of the institutional trappings necessary for its survival, many countries in Europe have lived beyond their means for many years. Many racked up massive government debts while benefiting from artificially low interest rates, as the euro signaled to markets that all European debts were alike. The poster child for this behavior, of course, is Greece. Greece racked up a debt-to-GDP ratio of 145 percent in 2010 and 165 percent in 2011.[18] Not surprisingly, investors eventually lost confidence in Greece's ability to service its debts. European lawmakers responded in early 2011 with a combination of a bailout and fiscal austerity. Nevertheless, Greece defaulted on its debts to the detriment of investors and other European taxpayers.

Many other European countries also amassed public debts beyond 90 percent of their economies—for instance Italy (100 percent) and Portugal (97 percent) in 2011—and are now undergoing wrenching austerity and prolonged recessions. In addition to disastrous currency policy, these countries also have a fiscal policy culprit in common: high levels of government spending on entitlements—a fiscal situation by no means foreign to the U.S. government.

Avoiding Japan's "Lost Decades" for America

Not all countries that build debt mountains suffer from a lack in investor confidence and go into default. Japan is arguably the world's most indebted major economy, with net public debt at 126 percent of GDP, and yet creditors continue to lend to the Japanese government. Japan amassed this public debt to a large extent in the midst of its "lost decades"—1991 to 2010—while falling again and again for the wishful thinking that government deficits stimulate economic growth. History and economic fundamentals have shown this thinking to be wrong. This misguided policy is standing in the way of a Japanese recovery. As The Heritage Foundation's Derek Scissors and J. D. Foster explain:

Japan's debt is almost entirely domestically financed, which means gigantic sums are shifted from the private sector to the public sector, where the social return on investment is almost nil and the yields paid on the debt are only slightly better. The huge debt and oversized government has sapped Japan's domestic sources of growth.[19]

Japan is experiencing a prolonged debt overhang episode with, as yet, no debt crisis drama because Japanese citizens are prodigious savers. The Japanese mostly owe their debt to themselves as Japanese citizens have been willing to forgo consumption and have been buying government bonds for a long time, enabling the Japanese government to accumulate gross debt levels more than twice the size of the Japanese economy. Instead, the country suffers from persistently weak economic growth.

The IMF warned the United States and Japan against a further buildup of risk by failing to lower their debt levels. U.S. policymakers should not allow themselves to be lulled into complacency by low interest rates. Policymakers must act now to allow an orderly and controlled mechanism to reduce public debt—not wait for a sovereign debt crisis to force their hands.[20]

A full-fledged fiscal crisis hits a country with the same force as a patient suffering severe trauma. However, a no-drama debt overhang that reduces growth slowly drains the life from the patient, like a long-term disease. The U.S. should not delay adopting a credible strategy to resolve chronic deficits and debt, lest it find itself on the stretcher.

A Credible Strategy

Federal budget deficits and debt are massive today—and future spending and debt projections are far worse if Congress and the President fail to act. Federal spending was about 23 percent of GDP in 2012—far above the historical average of 20.2 percent. It is projected to surge to nearly 36 percent in less than one generation.

This spending is the cause of the chronic deficits that are driving the debt higher yet. Public debt is projected to reach 87 percent of GDP by 2023 and rise sharply in later years.

This spending is the cause of the chronic deficits that are driving the debt higher yet. Public debt is projected to reach 87 percent of GDP by 2023 and rise sharply in later years.Two programs in particular—Social Security and Medicare—are taking over a quickly expanding share of federal spending. In addition, they suffer from programmatic weaknesses. Social Security and Medicare provide an important safety net for seniors, but in their current form the programs are unsustainable over the medium term and long term. These programs take up 39 percent of the budget today and are projected to grow to 44 percent of federal spending in just 10 years. At $48 trillion in net-present value, their unfunded obligations are triple the size of the entire gross U.S. national debt.

There are numerous reforms to help shore up financing for these programs that garner bipartisan support and that can be implemented quickly. These include raising the Social Security eligibility age to match increases in longevity and correcting the cost-of-living adjustment (COLA) to more accurately measure the impact of inflation on beneficiaries. In Medicare, raising the eligibility age to match Social Security makes common sense. Seniors with high incomes already pay a higher share of their own Medicare costs, and the remaining subsidy should be pared back even further.

Beyond resolving immediate financing challenges, there are bolder reforms to resolve many of the programs' inherent weaknesses. The goal should be to arrive at a strengthened social safety net for those seniors who need it. Doing so in an affordable manner means turning Social Security and Medicare into true insurance against poverty in retirement.

For Social Security, benefits should be phased out for upper-income retirees. Consolidating Medicare's three distinct components—Parts A, B, and D—and collecting a combined higher premium would save money and simplify the program. Lawmakers should begin pursuing a credible strategy on reining in massive budget deficits and debt by implementing proposals such as outlined here.[21]

The Time to Act Is Now

By neglecting the regular budget order—the institutional schedule to assess government spending and allocate taxpayer dollars with prudence—Congress and the President are increasingly failing to govern. Congress has only budgeted when forced to do so. Reaching the debt ceiling should be such an occasion, and Congress should not delay the decision again on necessary reforms and spending reductions. The President's and Congress's failure to establish a credible strategy for reining in massive deficits and debts in 2011 led Standard & Poor's to downgrade the U.S. credit rating,[22] Moody's, another major rating agency, warned Congress early in 2013 that failure to provide a basis for meaningful improvement in the government's debt ratios over the medium term could "affect the rating negatively."[23] Ratings agencies provide important signals to investors about the risks associated with investing in government bonds. Further downgrades of the U.S. debt and demand by capital markets will eventually lead to higher interest rates, whose costs would drive up federal spending and debt even more. As U.S. debt is quickly approaching economically damaging debt levels, U.S. lawmakers should delay no more. The time to act is now.

—Romina Boccia is Research Coordinator in the Thomas A. Roe Institute for Economic Policy Studies at The Heritage Foundation.

How the United States' High Debt Will Weaken the Economy and Hurt Americans

Last edited: