- Joined

- Nov 17, 2012

- Messages

- 1,880

- Likes

- 680

Emerging Markets Are Going To Spend A Massive $6 Trillion On Infrastructure In The Next Three Years

Each week, more than one million people are either born in or migrate to cities around the world.

Much of this rapid urbanization comes from the emerging world, putting tremendous pressure on that country's feeble infrastructure.

Pipes burst, roads are jammed, the water is tainted and the lights even go out.

Merrill Lynch estimates that $6 trillion will need to be spent by selected emerging market countries over the next three years to meet the basic needs of these citizens. Water, transportation and energy investments will consume the bulk of these funds, accounting for 82 percent of total projected spending. Nearly every emerging market country Merrill researched will make an investment in all three.

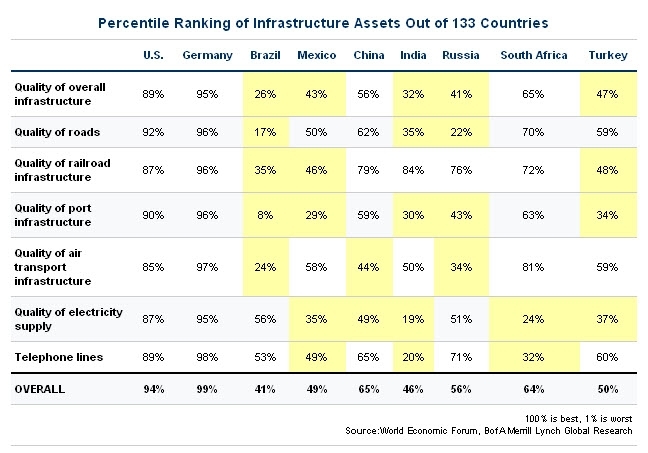

While each developing country could benefit from an upgrade, needs vary. This table details how different emerging market countries stand up against each other in terms of quality for the country's roads, rails, ports, etc. We've highlighted the specific areas where the countries rank in the bottom half among the 133 surveyed by the World Bank.

You can see that Brazil has the worst overall ranking among the countries listed. Though the country is a large exporter, the extremely poor condition of the country's roads and rails has hampered the growth of internal textile and farming industries. However, there is light at the end of the tunnel for the country, as the government already has a plan in place to improve these conditions (Read: Brazil's Infrastructure Plays Catch Up).

India's infrastructure also rates poorly, and is slowing the country's ascent to top of the world's economies (Read: India's Achilles Heel). One of India's key issues is electricity. Merrill says that nearly 40 percent of Indian households do not have access to electricity, the worst of any major developing economy.

Power is also a problem in South Africa where a major power plant has not been built in 20 years and blackouts/power outages have hurt the country's mining industry in recent years. Merrill projects $54 billion will need to be spent on the country's power system over the next three years, accounting for nearly half total infrastructure spending.

China, which accounts for more than half of that $6 trillion estimate, ranks far above emerging peers in terms of infrastructure at the 65th percentile. Merrill says that one of China's biggest needs is in water and environmental development. The firm estimates that the Asian country will need to build roughly 40,000 reservoirs at Rmb 12.5 million a piece to create an internal water distribution system and alleviate pressure when regions experience extended droughts such as what China is seeing presently.

The needs of a growing global population set to reach 7 billion later this year and investment needed to supply these people with sufficient water, roads, housing and power is why we identified infrastructure as a megatrend in 2007 and made it the key investment theme of the Global MegaTrends Fund (MEGAX).

Although some infrastructure investments, such as those in Russia, have seen delays as fiscal dollars have been diverted during the financial crisis, we continue to believe in the long-term viability of the story.

Emerging Markets Are Going To Spend A Massive $6 Trillion On Infrastructure In The Next Three Years - Business Insider

POOR PRODUCTIVITY, INFRASTRUCTURE, HIGH PRICES HOLD ECONOMY BACK AS RESULTS OF 2013 IMD WORLD COMPETITIVENESS RELEASED.

30 May 2013 2:39 PM

Israel scored its highest points in technical and scientific infrastructure, but was held back by low scores for productivity and efficiency, prices and basic infrastructure.

The country's highest "key attractiveness indicators" included a skilled workforce, strong culture of research and development, high education level and a dynamic economy.

Since 1997, Israel was among the countries whose rankings increased the most, alongside China, Germany, Korea, Mexico, Poland, Sweden, Switzerland and Taiwan. In 1997, it was ranked 25th.

Uriel Lynn, president of the Federation of Israeli Chambers of Commerce, said the improvement was a "tremendous achievement for the economy in the last 10 years," but noted that integrating excluded populations into the labor force and regulation destructive to the business sector remained problematic.

Professor Stéphane Garelli, director of the IMD World Competitiveness Center, said: "While the euro zone remains stalled, the robust comeback of the US to the top of the competitiveness rankings, and better news from Japan, have revived the austerity debate. Structural reforms are unavoidable, but growth remains a prerequisite for competitiveness. In addition, the harshness of austerity measures too often antagonizes the population. In the end, countries need to preserve social cohesion to deliver prosperity."

Highlights of the 2013 ranking

The US has regained the No. 1 spot in 2013, thanks to a rebounding financial sector, an abundance of technological innovation and successful companies.

China (21) and Japan (24) are also increasing their competitiveness. In the case of Japan, Abenomics seems to be having an initial impact on the dynamism of the economy.

In Europe, the most competitive nations include Switzerland (2), Sweden (4) and Germany (9), whose success relies upon export-oriented manufacturing, diversified economies, strong small and medium enterprises (SMEs) and fiscal discipline. Like last year, the rest of Europe is heavily constrained by austerity programs that are delaying recovery and calling into question the timeliness of the measures proposed.

The BRICS economies have enjoyed mixed fortunes. China (21) and Russia (42) rose in the rankings, while India (40), Brazil (51) and South Africa (53) all fell. Emerging economies in general remain highly dependent on the global economic recovery, which seems to be delayed.

In Latin America, Mexico (32) has seen a small revival in its competitiveness that now needs to be confirmed over time and by the continuous implementation of structural reforms.

A 25th anniversary perspective on World Competitiveness

In 1989, the IMD World Competitiveness Yearbook had a split ranking. The most competitive advanced economies were Japan, Switzerland and the Netherlands. Among emerging markets, Singapore, Hong Kong and Malaysia led the way. Globalization had not yet kicked in. China, Russia and several other nations (some of which did not exist back then) were not included.

By 1997, the world of competitiveness had become increasingly global, and IMD first produced a unified ranking including both advanced and emerging economies. Here are the countries that have risen and fallen the most since then:

Winners since 1997 (+ 5 or more ranks):

China, Germany, Israel, Korea, Mexico, Poland, Sweden, Switzerland, Taiwan

Losers since 1997 (- 5 or more ranks):

Argentina, Brazil, Chile, Finland, France, Greece, Hungary, Iceland, Ireland, Italy, Japan, Luxembourg, Netherlands, New Zealand, Philippines, Portugal, South Africa, Spain, United Kingdom and Venezuela.

Winners:

- The US, Singapore and Canada, although not in the "winners" list, have very stable and enduring competitiveness models that rely on long-term advantages such as technology, education and advanced infrastructure.

- In Europe, Switzerland, Sweden and Germany share the same recipe for success: exports, manufacturing, diversification, competitive SMEs and budget discipline.

- In Asia, China's success has had a pull effect on the region's competitiveness, prompting many Asian economies to redirect their exports from the US and Europe to other emerging markets. - Mexico and Poland are seeing a revival in competitiveness that will need to be confirmed over time.

Losers:

- Europe has lost ground and accounts for more than half of the "losers" since 1997.

- The UK and France in particular are losing their dominant position and competitive clout, while The Netherlands, Luxembourg and Finland need to adapt their competitiveness models to a changing environment.

- In Southern Europe Italy, Spain, Portugal and Greece are all lagging behind. They did not diversify their industry enough or control public spending and are now facing austerity programs.

- The fate of Ireland and Iceland shows that competitiveness needs to be sustainable, and that uncontrolled fast expansion can also lead to disaster.

- Latin America has been disappointing, with larger economies such as Chile, Brazil, Argentina and Venezuela all losing ground and being challenged by the emerging competitiveness of Asian nations.

Professor Garelli added: "Generalizations are, however, misleading. True, Europe's competitiveness is declining, but Switzerland, Sweden, Germany and Norway are shining successes. Latin America is disappointing, but there are great global companies all over that region. Brazil, Russia, India, China and South Africa are immensely different in their competitiveness strategies and performance, but the BRICS remain lands of opportunities."

"In the end, the golden rules of competitiveness are simple: manufacture, diversify, export, invest in infrastructure, educate, support SMEs, enforce fiscal discipline, and above all maintain social cohesion," concluded Professor Garelli.

Poor productivity, infrastructure, high prices hold economy back as results of 2013 IMD World Competitiveness released. | The Jewish Weekly Review

Last edited:

" director income tax (International Tax), MS Ray said at an Assocham event today.

" director income tax (International Tax), MS Ray said at an Assocham event today.