santosh10

Senior Member

- Joined

- Oct 5, 2014

- Messages

- 1,666

- Likes

- 177

Is the Eurozone crisis over? Or is it quietly getting worse?

@Ray

Deficit, national debt and government borrowing - how has it changed since 1946?

Deficit, national debt and government borrowing - how has it changed since 1946? | News | theguardian.com

India's exports to European countries increased by about 16 per cent to USD 57.7 billion in 2011-12, while imports rose by about 29 per cent year-on-year to USD 91.5 billion.

Exports to Europe up 16%; imports 29% - Financial Express

@RayIn 2012, Germany ran a trade deficit of €27bn with Russia, Libya and Norway, mainly for energy imports. Germany also had trade deficits with Japan (€4.7bn) and China (€11.7bn). In contrast, Germany had a trade surplus with the eurozone (France, Italy, Spain, Greece, Portugal, Cyprus and Ireland) of €54.6bn.

For example, the ESM relies primarily on the support of four countries: Germany (27.1 per cent), France (20.4 per cent), Italy (17.9 per cent) and Spain (11.9 per cent). If Spain or Italy needs assistance, then the contingent commitment of the remaining countries, especially France and Germany, would increase. :ranger:

Debt crisis has left Germany vulnerable - FT.com

. its a simple case that German companies are doing good as compare to its OECD rivals and hence its benefiting the nation :ranger:

. its a simple case that German companies are doing good as compare to its OECD rivals and hence its benefiting the nation :ranger:

New Delhi is frustrated that trade talks launched when Chinese Premier Wen Jiabao visited India in late 2010 haven't yielded significant benefits.India's trade deficit with China jumped 42% to nearly $40 billion in the last fiscal year ended March 31, and was the largest contributor to the country's overall gap between exports and imports.

Trade Gap Strains India-China Ties - WSJ

I did not know that Finland was so high on the list. Why has this been hidden from the public by our government. They should promote these positive news, instead of all the negstive euro news.Teenage sulks

Nov 18th 2013

Aged 15, the euro will remain a difficult adolescent

After four years of crisis-fighting, European leaders have the chance to build more solid foundations for their shaky currency zone by sorting out its wobbly banks in 2014. They are more likely to fumble this opportunity than to seize it wholeheartedly. As before, they will do enough to keep the single currency intact but not enough to make it work properly. :ranger:

The year will begin on a high note as Latvia becomes the 18th state to join a currency union that started in 1999 with just 11 members (see article). The decision of this small Baltic country is as much political as economic, as it seeks to curb Russian influence by embedding itself more deeply in Europe. But after all the fears about a "Grexit", Eurocrats will still hail the expansion as a vote of confidence in the euro. And it will come after an earlier boost at the end of 2013, as Ireland becomes the first economy to leave its bail-out programme and return to market financing (though it may still require help through a credit line).

In contrast with these northern lights, the outlook for the bailed-out economies of Greece, Portugal and Cyprus will remain a southern cross. Greece will be lucky to escape a seventh year of recession, and will require extra loans to meet its financing needs in 2014 and 2015: a third bail-out. And, even though Greece has defaulted on a record amount of sovereign bonds, its public debt will be oppressively high, at 175% of GDP. Further debt relief will come to the fore in 2014. Since most of the debt is now owed to other euro-zone countries, that will pose tricky questions, especially for Germany, the biggest creditor, which will do its utmost to avoid outright forgiveness for fear that other rescued countries will clamour for similar treatment.

Euro-zone GDP is expected to expand in 2014 by only a modest 1%

Portugal for its part is heading for a second bail-out. A deep recession caused a political crisis in 2013, which undermined investor confidence, causing hopes for a return to market financing in mid-2014 to recede. But it is Cyprus that will suffer the most. Output will decline cumulatively in 2013 and 2014 by over 12%, according to the IMF, which notes that the fall could exceed 20% in "adverse" circumstances. The main worry is that the recapitalisation of the Bank of Cyprus using uninsured deposits will prove to be inadequate as bad debts surge. :ranger:

A chance to grow up

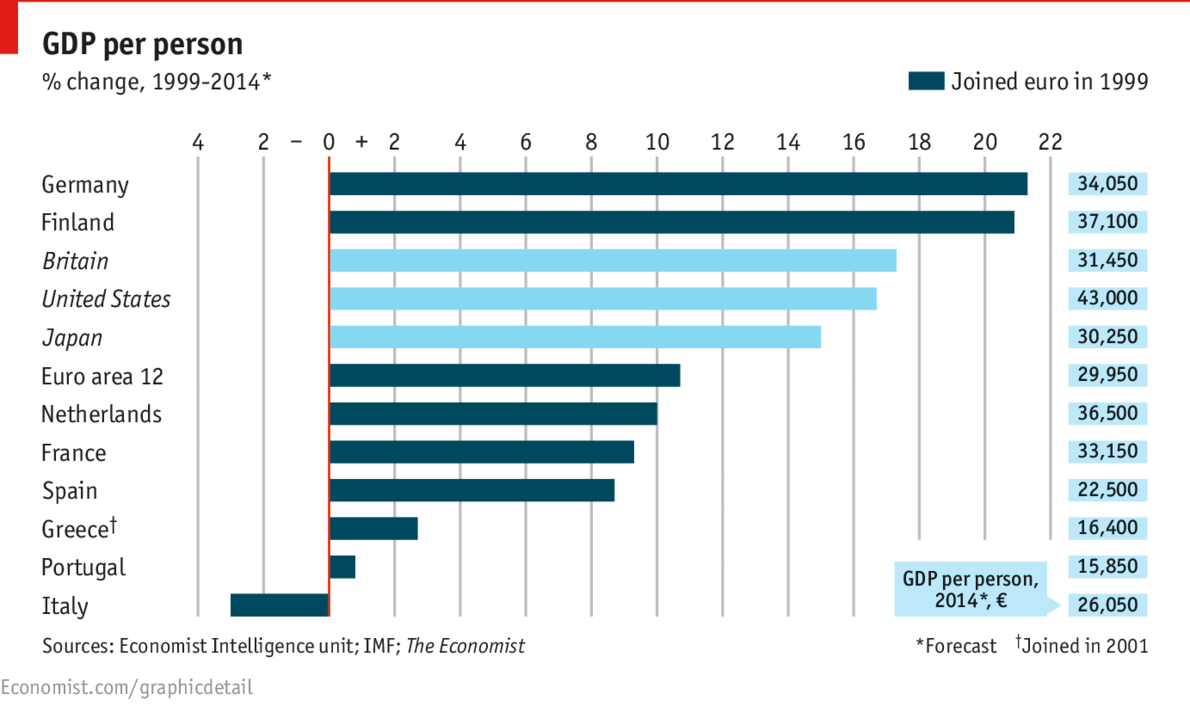

These setbacks in small southern countries will be manageable if the euro zone can sustain and strengthen the recovery that started in the spring of 2013, with the upswing spreading from Germany to include the big Mediterranean economies of Italy and Spain. One worry is that the German export machine may run slow if Chinese growth falters. Another is that a dearth of credit will hold back smaller Italian and Spanish firms. Even if these risks can be averted, euro-zone GDP is expected to expand in 2014 by only a modest 1%, leaving output still below its peak in 2008. That overall figure disguises how badly some economies like Italy and Portugal have done since the introduction of the euro in 1999 (see chart).

There is an opportunity nonetheless for European leaders to build a basis for stronger sustained growth. The European Central Bank will become the supervisor of the zone's biggest banks in late 2014. Before that, in the first half of the year, it will conduct a searching investigation of their books. This asset-quality review is a chance to deal once and for all with the banking weaknesses that have interacted with unsustainable sovereign-debt burdens to make the euro crisis so intractable. The review could restore investors' faith in euro-zone banks, lowering their funding rates and enabling them to lend more freely to companies.

But if the review is to carry conviction (seearticle), it will prompt tough and potentially costly decisions: closing down banks that are no longer viable and injecting funds to plug capital gaps. That requires recourse if necessary to taxpayers, but Germany has blocked efforts to make this possible at the euro-area level; instead banks will have to rely upon the public purses in their home countries. Yet the weakest banking industries are in the countries with the weakest public finances, such as Italy. The danger is that the asset review becomes another euro-fudge, which does not sever the link between shaky banks and shaky sovereigns.

If Europe fails to seize the opportunity to sort out its banks, then it will fit into a disappointing yet familiar pattern. The euro area may no longer be in mortal danger of breaking up. But it will increasingly resemble a joyless union whose members stay together only for fear of a more painful separation :ranger:

Europe: Teenage sulks | The Economist

wrong thead

Shrinking Europe Military Spending Stirs Concern

April 22, 2013

BRUSSELS — Alarmed by years of cuts to military spending, the NATO secretary general, Anders Fogh Rasmussen, issued a dire public warning to European nations, noting that together they had slashed $45 billion, or the equivalent of Germany's entire military budget, endangering the alliance's viability, its mission and its relationship with the United States. :ranger:

http://www.nytimes.com/2013/04/23/w...ing-under-scrutiny.html?pagewanted=all&_r=0#h

Trends in U.S. Military Spending

Military budgets are only one gauge of military power. A given financial commitment may be adequate or inadequate depending on the number and capability of a nation's adversaries, how well a country invests its funds, and what it seeks to accomplish, among other factors. Nevertheless, trends in military spending do reveal something about a country's capacity for coercion. Policymakers are currently debating the appropriate level of U.S. military spending given increasingly constrained budgets and the winding down of wars in Iraq and Afghanistan. The following charts present historical trends in U.S. military spending and analyze the forces that may drive it lower.

These charts draw on data from the Stockholm International Peace Research Institute (SIPRI) and from the U.S. Bureau of Economic Analysis (BEA). Both data sets include spending on overseas contingency operations as well as defense. This distinguishes them from data used in the U.S. budget, which separates defense spending from spending on overseas operations.

In inflation-adjusted dollars, SIPRI's measure of U.S. military spending rose sharply after the terrorist attacks of 2001.

In calendar year 2012, military spending declined from $711 billion to $668 billion.

In dollar terms, this was the largest decline since 1991.

The reduction in U.S. operations in the Middle East and the sequester mean this figure is likely to fall again in 2013.

:ranger:

Democracies are generally regarded as friendly to the United States, and this chart delivers a similar verdict to the last one. :ranger:

In 2012, U.S. military spending fell faster than overall military spending by democracies.

Trends in U.S. Military Spending - Council on Foreign Relations

Trends in U.S. Military Spending - Council on Foreign Relations

Dark Green - AAA

Light Green - AA

Celery - A

Yellow - BBB

Orange - BB

Red - B

Dark Red - CCC

Credit rating - Wikipedia, the free encyclopedia

A.M. Best defines country risk (read the methodology) as, "the risk that country-specific factors could adversely affect an insurer's ability to meet its financial obligations." Country risk is evaluated and factored into all A.M. Best ratings. As part of evaluating country risk, A.M. Best identifies the various factors within a country that may directly or indirectly affect an insurance company.

Best's Credit Ratings & Analysis

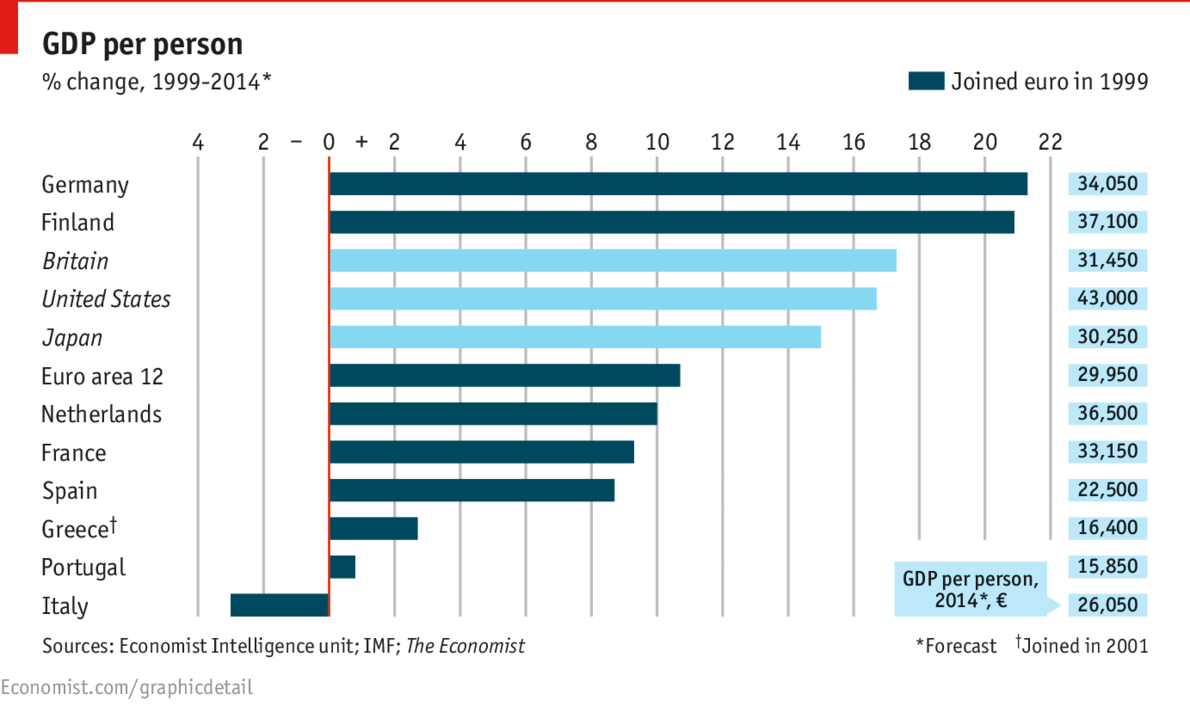

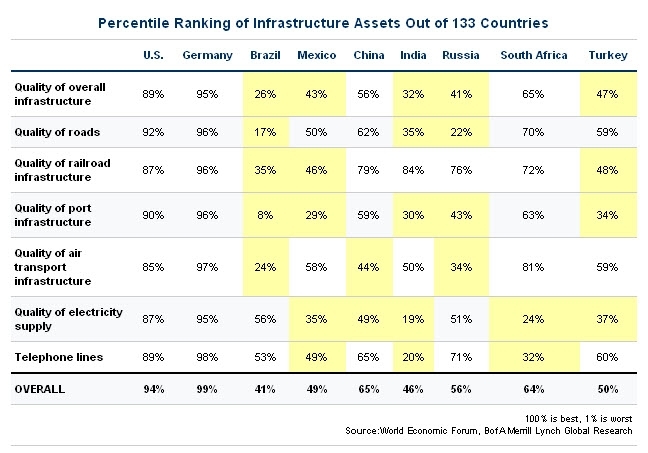

China, which accounts for more than half of that $6 trillion estimate, ranks far above emerging peers in terms of infrastructure at the 65th percentile. :thumb:

Emerging Markets Are Going To Spend A Massive $6 Trillion On Infrastructure In The Next Three Years - Business Insider

| Thread starter | Similar threads | Forum | Replies | Date |

|---|---|---|---|---|

|

|

UK - Eurozone Crisis Live | Europe and Russia | 126 | |

|

|

India, not China, at high risk from eurozone crisis | China | 1 | |

|

|

The eurozone Debt Crisis | Economy & Infrastructure | 0 | |

| W | Eurozone crisis | Americas | 0 |